Region:Middle East

Author(s):Geetanshi

Product Code:KRAA0007

Pages:83

Published On:July 2025

By Platform:The gaming market in the Middle East is significantly influenced by various platforms, with mobile games leading the charge. The increasing accessibility of smartphones and mobile internet has made gaming more convenient for users, particularly among younger demographics. Mobile games are favored for their ease of use and the ability to play on-the-go. PC and console games also hold substantial market shares, driven by dedicated gaming communities and the popularity of high-performance gaming setups. Cloud gaming is emerging as a new trend, offering gamers the ability to play high-quality games without the need for expensive hardware. The adoption of VR peripherals and the integration of gaming with smart devices are also contributing to market diversification .

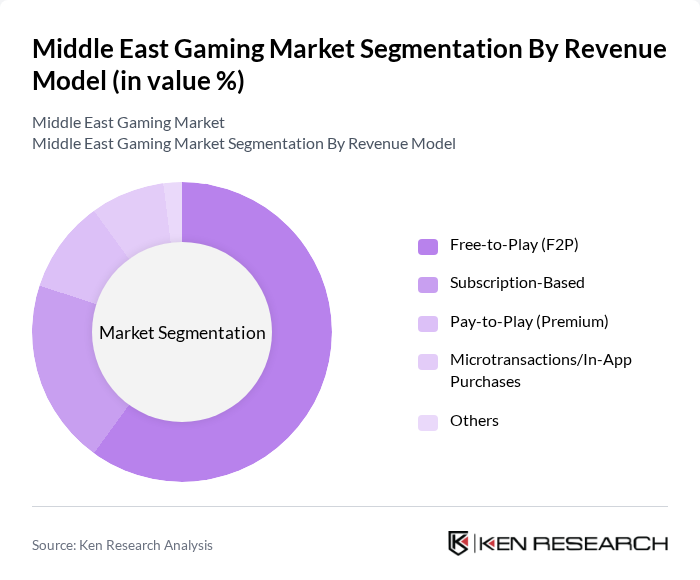

By Revenue Model:The revenue model segmentation reveals that Free-to-Play (F2P) games dominate the market, appealing to a broad audience by allowing users to access games without upfront costs. This model is particularly effective in the mobile gaming sector, where in-app purchases drive significant revenue. Subscription-based models are gaining traction, especially among PC and console gamers who seek premium content and experiences. Pay-to-Play games continue to attract dedicated gamers willing to invest in high-quality titles, while microtransactions and in-app purchases are increasingly common across all platforms. The integration of carrier billing by telecom operators and the localization of content for regional audiences further enhance monetization .

The Middle East Gaming Market is characterized by a dynamic mix of regional and international players. Leading participants such as Savvy Games Group (Saudi Arabia), Sandsoft Games (Saudi Arabia), Tamatem Games (Jordan), Babil Games (UAE), Falafel Games (Lebanon), Ubisoft, Tencent, Riot Games, Electronic Arts, Epic Games, Valve Corporation, NetEase, Stillfront Group (MENA Studios), Zynga, and King Digital Entertainment contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East gaming market appears promising, driven by technological advancements and a growing acceptance of gaming as a legitimate form of entertainment. As internet infrastructure continues to improve, and mobile gaming becomes more prevalent, the region is likely to see an influx of innovative gaming experiences. Additionally, the rise of e-sports and local game development initiatives will further enhance market dynamics, creating a vibrant ecosystem that attracts both local and international players in the gaming industry.

| Segment | Sub-Segments |

|---|---|

| By Platform | Mobile Games PC Games Console Games Cloud Gaming Smart TV & Set-Top Box Games Others |

| By Revenue Model | Free-to-Play (F2P) Subscription-Based Pay-to-Play (Premium) Microtransactions/In-App Purchases Others |

| By Genre | Action Adventure Strategy Sports Simulation Casual Others |

| By Distribution Channel | Online Platforms Mobile App Stores Retail Stores Subscription Services Telecom Bundles Others |

| By Payment Method | Credit/Debit Cards E-Wallets Carrier Billing Prepaid Cards Bank Transfers Others |

| By Age Group | Children (Under 12) Teenagers (13-19) Young Adults (20-35) Adults (36+) Others |

| By Country/Region | Saudi Arabia United Arab Emirates Egypt Turkey Rest of GCC Levant Region North Africa Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Mobile Gaming Users | 120 | Casual Gamers, Mobile Game Developers |

| Console Gaming Enthusiasts | 80 | Console Gamers, Retail Managers |

| PC Gaming Community | 60 | PC Gamers, eSports Organizers |

| Game Development Insights | 50 | Game Designers, Marketing Executives |

| Industry Experts and Analysts | 40 | Market Analysts, Gaming Consultants |

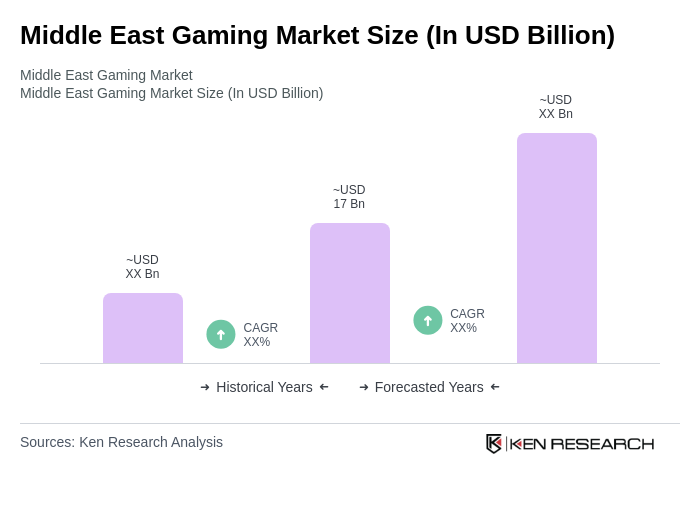

The Middle East Gaming Market is valued at approximately USD 17 billion, driven by smartphone penetration, internet connectivity, and a youthful demographic engaged in gaming. This growth reflects a significant increase in both mobile and console gaming, alongside rising eSports participation.