Region:Global

Author(s):Shubham

Product Code:KRAA2725

Pages:87

Published On:August 2025

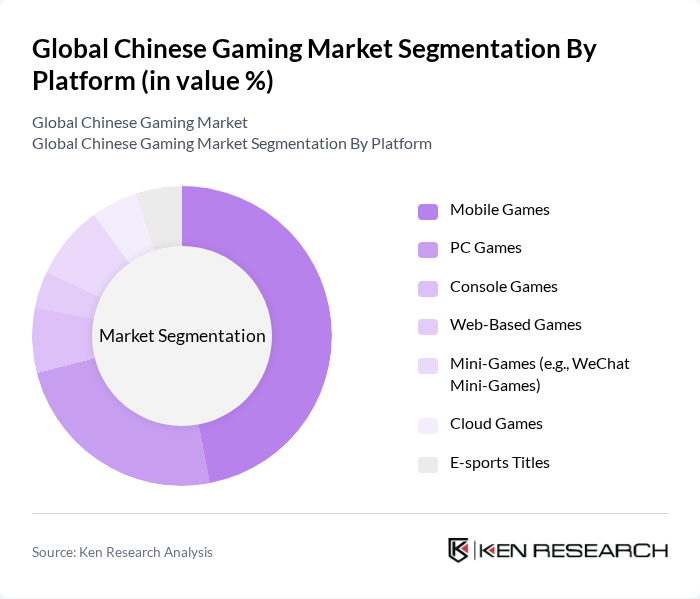

By Platform:The platform segmentation of the gaming market includes various categories such as Mobile Games, PC Games, Console Games, Web-Based Games, Mini-Games (e.g., WeChat Mini-Games), Cloud Games, and E-sports Titles. Among these, Mobile Games dominate the market due to the widespread use of smartphones and the convenience they offer. The increasing availability of high-speed internet, the popularity of social and casual gaming, and the rapid growth of mini-games (notably WeChat Mini-Games) have also contributed to the expansion of this segment. PC Games and E-sports Titles follow closely, driven by a dedicated gaming community and the proliferation of competitive gaming events. Console games have shown notable growth, with nearly 30% revenue increase in the most recent period .

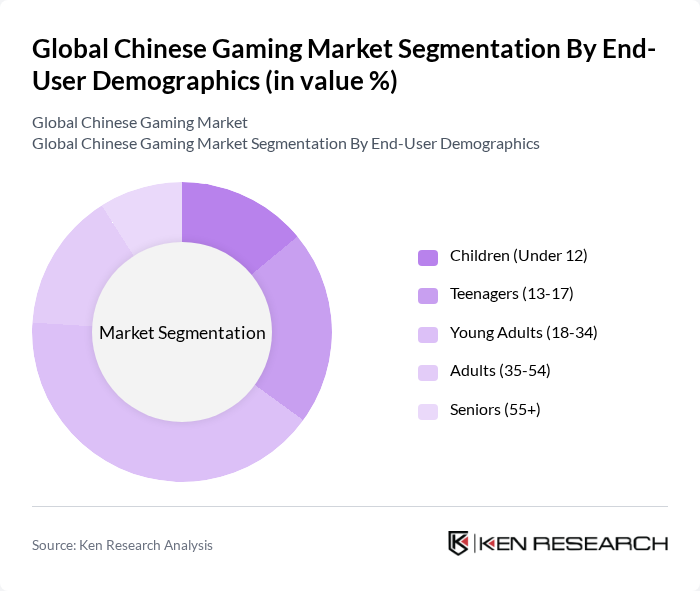

By End-User Demographics:This segmentation includes Children (Under 12), Teenagers (13-17), Young Adults (18-34), Adults (35-54), and Seniors (55+). The Young Adults segment remains the largest, driven by their affinity for gaming, high disposable income, and the increasing availability of diverse gaming options. Teenagers also represent a significant portion of the market, influenced by social gaming trends, peer interactions, and the growing popularity of E-sports. The demographic distribution reflects the strong engagement of younger users, with a gradual increase in adult and senior participation as gaming becomes more mainstream .

The Global Chinese Gaming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Tencent Holdings Limited, NetEase, Inc., miHoYo Co., Ltd., Perfect World Co., Ltd., Lilith Games, 37 Interactive Entertainment (37Games), IGG Inc., FunPlus, Bilibili Inc., Snail Games, YOOZOO Games, Game Science Interactive Technology Co., Ltd., Century Huatong Group Co., Ltd., Zhejiang Century Huatong Group Co., Ltd., CMGE Technology Group Limited contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Chinese gaming market appears promising, driven by technological advancements and evolving consumer preferences. The integration of artificial intelligence in game development is expected to enhance user experiences, while the rise of subscription-based models will likely reshape revenue streams. Additionally, as the market continues to expand internationally, Chinese developers are poised to leverage their expertise in mobile and e-sports gaming, creating a more dynamic and competitive landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Platform | Mobile Games PC Games Console Games Web-Based Games Mini-Games (e.g., WeChat Mini-Games) Cloud Games E-sports Titles |

| By End-User Demographics | Children (Under 12) Teenagers (13-17) Young Adults (18-34) Adults (35-54) Seniors (55+) |

| By Genre | Action Adventure Strategy Simulation Sports Role-Playing Games (RPG) Casual/Puzzle MOBA (Multiplayer Online Battle Arena) Others |

| By Distribution Channel | App Stores (e.g., Apple App Store, Tencent MyApp) Online Platforms (e.g., Steam China, TapTap, Bilibili) Retail Stores Subscription Services |

| By Payment Model | Free-to-Play (F2P) Pay-to-Play (P2P) Subscription-Based In-App Purchases (IAP) Advertising-Supported |

| By Device Type | Smartphones Tablets PCs Consoles Smart TVs/Set-Top Boxes |

| By User Engagement | Casual Gamers Hardcore Gamers Social Gamers E-sports Participants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Gaming Users | 120 | Casual Gamers, Mobile Game Developers |

| PC Gaming Enthusiasts | 90 | Hardcore Gamers, eSports Participants |

| Console Gaming Market | 60 | Console Owners, Retail Managers |

| Game Development Insights | 50 | Game Designers, Product Managers |

| Regulatory Impact Assessment | 40 | Policy Makers, Industry Analysts |

The Global Chinese Gaming Market is valued at approximately USD 47 billion, driven by the increasing penetration of smartphones, mobile gaming growth, and enhanced internet infrastructure, with nearly 680 million game users contributing to this robust market environment.