Region:Africa

Author(s):Dev

Product Code:KRAA1626

Pages:85

Published On:August 2025

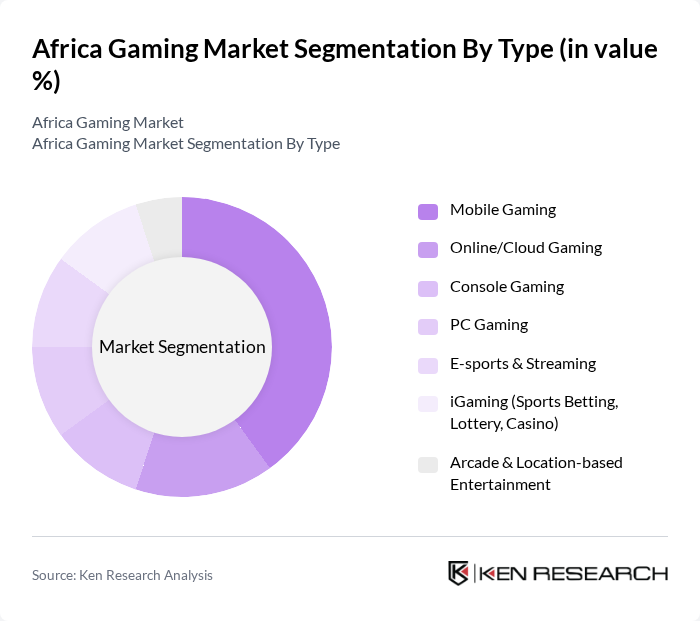

By Type:The gaming market can be segmented into various types, including Mobile Gaming, Online/Cloud Gaming, Console Gaming, PC Gaming, E-sports & Streaming, iGaming (Sports Betting, Lottery, Casino), and Arcade & Location-based Entertainment. Each of these segments caters to different consumer preferences and technological advancements.

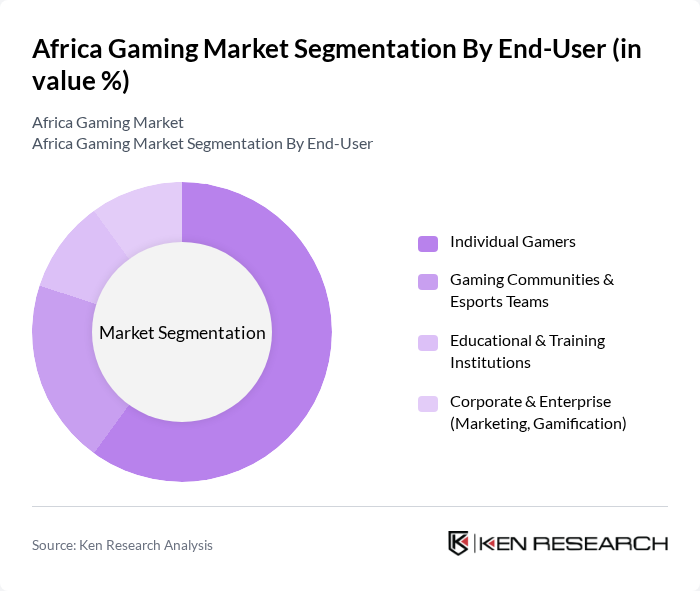

By End-User:The end-user segmentation includes Individual Gamers, Gaming Communities & Esports Teams, Educational & Training Institutions, and Corporate & Enterprise (Marketing, Gamification). Each segment reflects the diverse applications and audiences within the gaming ecosystem.

The Africa Gaming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Carry1st, Maliyo Games, Kagiso Interactive, Nyamakop, Kiro’o Games, Usiku Games, Leti Arts, Kucheza Gaming, Sea Monster Entertainment, Celestial Games, Nexters (Africa operations), Sony Interactive Entertainment (PlayStation Africa), Microsoft Xbox (MEA), Tencent (Africa publishing/partnerships), MTN Group (Gaming & esports initiatives) contribute to innovation, geographic expansion, and service delivery in this space.

The Africa gaming market is poised for significant transformation, driven by technological advancements and changing consumer preferences. As mobile gaming continues to dominate, developers are likely to focus on creating immersive experiences that leverage augmented and virtual reality technologies. Furthermore, the integration of blockchain technology in gaming is expected to enhance transparency and security, attracting more players. With a growing emphasis on responsible gaming practices, operators will need to adapt to regulatory changes while fostering a sustainable gaming environment that prioritizes player welfare.

| Segment | Sub-Segments |

|---|---|

| By Type | Mobile Gaming Online/Cloud Gaming Console Gaming PC Gaming E-sports & Streaming iGaming (Sports Betting, Lottery, Casino) Arcade & Location-based Entertainment |

| By End-User | Individual Gamers Gaming Communities & Esports Teams Educational & Training Institutions Corporate & Enterprise (Marketing, Gamification) |

| By Age Group | Under 18 24 34 44 and above |

| By Revenue Model | Free-to-Play (Ad-Supported) Subscription (Game Pass, Cloud, VIP) Premium/Pay-to-Play In-Game Purchases & Microtransactions Hybrid (Freemium + IAP/Ads) |

| By Distribution Channel | Mobile App Stores (Google Play, App Store, Huawei AppGallery) Online Platforms/Marketplaces (Steam, Epic, PlayStation Store, Xbox Store) Telco Bundles & Direct Carrier Billing Retail & Console Hardware Sales |

| By Game Genre | Action & Battle Royale Sports & Racing Strategy & MOBA Casino & Casual Simulation & Adventure |

| By Payment Method | Mobile Money (M-Pesa, MTN Mobile Money, Airtel Money) Cards (Credit/Debit) E-wallets & Fintech (Flutterwave, Paystack, Ozow, Yoco) Bank Transfers & Direct Carrier Billing |

| By Country | South Africa Nigeria Egypt Kenya Morocco Ghana Rest of Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Gaming Users | 120 | Casual Gamers, Mobile App Developers |

| Console Gaming Enthusiasts | 90 | Console Gamers, Retail Managers |

| PC Gaming Community | 80 | PC Gamers, eSports Organizers |

| Game Development Insights | 60 | Game Developers, Industry Analysts |

| Regulatory Impact Assessment | 50 | Policy Makers, Legal Advisors in Gaming |

The Africa Gaming Market is valued at approximately USD 2.1 billion, driven by factors such as increased smartphone penetration, improved internet connectivity, and a young demographic engaged in mobile-first gaming.