Saudi Arabia Pacific Gaming Market Overview

- The Saudi Arabia Pacific Gaming Market is valued at USD 2.3 billion, based on a five-year historical analysis of national games revenue. This growth is primarily driven by the increasing penetration of smartphones, expanding high?speed internet connectivity (including widespread 4G/5G), and a growing interest in esports and online gaming among the youth population, with more than 20 million active gamers in the country. The market has seen a significant uptick in user engagement and spending, reflecting a shift in entertainment preferences towards digital platforms and live-streamed esports events supported by large?scale government and private investments.

- Key cities such as Riyadh, Jeddah, and Dammam dominate the market due to their large populations and urbanization. Riyadh, as the capital, serves as a hub for technology and innovation and is the core location for gaming and esports initiatives under Vision 2030, including major tournaments and publishers establishing regional offices. Jeddah's coastal location attracts a diverse demographic and tourism?driven entertainment spend, while Dammam's strategic position in the Eastern Province enhances its accessibility across the Gulf, making these cities pivotal in driving the gaming market's growth.

- The Saudi government has implemented targeted policies to promote the gaming industry, including the establishment of the Saudi Esports Federation and the launch of the National Gaming and Esports Strategy under the Vision 2030 framework to position the Kingdom as a global gaming hub. In support of this, instruments such as the National Gaming and Esports Strategy, issued by the Saudi government in 2022, and the Gaming and Esports Financing Programme launched by the Saudi Esports Federation and allied public entities, set out clear investment, licensing, and support mechanisms for local studios, esports organizers, and gaming infrastructure. These initiatives aim to support local game developers and esports events, foster a sustainable ecosystem for gaming in the region, and create a regulatory and funding framework that encourages domestic and foreign investment and innovation in the gaming sector.

Saudi Arabia Pacific Gaming Market Segmentation

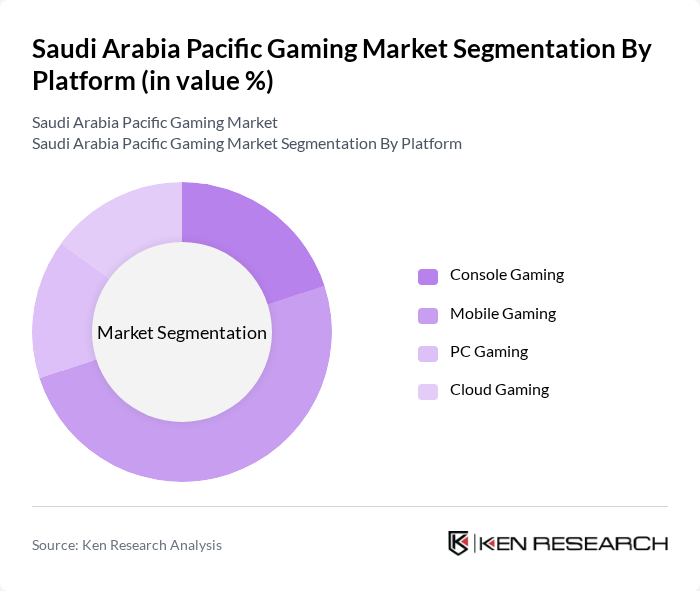

By Platform:The gaming market can be segmented into various platforms, including Console Gaming, Mobile Gaming, PC Gaming, and Cloud Gaming. Each platform caters to different consumer preferences and technological advancements, with mobile gaming currently leading due to its accessibility, strong smartphone adoption, and app?store based monetization; recent industry data indicates that mobile is the largest revenue?generating device segment in Saudi Arabia’s gaming market.

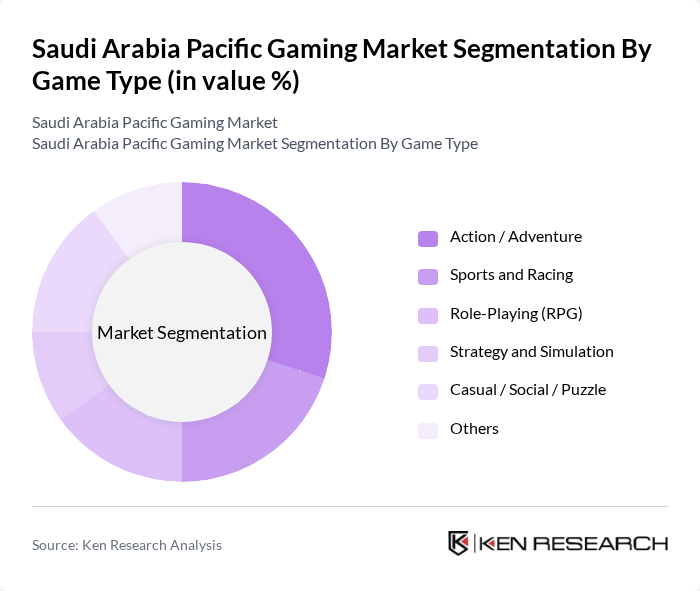

By Game Type:The market is also segmented by game type, which includes Action/Adventure, Sports and Racing, Role-Playing (RPG), Strategy and Simulation, Casual/Social/Puzzle, and Others. Action/Adventure games are particularly popular, appealing to a wide audience with engaging narratives and gameplay, while competitive online titles in sports, racing, and strategy are increasingly important in driving esports viewership and in?game spending in Saudi Arabia.

