Region:Middle East

Author(s):Rebecca

Product Code:KRAA0379

Pages:93

Published On:August 2025

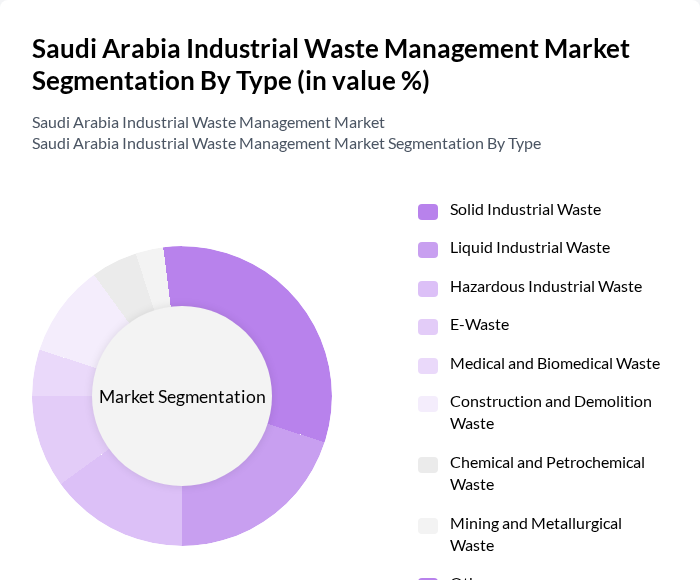

By Type:The market is segmented into various types of industrial waste, including solid industrial waste, liquid industrial waste, hazardous industrial waste, e-waste, medical and biomedical waste, construction and demolition waste, chemical and petrochemical waste, mining and metallurgical waste, and others. Each type presents unique challenges and requires specific management strategies to ensure compliance with environmental regulations and sustainability goals .

The solid industrial waste segment is currently the dominant sub-segment, accounting for a significant portion of the market share. This is largely due to the extensive manufacturing and construction activities in Saudi Arabia, which generate large volumes of solid waste. Industries are increasingly adopting recycling and waste-to-energy technologies to manage this waste effectively. The growing emphasis on sustainability and regulatory compliance is driving companies to invest in innovative waste management solutions, further solidifying the position of solid industrial waste in the market .

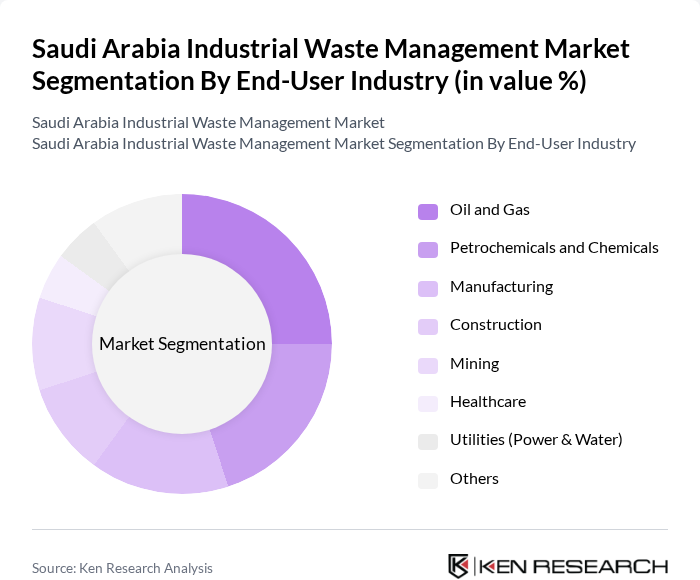

By End-User Industry:The market is segmented by end-user industries, including oil and gas, petrochemicals and chemicals, manufacturing, construction, mining, healthcare, utilities (power & water), and others. Each industry has distinct waste management needs and regulatory requirements, influencing the overall market dynamics .

The oil and gas sector is the leading end-user industry, contributing significantly to the industrial waste management market. This dominance is attributed to the high volume of waste generated during exploration, extraction, and refining processes. The stringent environmental regulations imposed on this sector compel companies to adopt advanced waste management practices, including recycling and safe disposal methods. Additionally, the increasing focus on sustainability and corporate social responsibility is driving investments in waste management solutions within the oil and gas industry .

