Region:Asia

Author(s):Dev

Product Code:KRAA0438

Pages:88

Published On:August 2025

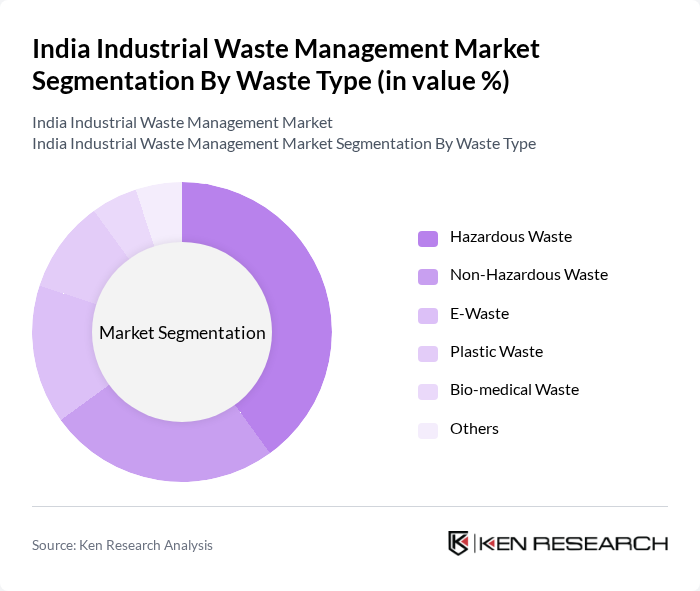

By Waste Type:The market is segmented into various waste types, including hazardous waste, non-hazardous waste, e-waste, plastic waste, bio-medical waste, and others. Among these, hazardous waste represents the most significant segment due to stringent regulations on its disposal and the high costs associated with its management. Non-hazardous waste and e-waste segments are also expanding, driven by increased industrial activity and the proliferation of electronic devices. The management of plastic and bio-medical waste is gaining attention due to environmental and health concerns, with regulatory focus intensifying on their safe disposal .

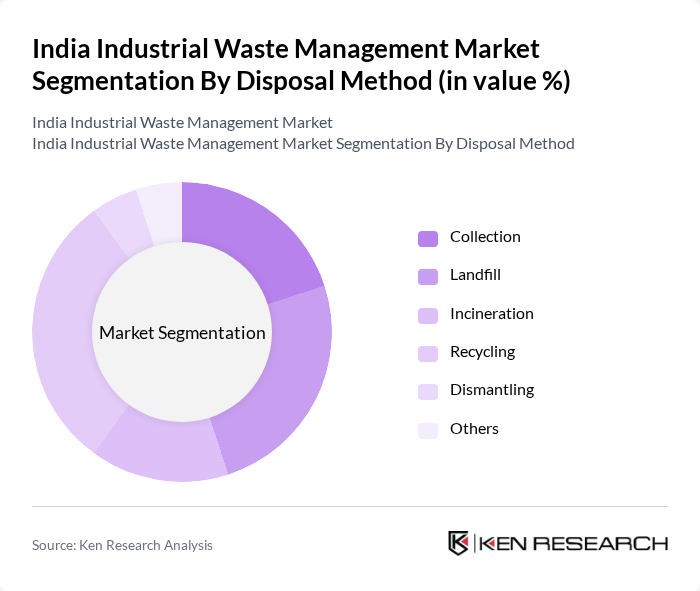

By Disposal Method:The disposal methods include collection, landfill, incineration, recycling, dismantling, and others. Recycling is the leading method due to the increasing focus on sustainability, resource recovery, and the adoption of circular economy practices. Urban areas, in particular, are witnessing a shift towards recycling and dismantling, while landfill and incineration remain significant but are gradually being replaced by more sustainable approaches .

The India Industrial Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Ramky Enviro Engineers Ltd., Antony Waste Handling Cell Ltd., EcoWise Waste Management Pvt. Ltd., IL&FS Environmental Infrastructure & Services Ltd., SMS Envoclean Pvt. Ltd., Shriram EPC Ltd., Jindal SAW Ltd., Synergy Waste Management Pvt. Ltd., Sembcorp Green Infra Ltd., Greenobin Recycling Pvt. Ltd., Re Sustainability Limited (formerly Ramky Enviro Engineers), Tata Steel Industrial By-Products Management Division, Dalmia Cement (Bharat) Ltd. (Industrial Waste Co-processing), Gujarat Enviro Protection & Infrastructure Ltd. (GEPIL), and SUEZ India Pvt. Ltd. contribute to innovation, geographic expansion, and service delivery in this space .

The future of the India Industrial Waste Management Market appears promising, driven by increasing industrial activities and a heightened focus on sustainability. As industries adopt circular economy principles, the demand for innovative waste management solutions is expected to rise. Additionally, the integration of digital technologies, such as IoT, will enhance operational efficiency and monitoring capabilities, paving the way for smarter waste management practices that align with global sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Waste Type | Hazardous Waste Non-Hazardous Waste E-Waste Plastic Waste Bio-medical Waste Others |

| By Disposal Method | Collection Landfill Incineration Recycling Dismantling Others |

| By End-User Industry | Manufacturing Construction Healthcare Automotive Chemicals & Pharmaceuticals Others |

| By Region | North India South India East India West India |

| By Type of Ownership | Public Private Public-Private Partnership |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Waste Management | 120 | Plant Managers, Environmental Compliance Officers |

| Construction Industry Waste Disposal | 90 | Project Managers, Site Supervisors |

| Hazardous Waste Treatment Facilities | 60 | Facility Operators, Safety Managers |

| Recycling and Recovery Services | 50 | Recycling Plant Managers, Business Development Executives |

| Government Regulatory Bodies | 40 | Policy Makers, Environmental Analysts |

The India Industrial Waste Management Market is valued at approximately USD 13 billion, driven by increasing industrial activities, stringent environmental regulations, and a growing emphasis on sustainable waste management practices.