Region:Middle East

Author(s):Geetanshi

Product Code:KRAD5929

Pages:98

Published On:December 2025

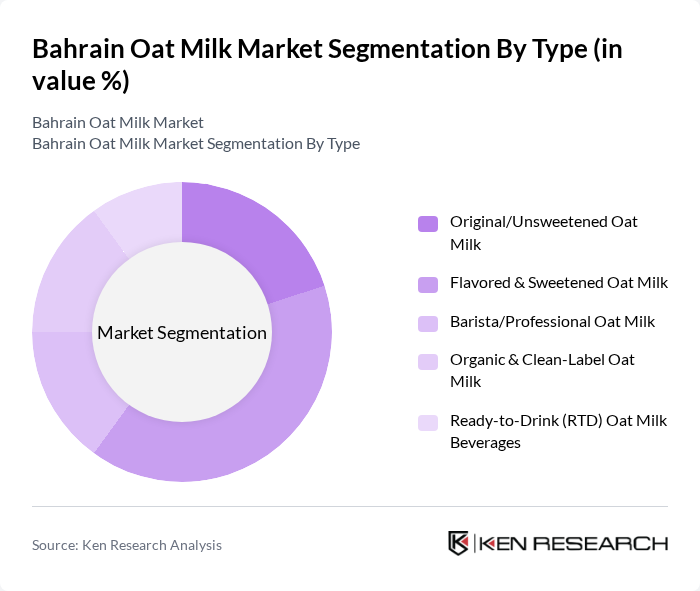

By Type:The market is segmented into various types of oat milk products, including Original/Unsweetened Oat Milk, Flavored & Sweetened Oat Milk, Barista/Professional Oat Milk, Organic & Clean-Label Oat Milk, and Ready-to-Drink (RTD) Oat Milk Beverages. Among these, Flavored & Sweetened Oat Milk is currently dominating the market due to its appeal to a broader audience, particularly younger consumers who prefer taste and variety in their beverages. The trend towards healthier lifestyles has also led to an increase in demand for Organic & Clean-Label Oat Milk, as consumers become more conscious of the ingredients in their food and beverages.

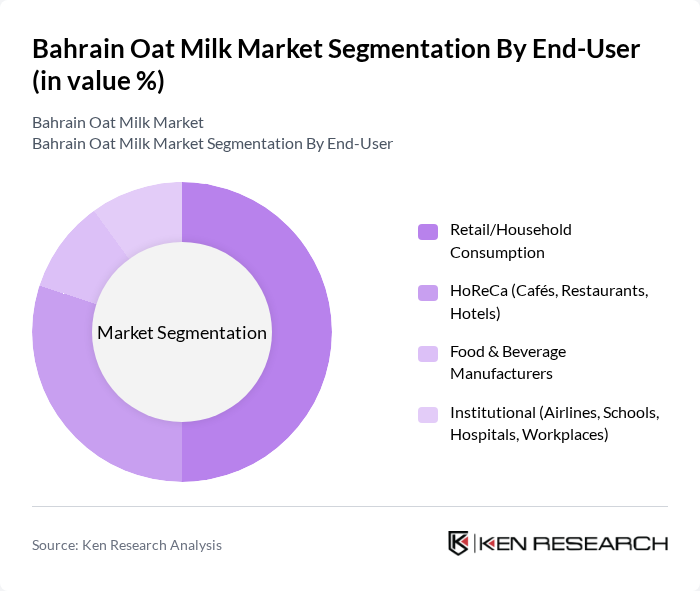

By End-User:The end-user segmentation includes Retail/Household Consumption, HoReCa (Cafés, Restaurants, Hotels), Food & Beverage Manufacturers, and Institutional (Airlines, Schools, Hospitals, Workplaces). Retail/Household Consumption is the leading segment, driven by the increasing trend of consumers purchasing oat milk for home use, particularly among health-conscious individuals and families. The HoReCa sector is also growing, as more cafes and restaurants incorporate oat milk into their menus to cater to the rising demand for plant-based options.

The Bahrain Oat Milk Market is characterized by a dynamic mix of regional and international players. Leading participants such as Alpro (Danone SA), Oatly Group AB, Almarai Company, Nada Dairy (Naqi Dairy Factory Company), Savola Foods Company, Koita FZE, UFC Oat Milk (UFC Refresh – Universal Food Public Company Limited), Earth’s Own Food Company Inc., Rude Health, Chobani LLC, Califia Farms LLC, Danone SA (Silk & So Delicious brands), Planet Oat (HP Hood LLC), Oatley (Local/Private-Label & In-Store Brands in Bahrain), Bahrain-Based Importers & Distributors of Oat Milk (e.g., VIVA Supermarket, Carrefour Bahrain, Lulu Hypermarket) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the oat milk market in Bahrain appears promising, driven by increasing health awareness and a shift towards sustainable consumption. As more consumers adopt plant-based diets, the demand for oat milk is expected to rise significantly. Innovations in product offerings, such as flavored and fortified oat milk, will likely attract a broader audience. Additionally, partnerships with health and wellness brands can enhance visibility and credibility, further propelling market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Original/Unsweetened Oat Milk Flavored & Sweetened Oat Milk Barista/Professional Oat Milk Organic & Clean-Label Oat Milk Ready-to-Drink (RTD) Oat Milk Beverages |

| By End-User | Retail/Household Consumption HoReCa (Cafés, Restaurants, Hotels) Food & Beverage Manufacturers Institutional (Airlines, Schools, Hospitals, Workplaces) |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience & Grocery Stores Online Grocery & E-commerce Platforms Specialty & Health Food Stores |

| By Packaging Type | Aseptic Cartons (Tetra Pak) Plastic & PET Bottles Glass Bottles Bulk Foodservice Packs |

| By Price Range | Premium Imported Brands Mid-Range Brands Value/Private-Label Offerings Promotion-Driven & Bundle Packs |

| By Nutritional & Functional Profile | Fortified (Vitamins & Minerals) High-Protein Oat Milk Low-Sugar/No-Added-Sugar Oat Milk Gluten-Free & Allergen-Friendly Oat Milk |

| By Consumer Demographics & Need States | Health & Wellness Focused Consumers Lactose-Intolerant & Allergy-Sensitive Consumers Vegan, Vegetarian & Flexitarian Consumers |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Oat Milk | 120 | Health-conscious Consumers, Plant-based Diet Adopters |

| Retailer Insights on Oat Milk Sales | 80 | Store Managers, Category Buyers |

| Nutritionist Perspectives on Oat Milk | 40 | Registered Dietitians, Nutrition Experts |

| Market Trends from Food Distributors | 60 | Distribution Managers, Supply Chain Analysts |

| Consumer Awareness and Brand Loyalty | 100 | Frequent Buyers of Dairy Alternatives, Brand Advocates |

The Bahrain Oat Milk Market is valued at approximately USD 45 million, reflecting a growing trend towards plant-based diets and increasing health consciousness among consumers in the region.