Saudi Arabia Pacific Gaming Market Competitive Landscape

The Saudi Arabia Pacific Gaming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Esports Federation, Nine66 (Savvy Games Group), Savvy Games Group, Manga Productions, Spoilz Games, UMX Studio, Semaphore (Game Development Studio), Telfaz11 / Telfaz Games, Nahdet Game Studio, My Games (regional publisher), International Console & PC Publishers (e.g., Sony, Microsoft, Nintendo), Global Mobile Game Publishers (selected leading titles in KSA), Local Esports Organizations and Teams, Regional Online Gaming Platforms and Marketplaces, Cloud Gaming and Streaming Platforms Active in KSA contribute to innovation, geographic expansion, and service delivery in this space.

Saudi Arabia Pacific Gaming Market Industry Analysis

Growth Drivers

- Increasing Disposable Income:The rise in disposable income in Saudi Arabia, projected to reach approximately SAR 1.1 trillion (USD 292 billion) in future, is a significant growth driver for the gaming market. As consumers have more financial resources, they are likely to spend on entertainment, including gaming. This trend is supported by the Kingdom's Vision 2030 initiative, which aims to diversify the economy and enhance the quality of life, thereby increasing consumer spending power.

- Rise in Tourism and Entertainment Demand:Saudi Arabia's tourism sector is expected to attract over 30 million visitors in future, driven by initiatives like the Red Sea Project and NEOM. This influx of tourists is anticipated to boost demand for entertainment options, including gaming. The government's investment of SAR 1.2 trillion (USD 320 billion) in tourism infrastructure will further enhance the appeal of gaming venues, creating a vibrant entertainment landscape that caters to both locals and tourists.

- Technological Advancements in Gaming:The gaming industry in Saudi Arabia is experiencing rapid technological advancements, with investments in mobile and online gaming platforms expected to exceed SAR 500 million (USD 133 million) in future. The integration of cutting-edge technologies, such as augmented reality (AR) and artificial intelligence (AI), is enhancing user experiences and attracting a younger demographic. This technological evolution is crucial for maintaining competitiveness in the global gaming market.

Market Challenges

- Regulatory Restrictions:The gaming market in Saudi Arabia faces significant regulatory challenges, with strict laws governing gambling activities. Currently, only limited forms of gaming are permitted, and operators must navigate complex licensing processes. The government’s cautious approach to regulation stems from cultural and religious considerations, which can hinder market growth. The lack of clear regulations for online gaming remains a barrier to entry for potential investors.

- Cultural Resistance to Gaming:Cultural attitudes towards gaming in Saudi Arabia present a notable challenge. Many segments of the population view gaming as a vice, leading to societal resistance against its expansion. This cultural resistance is reflected in the limited acceptance of gaming activities, which can deter potential investors and operators. Addressing these cultural perceptions will be essential for fostering a more favorable environment for gaming development.

Saudi Arabia Pacific Gaming Market Future Outlook

The future of the Saudi Arabian Pacific gaming market appears promising, driven by increasing disposable incomes and a growing tourism sector. As the government continues to invest in entertainment infrastructure, the gaming landscape is expected to evolve significantly. Additionally, the integration of advanced technologies and the potential for online gaming platforms will likely attract a younger audience. However, addressing regulatory and cultural challenges will be crucial for sustainable growth in this sector, ensuring that it aligns with societal values and expectations.

Market Opportunities

- Development of Online Gaming Platforms:The shift towards digitalization presents a significant opportunity for the development of online gaming platforms. With an estimated 30 million internet users in Saudi Arabia by future, the demand for accessible online gaming experiences is set to rise. This trend can attract both local and international players, enhancing market growth and diversifying revenue streams.

- Partnerships with International Gaming Companies:Collaborating with established international gaming companies can provide local operators with valuable expertise and technology. Such partnerships can facilitate knowledge transfer and enhance the quality of gaming offerings. In future, these collaborations could lead to the introduction of innovative gaming experiences, positioning Saudi Arabia as a competitive player in the regional gaming market.