Region:Africa

Author(s):Shubham

Product Code:KRAA1079

Pages:91

Published On:August 2025

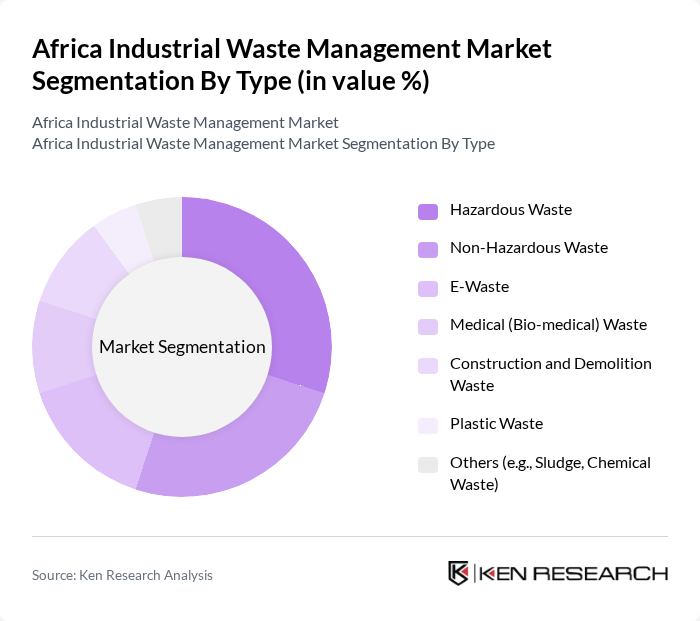

By Type:The market is segmented into various types of waste, including hazardous waste, non-hazardous waste, e-waste, medical (bio-medical) waste, construction and demolition waste, plastic waste, and others such as sludge and chemical waste. Each type presents unique challenges and opportunities for waste management, with hazardous waste requiring specialized handling and disposal methods due to its potential harm to human health and the environment .

The hazardous waste segment is currently the dominant type in the market, accounting for a significant portion of the overall waste management efforts. This dominance is driven by the stringent regulations surrounding hazardous materials, which require specialized treatment and disposal methods to mitigate environmental and health risks. Industries such as manufacturing, chemicals, and healthcare generate substantial amounts of hazardous waste, necessitating advanced waste management solutions. The increasing focus on compliance with environmental standards and the growing awareness of the dangers posed by hazardous waste further bolster this segment's leadership .

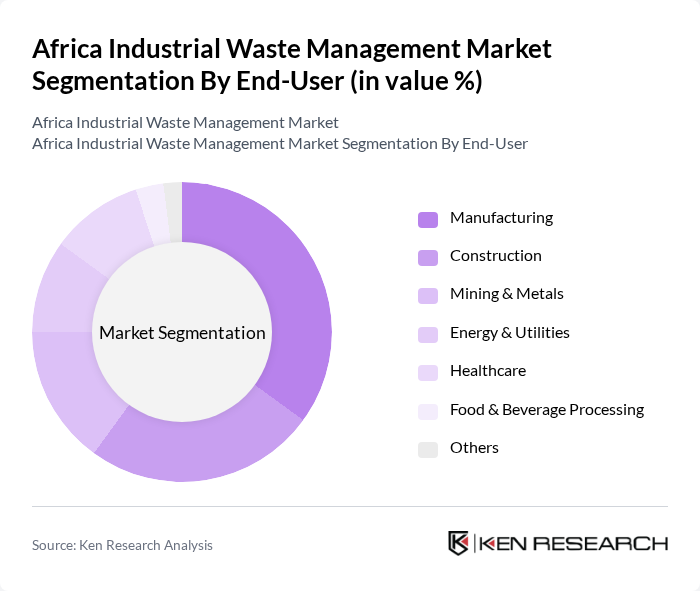

By End-User:The market is segmented by end-user industries, including manufacturing, construction, mining & metals, energy & utilities, healthcare, food & beverage processing, and others. Each sector has distinct waste management needs, with manufacturing and construction being the largest contributors to industrial waste generation .

