Region:Asia

Author(s):Rebecca

Product Code:KRAD2714

Pages:86

Published On:November 2025

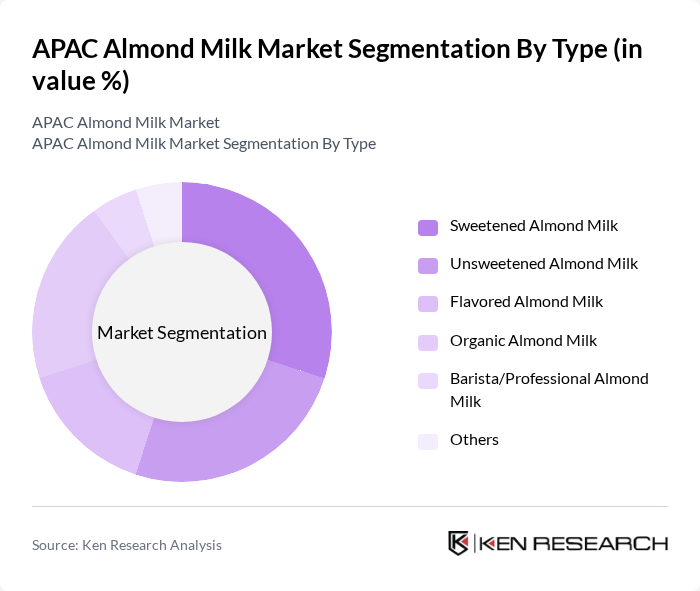

By Type:The almond milk market can be segmented into various types, including Sweetened Almond Milk, Unsweetened Almond Milk, Flavored Almond Milk, Organic Almond Milk, Barista/Professional Almond Milk, and Others. Each of these sub-segments caters to different consumer preferences and dietary needs. Sweetened almond milk is popular among consumers looking for a sweeter taste, while unsweetened options appeal to health-conscious individuals. Organic almond milk is gaining traction due to the increasing demand for organic products, and flavored varieties attract consumers seeking variety in their beverages. Barista/professional almond milk is specifically formulated for use in coffee shops and foodservice outlets, offering improved frothing and texture for specialty drinks.

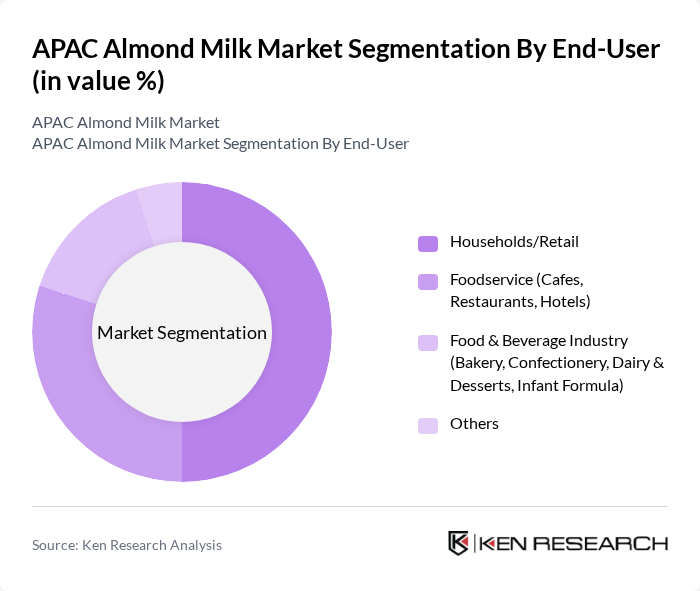

By End-User:The almond milk market is segmented by end-user into Households/Retail, Foodservice (Cafes, Restaurants, Hotels), Food & Beverage Industry (Bakery, Confectionery, Dairy & Desserts, Infant Formula), and Others. Households and retail channels dominate the market as consumers increasingly purchase almond milk for home use. The foodservice sector is also significant, with cafes and restaurants incorporating almond milk into their menus to cater to health-conscious customers. The food and beverage industry utilizes almond milk in various products, further driving demand. The rise of specialty coffee outlets and premium bakeries has increased demand for barista-grade almond milk, while manufacturers are expanding distribution in both online and offline channels to reach wider audiences.

The APAC Almond Milk Market is characterized by a dynamic mix of regional and international players. Leading participants such as Blue Diamond Growers, Califia Farms, Vitasoy International Holdings Ltd., Sanitarium Health and Wellbeing Company, Pureharvest, Earth’s Own Food Company Inc., The Hain Celestial Group (Dream, WestSoy), Danone S.A. (Silk, Alpro, So Delicious Dairy Free), SunOpta Inc., MALK Organics, Rude Health, Good Karma Foods, Nutty Life, Elmhurst 1925, Rebel Kitchen contribute to innovation, geographic expansion, and service delivery in this space.

The APAC almond milk market is poised for significant growth, driven by evolving consumer preferences towards healthier and sustainable options. As the trend towards plant-based diets continues, manufacturers are likely to innovate with new flavors and formulations to cater to diverse tastes. Additionally, the rise of e-commerce will facilitate broader distribution, allowing brands to reach untapped markets. Companies that prioritize sustainability and transparency in their sourcing will likely resonate more with environmentally conscious consumers, enhancing brand loyalty and market presence.

| Segment | Sub-Segments |

|---|---|

| By Type | Sweetened Almond Milk Unsweetened Almond Milk Flavored Almond Milk Organic Almond Milk Barista/Professional Almond Milk Others |

| By End-User | Households/Retail Foodservice (Cafes, Restaurants, Hotels) Food & Beverage Industry (Bakery, Confectionery, Dairy & Desserts, Infant Formula) Others |

| By Country/Region | China Japan South Korea India Australia & New Zealand Southeast Asia Rest of APAC |

| By Packaging Type | Cartons Bottles Pouches Tetra Pak Others |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Specialty Stores Others |

| By Nutritional Content | High Protein Low-Calorie Fortified with Vitamins & Minerals Sugar-Free/Low Sugar Others |

| By Price Range | Premium Mid-Range Economy Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sales of Almond Milk | 100 | Store Managers, Category Buyers |

| Consumer Preferences for Dairy Alternatives | 120 | Health-Conscious Consumers, Millennials |

| Distribution Channels for Almond Milk | 80 | Logistics Coordinators, Supply Chain Managers |

| Market Trends in Plant-Based Beverages | 60 | Market Analysts, Product Development Teams |

| Health Benefits Awareness of Almond Milk | 90 | Nutritionists, Dietitians, Health Coaches |

The APAC Almond Milk Market is valued at approximately USD 4.5 billion, reflecting a significant growth trend driven by increasing health consciousness, demand for plant-based alternatives, and rising awareness of lactose intolerance among consumers.