Region:Asia

Author(s):Geetanshi

Product Code:KRAD4174

Pages:91

Published On:December 2025

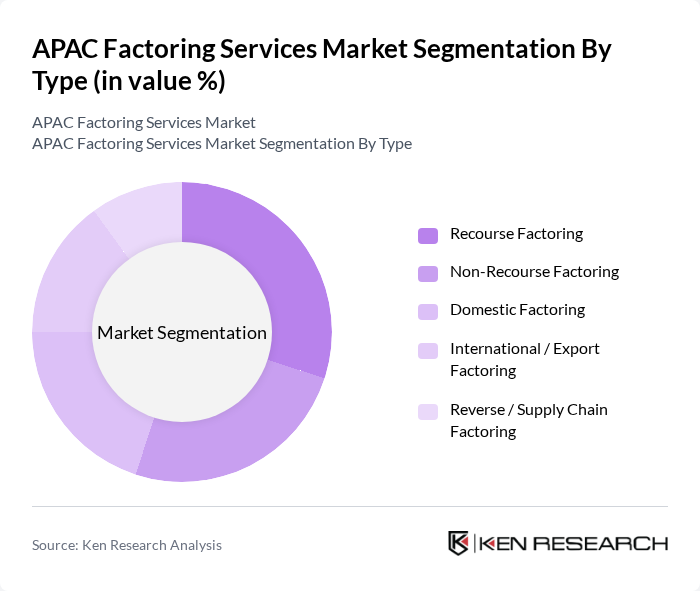

By Type:The market is segmented into various types of factoring services, including Recourse Factoring, Non-Recourse Factoring, Domestic Factoring, International / Export Factoring, and Reverse / Supply Chain Factoring. Each type serves different business needs and risk profiles, influencing their adoption rates across various industries. Recourse factoring remains widely used due to its relatively lower cost and strong applicability in domestic supply chains, while non?recourse and international / export factoring are increasingly adopted to manage cross?border credit risk and support export-oriented SMEs. Reverse / supply chain factoring is gaining traction as large buyers adopt supply chain finance programs to improve supplier liquidity and stabilize procurement networks in sectors such as manufacturing, retail, and logistics.

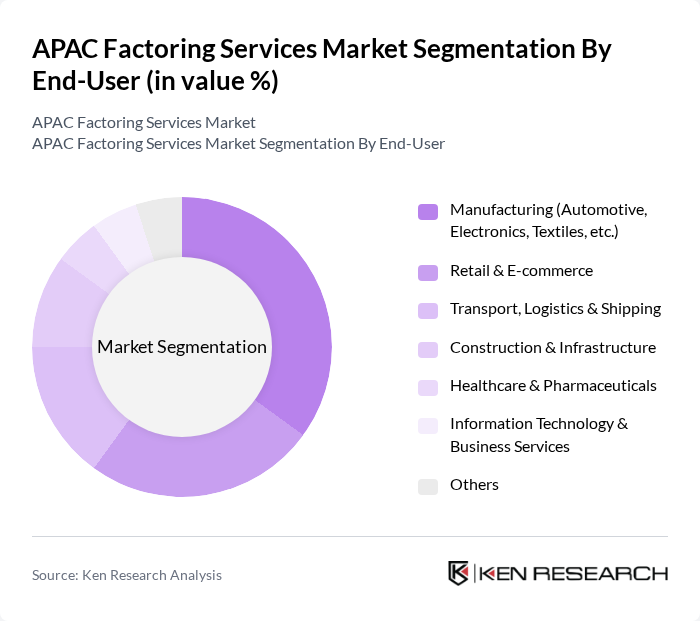

By End-User:The end-user segmentation includes Manufacturing (Automotive, Electronics, Textiles, etc.), Retail & E-commerce, Transport, Logistics & Shipping, Construction & Infrastructure, Healthcare & Pharmaceuticals, Information Technology & Business Services, and Others. Each sector has unique cash flow requirements, driving the demand for tailored factoring solutions. Manufacturing holds the largest share in APAC factoring usage, reflecting high working capital intensity and extensive use of export factoring, while retail & e?commerce, transport and logistics are increasingly using factoring and supply chain finance to support rapid inventory cycles, omni?channel distribution, and cross?border trade flows.

The APAC Factoring Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as HSBC Holdings plc (including HSBC Invoice Finance), BNP Paribas SA (BNP Paribas Factor), Standard Chartered plc, DBS Bank Ltd, Oversea-Chinese Banking Corporation Limited (OCBC), Australia and New Zealand Banking Group Limited (ANZ), Mitsubishi UFJ Financial Group, Inc. (MUFG), Sumitomo Mitsui Banking Corporation (SMBC), Industrial and Commercial Bank of China Limited (ICBC), Bank of China Limited, ICICI Bank Limited, China Construction Bank Corporation, CIMB Group Holdings Berhad, Coface SA, Allianz Trade (Euler Hermes) contribute to innovation, geographic expansion, and service delivery in this space by integrating digital platforms, data?driven credit scoring, and cross?border trade finance capabilities into their factoring and supply chain finance offerings.

The APAC factoring services market is poised for transformative growth, driven by technological advancements and evolving customer needs. The integration of AI and machine learning is expected to enhance risk assessment and streamline operations, making factoring services more accessible. Additionally, the increasing focus on sustainable financing solutions will likely shape service offerings, as businesses seek to align with environmental and social governance criteria. This dynamic environment presents opportunities for innovation and collaboration among stakeholders in the financial ecosystem.

| Segment | Sub-Segments |

|---|---|

| By Type | Recourse Factoring Non-Recourse Factoring Domestic Factoring International / Export Factoring Reverse / Supply Chain Factoring |

| By End-User | Manufacturing (Automotive, Electronics, Textiles, etc.) Retail & E-commerce Transport, Logistics & Shipping Construction & Infrastructure Healthcare & Pharmaceuticals Information Technology & Business Services Others |

| By Region / Country | China Japan South Korea India ASEAN (Indonesia, Vietnam, Thailand, Malaysia, etc.) Australia & New Zealand |

| By Provider Type | Banks Non-Banking Financial Institutions (NBFIs) Fintech Platforms & Digital Factoring Providers Others |

| By Service Model | Full-Service Factoring (Finance, Collection & Credit Cover) Selective / Single-Invoice Factoring Reverse / Payables Finance Programs Confidential Invoice Discounting Others |

| By Client Size | Micro & Small Enterprises Medium Enterprises Large Corporates |

| By Tenor | Short-Term (up to 90 days) Medium-Term (91–180 days) Long-Term (above 180 days) |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Sector Factoring | 60 | Finance Managers, CFOs |

| Retail Industry Factoring Solutions | 50 | Operations Directors, Accounts Receivable Managers |

| SME Factoring Utilization | 70 | Business Owners, Financial Advisors |

| Export Factoring Services | 40 | Export Managers, Trade Finance Specialists |

| Technology Sector Factoring | 50 | Product Managers, Financial Analysts |

The APAC Factoring Services Market is valued at approximately USD 1,080 billion, driven by the increasing demand for working capital solutions among SMEs, the growth of e-commerce, and the trend of digitalization in financial services.