Region:Asia

Author(s):Rebecca

Product Code:KRAC4594

Pages:80

Published On:October 2025

By Type:The market is segmented into various types, including Monoclonal Antibodies, Vaccines, Recombinant Proteins, Cell and Gene Therapies, Blood Products, Biosimilars, and Others. Among these, Monoclonal Antibodies are leading the market due to their widespread application in therapeutic areas such as oncology and autoimmune diseases. The increasing prevalence of these diseases and the growing focus on personalized medicine are driving the demand for monoclonal antibodies, making them a dominant force in the biologics contract manufacturing landscape. Single-use bioreactor technology and continuous manufacturing platforms are further supporting the rapid scale-up of monoclonal antibody production .

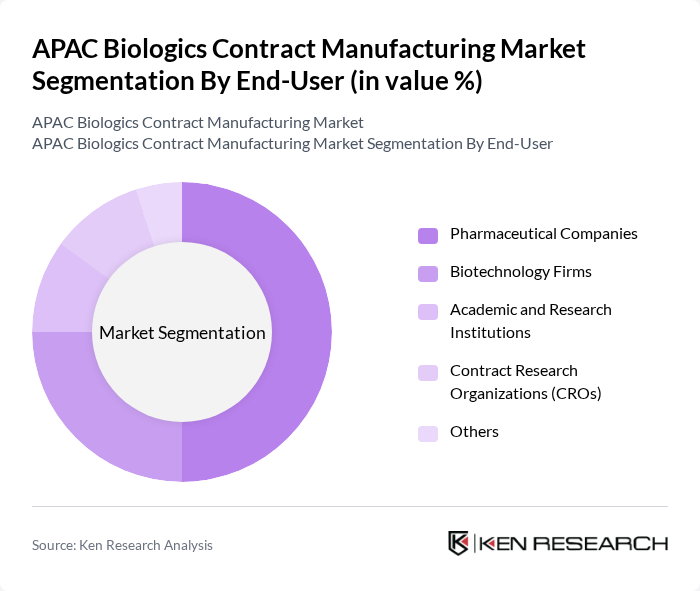

By End-User:The end-user segmentation includes Pharmaceutical Companies, Biotechnology Firms, Academic and Research Institutions, Contract Research Organizations (CROs), and Others. Pharmaceutical Companies are the leading end-users in the market, driven by their need for efficient and cost-effective manufacturing solutions. The increasing trend of outsourcing biologics production to specialized contract manufacturers allows these companies to focus on their core competencies while ensuring high-quality product delivery. Biotechnology firms are also expanding their reliance on contract manufacturing to accelerate product development and market entry .

The APAC Biologics Contract Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Samsung Biologics, WuXi Biologics, Lonza Group, Catalent, Inc., Fujifilm Diosynth Biotechnologies, Boehringer Ingelheim, AGC Biologics, Thermo Fisher Scientific, AbbVie Inc., Novartis AG, Innovent Biologics, Rentschler Biopharma, JRS Pharma, Probiogen, Toyobo Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC biologics contract manufacturing market appears promising, driven by technological advancements and increasing demand for personalized medicine. As the region embraces digital transformation, manufacturers are expected to adopt innovative production techniques, enhancing efficiency and sustainability. Furthermore, the rise of biosimilars is anticipated to create new avenues for growth, allowing contract manufacturers to diversify their offerings and cater to a broader range of therapeutic areas, ultimately shaping the market landscape in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Monoclonal Antibodies Vaccines Recombinant Proteins Cell and Gene Therapies Blood Products Biosimilars Others |

| By End-User | Pharmaceutical Companies Biotechnology Firms Academic and Research Institutions Contract Research Organizations (CROs) Others |

| By Application | Therapeutics Diagnostics Research and Development Others |

| By Region | China Japan India South Korea Australia Southeast Asia (Singapore, Malaysia, Thailand, etc.) Rest of APAC |

| By Manufacturing Process | Mammalian Cell Culture Microbial Fermentation Upstream Processing Downstream Processing Fill and Finish Others |

| By Distribution Channel | Direct Sales Distributors Online Platforms Others |

| By Pricing Model | Cost-Plus Pricing Value-Based Pricing Competitive Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Biologics Manufacturing Capacity | 60 | Operations Managers, Production Directors |

| Regulatory Compliance in Biologics | 50 | Quality Assurance Managers, Regulatory Affairs Specialists |

| Market Trends in Biologics | 40 | Market Analysts, Business Development Managers |

| Investment in Biologics R&D | 45 | R&D Directors, Financial Analysts |

| Client Satisfaction with CMO Services | 50 | Procurement Officers, Project Managers |

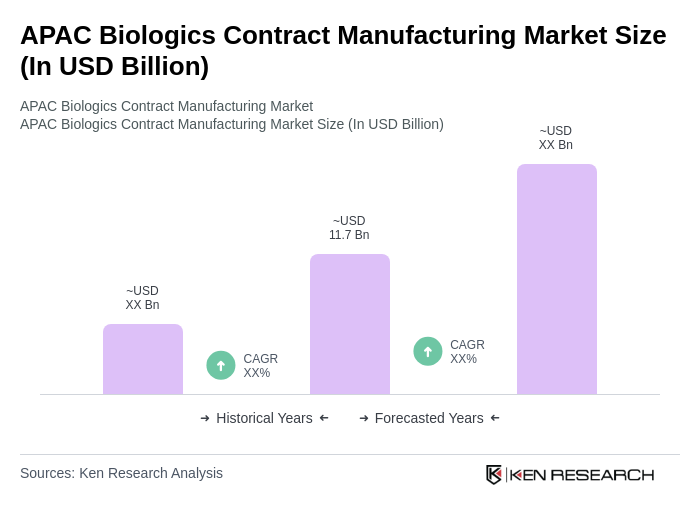

The APAC Biologics Contract Manufacturing Market is valued at approximately USD 11.7 billion, driven by increasing demand for biologics, advancements in biomanufacturing technologies, and the rising prevalence of chronic diseases.