Region:Global

Author(s):Rebecca

Product Code:KRAA1405

Pages:94

Published On:August 2025

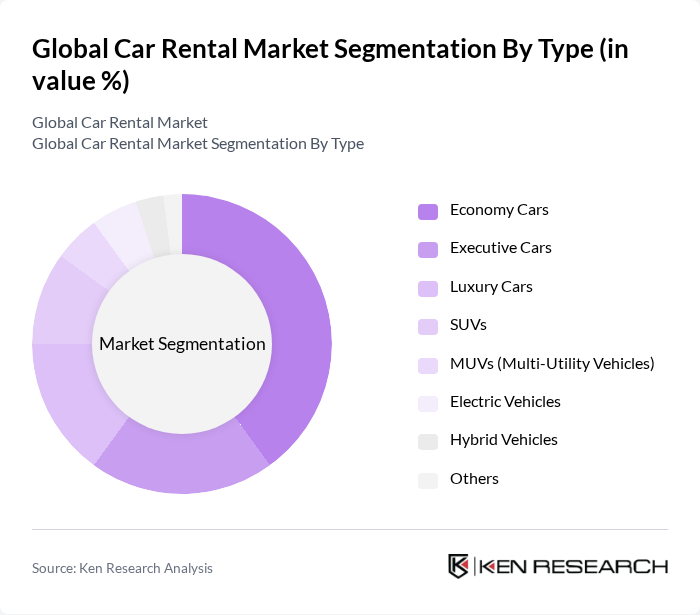

By Type:The car rental market is segmented into various types, including Economy Cars, Executive Cars, Luxury Cars, SUVs, MUVs (Multi-Utility Vehicles), Electric Vehicles, Hybrid Vehicles, and Others. Among these, Economy Cars dominate the market due to their affordability and practicality for budget-conscious travelers. The increasing trend of urbanization, digitalization of booking processes, and the need for cost-effective transportation solutions have led to a surge in demand for this segment, making it a preferred choice for both leisure and business travelers .

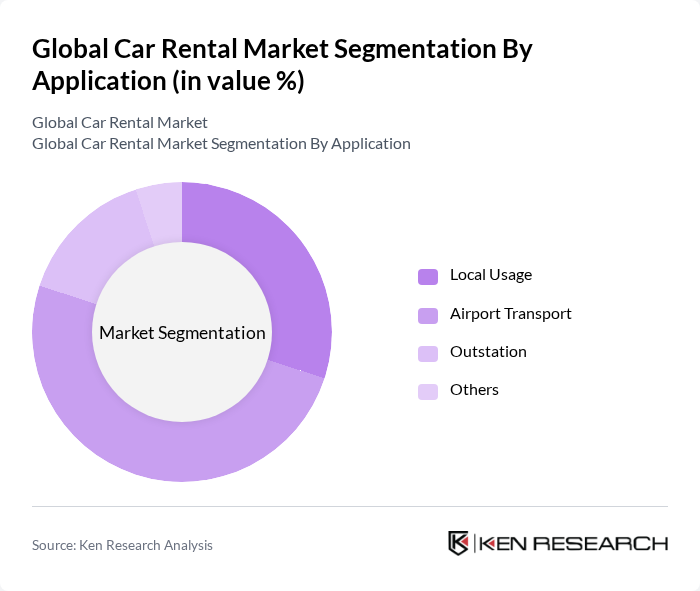

By Application:This segmentation includes Local Usage, Airport Transport, Outstation, and Others. The Airport Transport segment is currently leading the market due to the high volume of travelers requiring convenient transportation options upon arrival. The growth of international tourism and business travel, along with the expansion of airport infrastructure and digital booking channels, has significantly increased the demand for car rentals at airports, making this segment a critical driver of market growth .

The Global Car Rental Market is characterized by a dynamic mix of regional and international players. Leading participants such as Enterprise Holdings, Hertz Global Holdings, Avis Budget Group, Sixt SE, Europcar Mobility Group, National Car Rental, Alamo Rent A Car, Thrifty Car Rental, Dollar Rent A Car, Localiza Rent a Car S.A., Turo, Getaround, Zipcar, Green Motion, Carzonrent India Pvt. Ltd., Buchbinder, Zoomcar contribute to innovation, geographic expansion, and service delivery in this space.

The future of the car rental market appears promising, driven by technological innovations and evolving consumer preferences. As digital platforms become increasingly popular, rental companies are expected to enhance their online booking systems, improving customer experience. Additionally, the shift towards sustainable practices will likely accelerate the adoption of electric vehicles in rental fleets, aligning with global environmental goals. These trends indicate a dynamic market landscape that will continue to evolve in response to consumer demands and regulatory pressures.

| Segment | Sub-Segments |

|---|---|

| By Type | Economy Cars Executive Cars Luxury Cars SUVs MUVs (Multi-Utility Vehicles) Electric Vehicles Hybrid Vehicles Others |

| By Application | Local Usage Airport Transport Outstation Others |

| By Rental Duration | Short-Term Rentals Long-Term Rentals |

| By Booking Channel | Online Platforms Offline Booking/Travel Agencies Direct Rentals |

| By End-Use | Self-Drive Chauffeur-Driven |

| By Fare Price | Economy/Budget Cars Luxury/Premium Cars |

| By Region | North America Europe Asia Pacific Middle East & Africa South America |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Leisure Car Rentals | 100 | Vacationers, Travel Agents |

| Corporate Car Rentals | 90 | Corporate Travel Managers, HR Executives |

| Long-term Rentals | 60 | Business Executives, Fleet Managers |

| Luxury Car Rentals | 40 | Affluent Consumers, Event Planners |

| Car Sharing Services | 50 | Urban Residents, Tech-savvy Users |

The Global Car Rental Market is valued at approximately USD 150 billion, driven by increasing travel demand, urbanization, and the rise of the sharing economy, making car rental services more accessible to consumers.