The manufacturing sector is the leading end-user in the market, driven by its substantial waste generation and the need for effective waste management solutions. This sector produces a wide range of waste types, including hazardous materials, which require specialized handling and disposal. The increasing focus on sustainability and regulatory compliance in manufacturing processes has led to a growing demand for efficient waste management services. Additionally, the construction industry is also a significant contributor, with construction and demolition waste representing a large portion of the total industrial waste generated .

The Africa Industrial Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Veolia Environmental Services (Africa), SUEZ Recycling and Recovery (Africa), Interwaste Holdings Limited, EnviroServ Waste Management, Averda, Pikitup Johannesburg SOC Ltd, WastePlan, GreenCape, Wasteman Group, Dolphin Bay Chemicals, Mpact Recycling, Biogas Energy, EcoWaste Solutions, BCL Environmental, Clean City Africa contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Africa industrial waste management market is poised for transformation, driven by technological advancements and a shift towards sustainable practices. As industries increasingly adopt digital waste management solutions, the integration of AI and IoT technologies will enhance operational efficiency and compliance. Furthermore, the emphasis on circular economy principles will encourage recycling and waste-to-energy initiatives, fostering a more sustainable industrial landscape across the continent, which is essential for economic growth and environmental protection.

| Segment | Sub-Segments |

|---|---|

| By Type | Hazardous Waste Non-Hazardous Waste E-Waste Medical (Bio-medical) Waste Construction and Demolition Waste Plastic Waste Others (e.g., Sludge, Chemical Waste) |

| By End-User | Manufacturing Construction Mining & Metals Energy & Utilities Healthcare Food & Beverage Processing Others |

| By Waste Management Method | Recycling Landfilling Incineration Composting Waste-to-Energy Dismantling Others |

| By Region | North Africa West Africa East Africa Southern Africa Central Africa Others |

| By Collection Method | Curbside Collection Drop-off Centers On-site Collection (Industrial Facilities) Collection Events Others |

| By Service Type | Collection Services Transportation Services Treatment Services Disposal Services Consulting & Compliance Services Others |

| By Investment Source | Private Investment Government Funding International Aid Public-Private Partnerships Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Waste Management | 120 | Plant Managers, Environmental Compliance Officers |

| Construction Industry Waste Practices | 60 | Project Managers, Site Supervisors |

| Mining Sector Waste Handling | 50 | Operations Managers, Environmental Engineers |

| Food Processing Waste Management | 40 | Quality Control Managers, Sustainability Coordinators |

| Recycling Initiatives in Urban Areas | 45 | City Planners, Waste Management Directors |

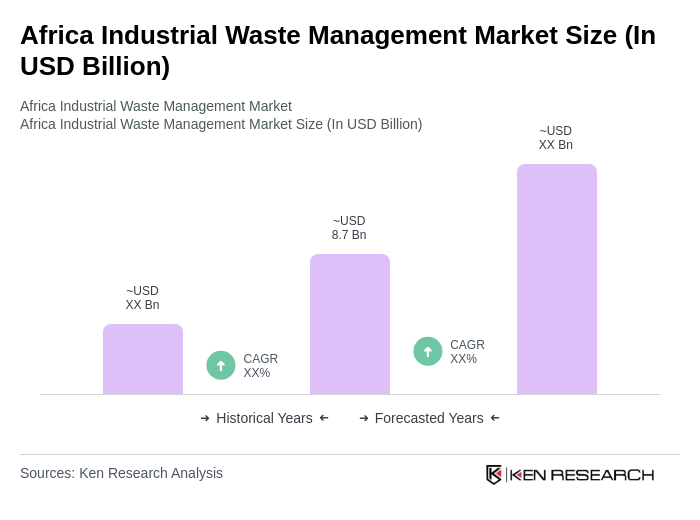

The Africa Industrial Waste Management Market is valued at approximately USD 8.7 billion, reflecting significant growth driven by increasing industrial activities, urbanization, and stricter environmental regulations across the continent.