Region:Middle East

Author(s):Geetanshi

Product Code:KRAC9341

Pages:85

Published On:November 2025

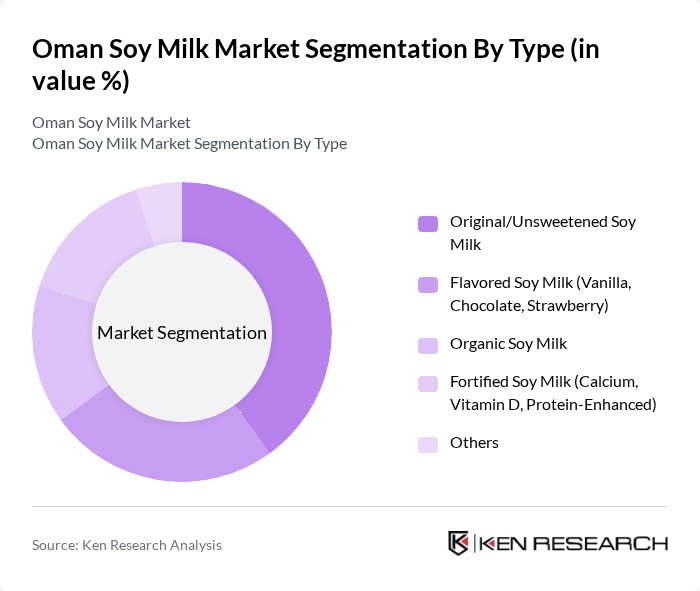

By Type:The market is segmented into various types of soy milk products, including Original/Unsweetened Soy Milk, Flavored Soy Milk (Vanilla, Chocolate, Strawberry), Organic Soy Milk, Fortified Soy Milk (Calcium, Vitamin D, Protein-Enhanced), and Others. Among these, Original/Unsweetened Soy Milk remains the most popular due to its versatility and health benefits, appealing to health-conscious consumers and those seeking low-sugar options. Flavored variants are gaining traction, especially among younger demographics and families seeking taste variety without compromising health. The demand for organic and fortified soy milk is also increasing, driven by rising awareness of nutritional enrichment and clean-label trends .

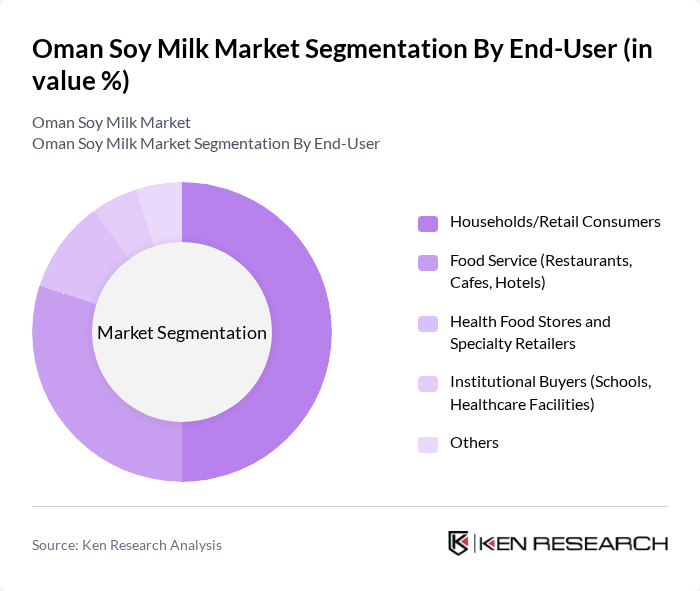

By End-User:The end-user segmentation includes Households/Retail Consumers, Food Service (Restaurants, Cafes, Hotels), Health Food Stores and Specialty Retailers, Institutional Buyers (Schools, Healthcare Facilities), and Others. Households/Retail Consumers dominate the market, driven by the increasing trend of home cooking, demand for healthy beverage options, and the influence of wellness-focused marketing. The food service sector is also growing as restaurants and cafes increasingly incorporate soy milk into their menus to cater to health-conscious and lactose-intolerant customers. Health food stores and specialty retailers are expanding their offerings to meet demand for plant-based and functional beverages .

