Region:Asia

Author(s):Geetanshi

Product Code:KRAD5932

Pages:80

Published On:December 2025

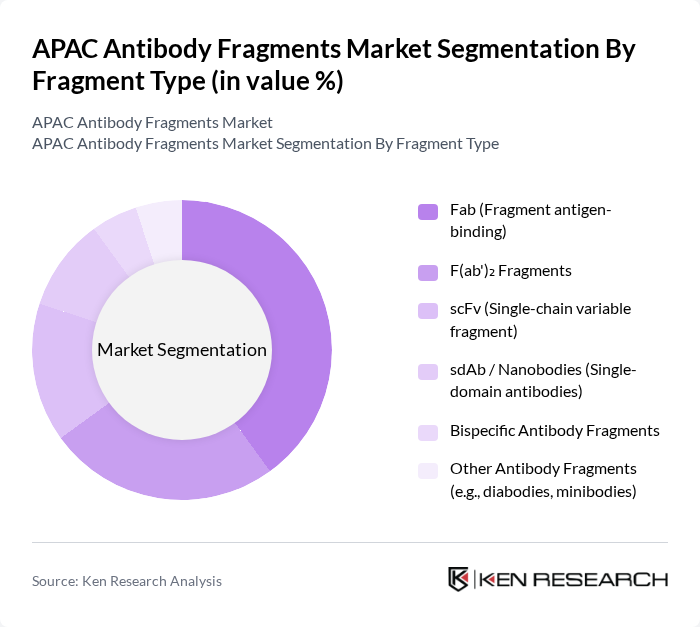

By Fragment Type:The market is segmented into various types of antibody fragments, including Fab (Fragment antigen-binding), F(ab')? Fragments, scFv (Single-chain variable fragment), sdAb / Nanobodies (Single-domain antibodies), Bispecific Antibody Fragments, and Other Antibody Fragments (e.g., diabodies, minibodies). Among these, Fab fragments are leading the market due to their high specificity and affinity for antigens, making them ideal for therapeutic applications. The increasing focus on personalized medicine and targeted therapies is further driving the demand for these fragments.

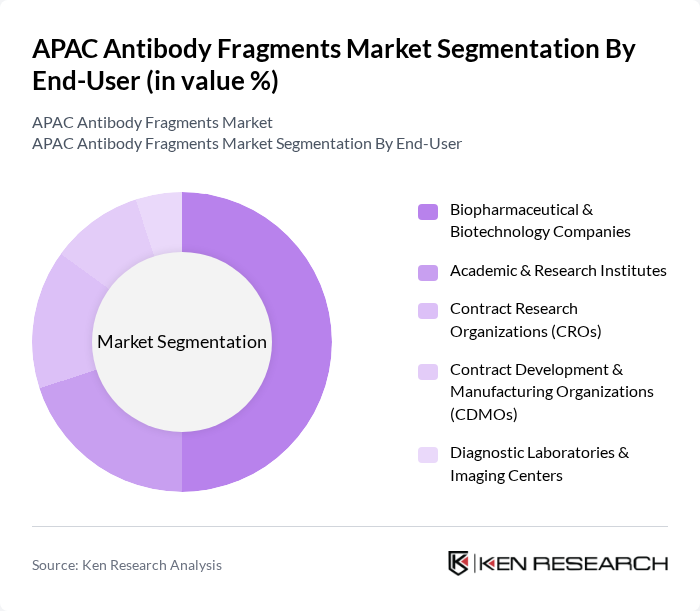

By End-User:The end-user segmentation includes Biopharmaceutical & Biotechnology Companies, Academic & Research Institutes, Contract Research Organizations (CROs), Contract Development & Manufacturing Organizations (CDMOs), and Diagnostic Laboratories & Imaging Centers. Biopharmaceutical companies are the dominant end-users, driven by their need for innovative therapies and the increasing number of antibody-based drugs in development. The collaboration between these companies and research institutes is also fostering advancements in antibody fragment technologies.

The APAC Antibody Fragments Market is characterized by a dynamic mix of regional and international players. Leading participants such as F. Hoffmann-La Roche AG, Novartis AG, Takeda Pharmaceutical Company Limited, Chugai Pharmaceutical Co., Ltd., Daiichi Sankyo Company, Limited, Samsung Biologics Co., Ltd., WuXi Biologics (Cayman) Inc., BeiGene, Ltd., Jiangsu Hengrui Pharmaceuticals Co., Ltd., Zai Lab Limited, Innovent Biologics, Inc., Bio-Rad Laboratories, Inc., Abcam plc, Merck KGaA, Regeneron Pharmaceuticals, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC antibody fragments market appears promising, driven by ongoing innovations in biotechnology and a growing emphasis on personalized medicine. As healthcare systems increasingly adopt digital health technologies, the integration of data analytics and artificial intelligence will enhance the development and delivery of targeted therapies. Furthermore, the expansion of biosimilars is expected to create competitive pricing dynamics, making antibody therapies more accessible to a broader patient population, thereby fostering market growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Fragment Type | Fab (Fragment antigen-binding) F(ab')? Fragments scFv (Single-chain variable fragment) sdAb / Nanobodies (Single-domain antibodies) Bispecific Antibody Fragments Other Antibody Fragments (e.g., diabodies, minibodies) |

| By End-User | Biopharmaceutical & Biotechnology Companies Academic & Research Institutes Contract Research Organizations (CROs) Contract Development & Manufacturing Organizations (CDMOs) Diagnostic Laboratories & Imaging Centers |

| By Application | Oncology (Cancer Therapy) Autoimmune & Inflammatory Diseases Infectious Diseases Cardiovascular & Metabolic Diseases Diagnostic & Imaging Applications Other Therapeutic Areas |

| By Distribution / Commercial Channel | Direct Sales to Biopharma & Research Institutes Distributors / Local Agents Online Scientific & E-commerce Platforms Other Channels |

| By Country / Sub-region | China Japan South Korea India Australia & New Zealand Southeast Asia (Singapore, Malaysia, Thailand, Indonesia, Others) Rest of APAC |

| By Research / Development Stage | Preclinical Research Early-stage Clinical Trials (Phase I–II) Late-stage Clinical Trials (Phase III) Commercialized Products |

| By Funding Source | Public & Government Grants Corporate R&D Budgets Venture Capital & Private Equity Other Funding Sources (Foundations, Consortia, PPPs) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biopharmaceutical R&D Departments | 120 | R&D Directors, Lead Scientists |

| Clinical Research Organizations | 90 | Clinical Trial Managers, Regulatory Affairs Specialists |

| Healthcare Providers and Hospitals | 75 | Oncologists, Immunologists |

| Biotech Startups Focused on Antibody Fragments | 55 | Founders, Product Development Managers |

| Academic Institutions and Research Labs | 95 | Professors, Research Fellows |

The APAC Antibody Fragments Market is valued at approximately USD 2.1 billion, driven by the increasing prevalence of chronic diseases, advancements in biotechnology, and a growing demand for targeted therapies.