Region:Asia

Author(s):Dev

Product Code:KRAD3435

Pages:86

Published On:November 2025

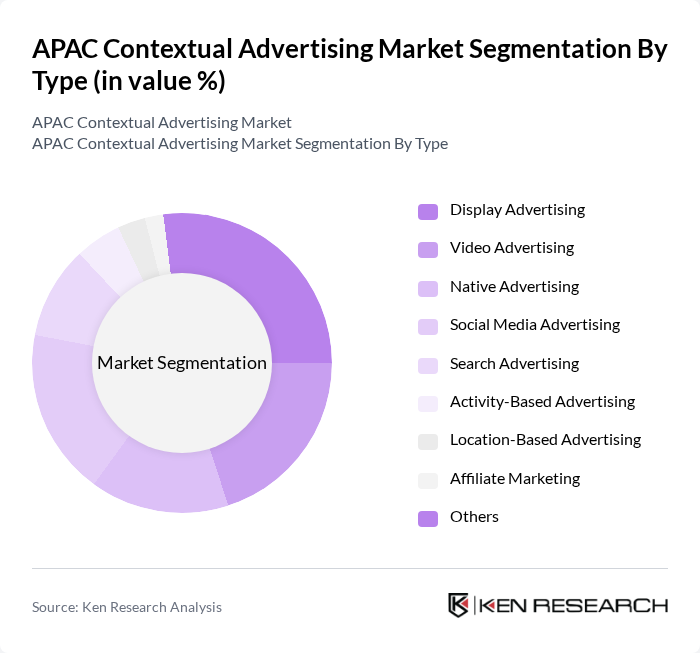

By Type:The market is segmented into various types of contextual advertising, including Display Advertising, Video Advertising, Native Advertising, Social Media Advertising, Search Advertising, Activity-Based Advertising, Location-Based Advertising, Affiliate Marketing, and Others. Each sub-segment addresses distinct advertising needs and consumer behaviors, with strategies increasingly leveraging AI and real-time data to maximize engagement and conversion rates .

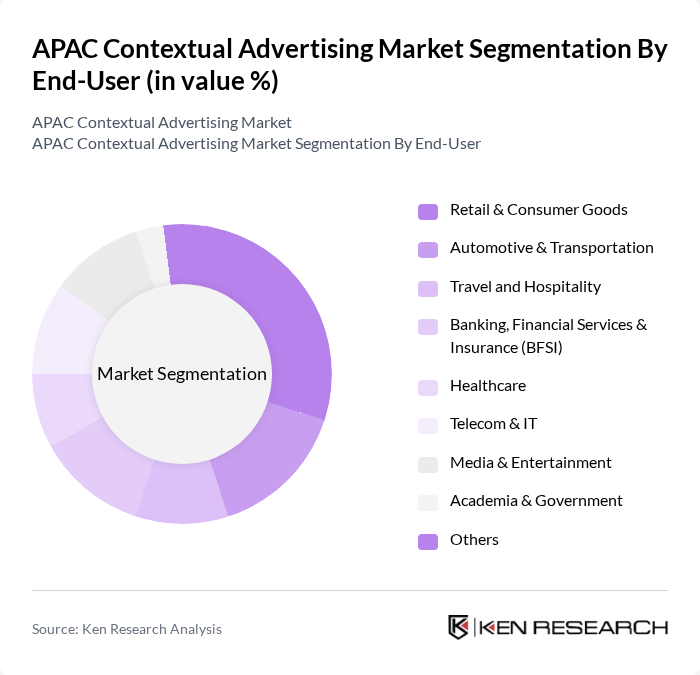

By End-User:The end-user segmentation includes Retail & Consumer Goods, Automotive & Transportation, Travel and Hospitality, Banking, Financial Services & Insurance (BFSI), Healthcare, Telecom & IT, Media & Entertainment, Academia & Government, and Others. Each sector utilizes contextual advertising to reach its target audience effectively, with retail and consumer goods, BFSI, and media & entertainment sectors leading adoption due to their high digital engagement and focus on personalized consumer experiences .

The APAC Contextual Advertising Market is characterized by a dynamic mix of regional and international players. Leading participants such as Google (Alphabet Inc.), Meta (Facebook), Amazon Advertising, Taboola, Outbrain, Criteo, AdRoll, Microsoft Advertising, Media.net, InMobi, AppNexus (Xandr), AdColony, Amobee, Beijing Miteno Communication Technology (Gridsum), The Trade Desk contribute to innovation, geographic expansion, and service delivery in this space.

The future of contextual advertising in APAC appears promising, driven by technological advancements and evolving consumer behaviors. As brands increasingly prioritize data privacy and compliance, innovative solutions that respect user consent will gain traction. Furthermore, the integration of AI and machine learning will enhance targeting precision, enabling advertisers to deliver more relevant content. The shift towards mobile and programmatic advertising will also continue, fostering a more dynamic and responsive advertising environment that meets the needs of both consumers and brands.

| Segment | Sub-Segments |

|---|---|

| By Type | Display Advertising Video Advertising Native Advertising Social Media Advertising Search Advertising Activity-Based Advertising Location-Based Advertising Affiliate Marketing Others |

| By End-User | Retail & Consumer Goods Automotive & Transportation Travel and Hospitality Banking, Financial Services & Insurance (BFSI) Healthcare Telecom & IT Media & Entertainment Academia & Government Others |

| By Industry Vertical | E-commerce Entertainment Education Real Estate Telecommunications Others |

| By Geographic Focus | China India Japan South Korea Southeast Asia (ASEAN) Oceania (Australia & New Zealand) Others |

| By Advertising Format | Text Ads Image Ads Interactive Ads Audio Ads Video Ads Others |

| By Campaign Objective | Brand Awareness Lead Generation Customer Retention Sales Conversion Others |

| By Budget Size | Small Budget Medium Budget Large Budget Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Brand Awareness in Contextual Advertising | 150 | Marketing Directors, Brand Managers |

| Consumer Engagement Metrics | 100 | Digital Marketing Analysts, Consumer Insights Managers |

| Effectiveness of Ad Formats | 80 | Creative Directors, Media Planners |

| Trends in Mobile Advertising | 120 | Mobile Marketing Specialists, App Developers |

| Impact of AI on Contextual Advertising | 90 | Data Scientists, AI Specialists in Marketing |

The APAC Contextual Advertising Market is valued at approximately USD 54 billion, driven by digitalization, mobile internet usage, and the demand for personalized advertising experiences. This growth reflects the increasing importance of contextual data in enhancing targeting precision and engagement rates.