The Oman Soy Milk Market is characterized by a dynamic mix of regional and international players. Leading participants such as Almarai Company, Al Ain Dairy (UAE-based, operating in Oman), Al Safi Danone, Al Rawabi Dairy Company, Nadec (National Dairy and Foodstuffs Company), Oman Dairy Company, Lulu Hypermarket (Private Label Soy Milk), Carrefour Oman (Private Label Soy Milk), Organic Oman (Local Organic Producer), Gulf Dairy Company, International Brands (Alpro, Oatly - where available), and Local Specialty Health Food Brands contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Oman soy milk market appears promising, driven by increasing health awareness and a growing preference for plant-based diets. As the government continues to support local producers and promote healthy eating, the market is expected to see enhanced product availability and innovation. Additionally, the rise of e-commerce platforms is likely to facilitate greater access to soy milk products, further expanding consumer reach and driving sales growth in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Original/Unsweetened Soy Milk Flavored Soy Milk (Vanilla, Chocolate, Strawberry) Organic Soy Milk Fortified Soy Milk (Calcium, Vitamin D, Protein-Enhanced) Others |

| By End-User | Households/Retail Consumers Food Service (Restaurants, Cafes, Hotels) Health Food Stores and Specialty Retailers Institutional Buyers (Schools, Healthcare Facilities) Others |

| By Packaging Type | Tetra Packs (1L, 200ml) Plastic Bottles (1L, 500ml) Cans (250ml) Pouches and Others |

| By Distribution Channel | Supermarkets and Hypermarkets Online Retail (E-commerce Platforms) Convenience Stores and Small Retailers Direct-to-Consumer and Others |

| By Nutritional Content | High Protein Soy Milk (8g+ per serving) Low Sugar Soy Milk (Less than 2g per serving) Calcium-Fortified Soy Milk Others |

| By Consumer Demographics | Age Group (Children 6-12, Teens 13-19, Adults 20-50, Seniors 50+) Gender (Male, Female) Lifestyle (Active/Fitness-Focused, Health-Conscious, Vegan/Vegetarian) Others |

| By Price Range | Premium Soy Milk (OMR 2.5+) Mid-Range Soy Milk (OMR 1.5-2.5) Budget Soy Milk (Below OMR 1.5) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 100 | Store Managers, Category Buyers |

| Consumer Preferences Survey | 120 | Health-Conscious Consumers, Families |

| Food Service Sector Analysis | 80 | Restaurant Owners, Menu Planners |

| Nutritionist Insights | 40 | Registered Dietitians, Health Coaches |

| Distribution Channel Feedback | 60 | Wholesalers, Distributors |

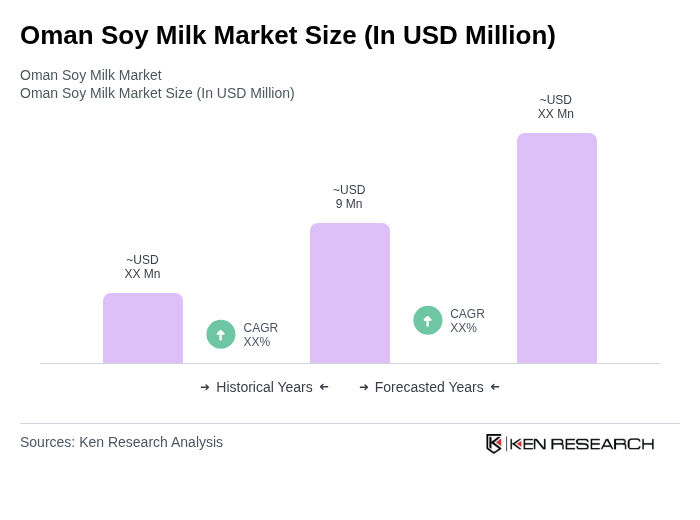

The Oman Soy Milk Market is valued at approximately USD 9 million, reflecting a growing trend towards health-conscious consumption and plant-based diets among consumers in the region.