Region:Middle East

Author(s):Rebecca

Product Code:KRAE0917

Pages:86

Published On:December 2025

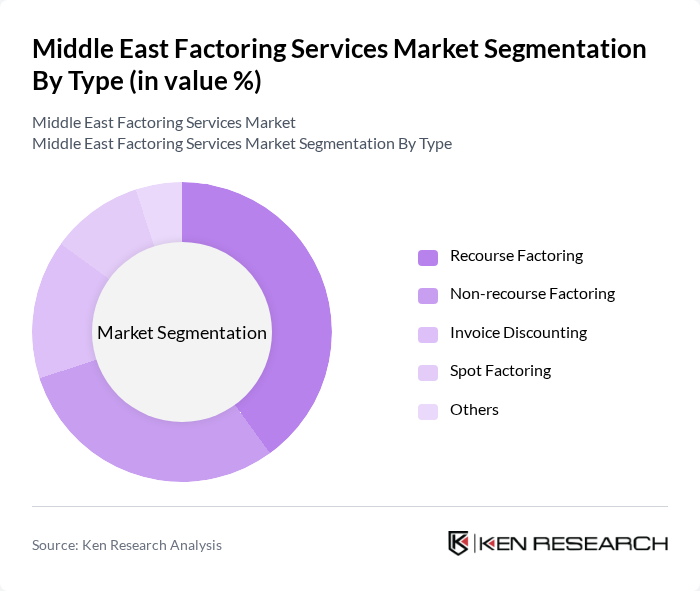

By Type:The market is segmented into various types of factoring services, including Recourse Factoring, Non-recourse Factoring, Invoice Discounting, Spot Factoring, and Others. Among these, Recourse Factoring is the most dominant segment, as it allows businesses to retain control over their receivables while providing flexibility in financing. Non-recourse Factoring is also gaining traction due to its risk mitigation benefits, appealing to businesses looking to minimize credit risk.

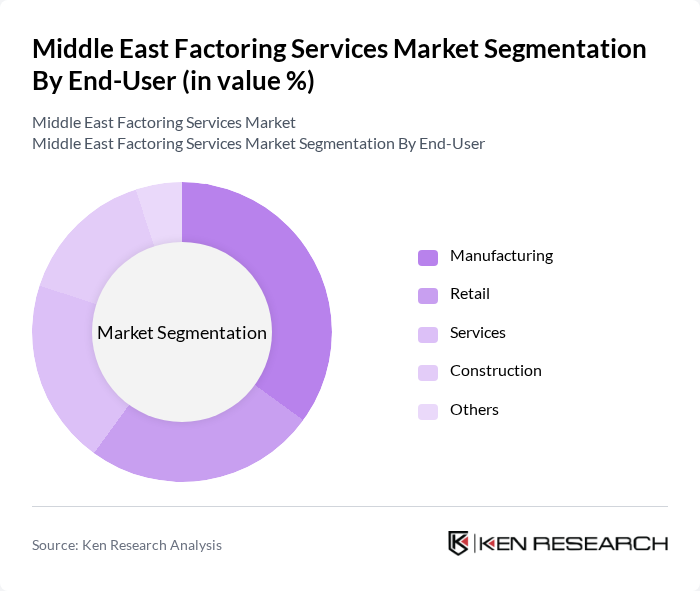

By End-User:The end-user segmentation includes Manufacturing, Retail, Services, Construction, and Others. The Manufacturing sector leads the market, driven by the need for immediate cash flow to manage operational costs and invest in production. Retail also shows significant demand for factoring services, as businesses seek to improve liquidity and manage inventory costs effectively.

The Middle East Factoring Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Qatar National Bank, Emirates NBD, Arab Banking Corporation, Al Baraka Banking Group, Abu Dhabi Commercial Bank, National Bank of Kuwait, Bank of Beirut and the Arab Countries, Saudi British Bank, Gulf Bank, Mashreq Bank, Bank Al Jazira, Qatar Islamic Bank, Al Ahli Bank of Kuwait, Bank of Sharjah, and Bahrain Islamic Bank contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East factoring services market appears promising, driven by technological advancements and increasing digitalization. As businesses increasingly adopt digital solutions, the demand for efficient and transparent factoring services is expected to rise. Moreover, the integration of artificial intelligence in risk assessment will enhance service delivery, making factoring more accessible. The focus on sustainability in financing practices will also shape the market, encouraging providers to develop eco-friendly financial products that align with global sustainability goals.

| Segment | Sub-Segments |

|---|---|

| By Type | Recourse Factoring Non-recourse Factoring Invoice Discounting Spot Factoring Others |

| By End-User | Manufacturing Retail Services Construction Others |

| By Industry | Healthcare Transportation Agriculture Technology Others |

| By Geography | GCC Countries Levant Region North Africa Others |

| By Service Model | Full-Service Factoring Selective Factoring Reverse Factoring Others |

| By Client Size | Small Enterprises Medium Enterprises Large Enterprises Others |

| By Payment Terms | Short-term Factoring Long-term Factoring Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| SME Factoring Utilization | 150 | Business Owners, Financial Managers |

| Corporate Factoring Services | 100 | Chief Financial Officers, Treasury Managers |

| Sector-Specific Factoring Insights | 80 | Industry Analysts, Sector Specialists |

| Regulatory Impact on Factoring | 60 | Compliance Officers, Legal Advisors |

| Market Trends and Innovations | 70 | Product Development Managers, Strategy Consultants |

The Middle East Factoring Services Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by increased awareness of invoice financing among SMEs and the adoption of fintech platforms across the region.