The Saudi Arabia Industrial Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Saudi Investment Recycling Company (SIRC), Veolia Environmental Services Saudi Arabia, Suez Middle East Recycling LLC, National Environmental Recycling Company (Tadweer), Dulsco Saudi Arabia, Al-Qaryan Group, Al-Babtain Contracting Company, Eastern Environmental Services Company (EESCO), Al-Jomaih Energy and Water Company, Bee'ah Saudi Arabia, Al-Muhaidib Group, Al-Suwaidi Industrial Services, Al-Khodari & Sons Company, Saudi Arabian Oil Company (Saudi Aramco) – Environmental Services Division, Nesma Recycling contribute to innovation, geographic expansion, and service delivery in this space.

The future of the industrial waste management market in Saudi Arabia appears promising, driven by technological advancements and a shift towards a circular economy. The integration of smart waste management solutions is expected to enhance operational efficiency, while increased investments in recycling facilities will support sustainable practices. Furthermore, the government's commitment to environmental protection will likely foster innovation, encouraging industries to adopt more effective waste management strategies that align with global sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Solid Industrial Waste Liquid Industrial Waste Hazardous Industrial Waste E-Waste Medical and Biomedical Waste Construction and Demolition Waste Chemical and Petrochemical Waste Mining and Metallurgical Waste Others |

| By End-User Industry | Oil and Gas Petrochemicals and Chemicals Manufacturing Construction Mining Healthcare Utilities (Power & Water) Others |

| By Region | Eastern Region (incl. Dammam, Jubail, Khobar) Central Region (incl. Riyadh) Western Region (incl. Jeddah, Yanbu, Makkah) Southern Region Northern Region |

| By Disposal Method / Technology | Landfilling Incineration Recycling Composting Anaerobic Digestion Waste-to-Energy Others |

| By Application | Waste Collection Waste Transportation Waste Treatment Waste Disposal Waste Recycling Others |

| By Investment Source | Private Investments Government Funding International Aid Public-Private Partnerships Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Innovation Regulatory Support Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Waste Management | 100 | Environmental Managers, Operations Directors |

| Construction Industry Waste Handling | 60 | Project Managers, Site Supervisors |

| Oil & Gas Sector Waste Disposal | 50 | Health and Safety Officers, Compliance Managers |

| Food Processing Waste Management | 40 | Quality Control Managers, Sustainability Coordinators |

| Recycling Initiatives in Industrial Sectors | 70 | Recycling Program Managers, Waste Reduction Specialists |

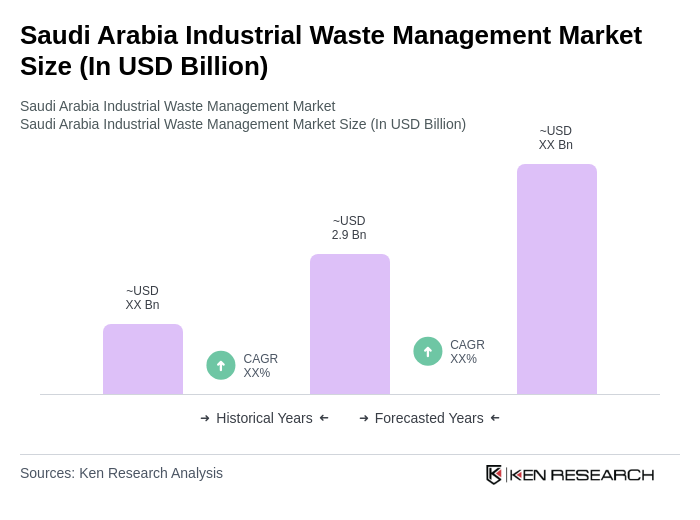

The Saudi Arabia Industrial Waste Management Market is valued at approximately USD 2.9 billion, driven by increasing industrial activities, stricter environmental regulations, and a growing awareness of sustainable waste management practices among businesses.