Region:Asia

Author(s):Rebecca

Product Code:KRAA0357

Pages:87

Published On:August 2025

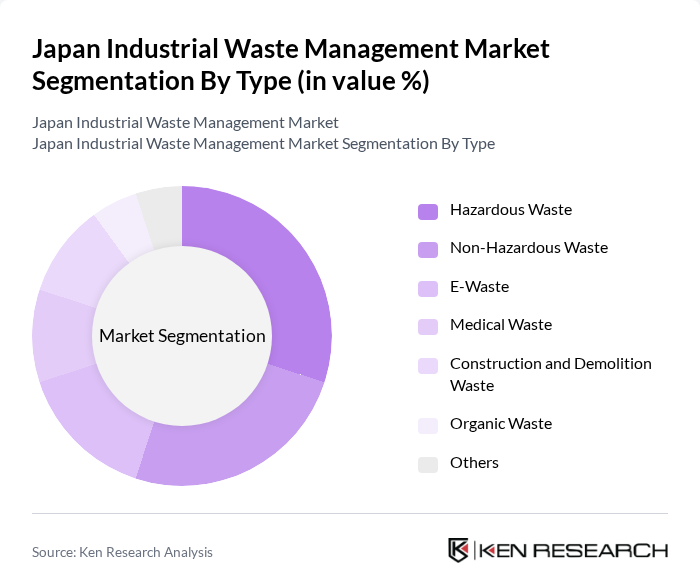

By Type:The market is segmented into various types of waste, including hazardous waste, non-hazardous waste, e-waste, medical waste, construction and demolition waste, organic waste, and others. Each sub-segment plays a crucial role in the overall waste management landscape, with specific treatment and disposal methods tailored to the nature of the waste. Hazardous waste management involves specialized containment and treatment processes to prevent environmental contamination. Non-hazardous waste is typically managed through recycling and landfill solutions. E-waste requires disassembly and recovery of valuable materials, while medical waste is handled through sterilization and incineration. Construction and demolition waste is often recycled or repurposed, and organic waste is processed through composting or anaerobic digestion .

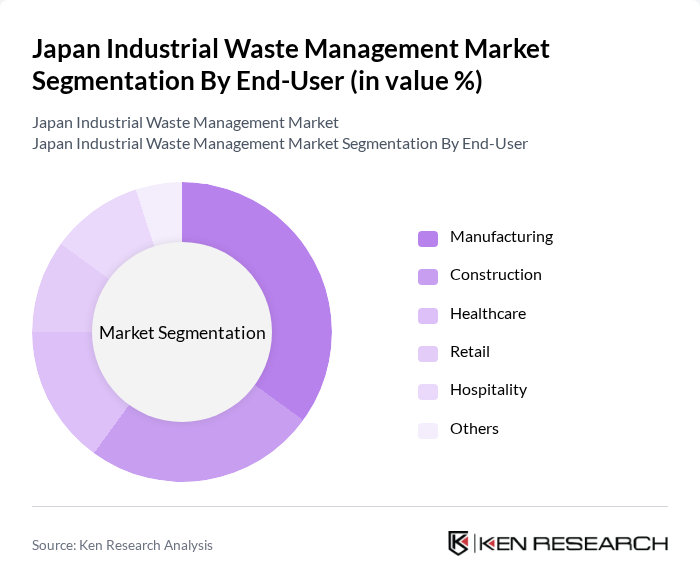

By End-User:The end-user segmentation includes manufacturing, construction, healthcare, retail, hospitality, and others. Each sector has unique waste management needs, with varying volumes and types of waste generated, influencing the demand for specific waste management services. Manufacturing and construction sectors are the largest generators of industrial waste, requiring comprehensive collection, treatment, and recycling solutions. Healthcare generates regulated medical waste, while retail and hospitality sectors focus on packaging, organic, and general waste streams .

The Japan Industrial Waste Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hitachi Zosen Corporation, Mitsubishi Heavy Industries Environmental & Chemical Engineering Co., Ltd., JFE Engineering Corporation, Daiseki Co., Ltd., Takuma Co., Ltd., Tsukishima Kikai Co., Ltd., Veolia Japan, Suez Japan, Tokyo Seiren Co., Ltd., Daiki Axis Co., Ltd., Marubeni Corporation, Mitsui & Co., Ltd., Japan Waste Management Association, Kokusai Kogyo Co., Ltd., Shimizu Corporation contribute to innovation, geographic expansion, and service delivery in this space .

The future of Japan's industrial waste management market is poised for significant transformation, driven by technological advancements and a shift towards sustainable practices. As the government intensifies its focus on zero waste initiatives, companies are expected to adopt innovative waste management solutions. Additionally, the integration of IoT technologies will enhance operational efficiency, enabling real-time monitoring and data-driven decision-making. This evolving landscape presents opportunities for collaboration between public and private sectors, fostering a more sustainable waste management ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Hazardous Waste Non-Hazardous Waste E-Waste Medical Waste Construction and Demolition Waste Organic Waste Others |

| By End-User | Manufacturing Construction Healthcare Retail Hospitality Others |

| By Waste Treatment Method | Physical Treatment Thermal Treatment (Incineration, Pyrolysis) Biological Treatment (Composting, Anaerobic Digestion) Landfilling Recycling Others |

| By Collection Method | Curbside Collection Drop-off Centers Scheduled Collection On-Demand Collection Others |

| By Geographic Region | Kanto Region Kansai Region Chubu Region Kyushu Region Hokkaido Region Others |

| By Industry Compliance Level | Fully Compliant Partially Compliant Non-Compliant Others |

| By Policy Support | Government Subsidies Tax Incentives Grants for Recycling Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Waste Management | 100 | Plant Managers, Environmental Compliance Officers |

| Construction and Demolition Waste | 60 | Project Managers, Site Supervisors |

| Hazardous Waste Disposal | 50 | Safety Officers, Waste Management Coordinators |

| Recycling Initiatives in Industry | 40 | Sustainability Managers, Operations Directors |

| Government Policy Impact Assessment | 40 | Policy Analysts, Regulatory Affairs Specialists |

The Japan Industrial Waste Management Market is valued at approximately USD 13 billion, driven by stringent environmental regulations, increasing industrial activities, and a focus on sustainable waste management practices.