Region:Asia

Author(s):Dev

Product Code:KRAD5230

Pages:91

Published On:December 2025

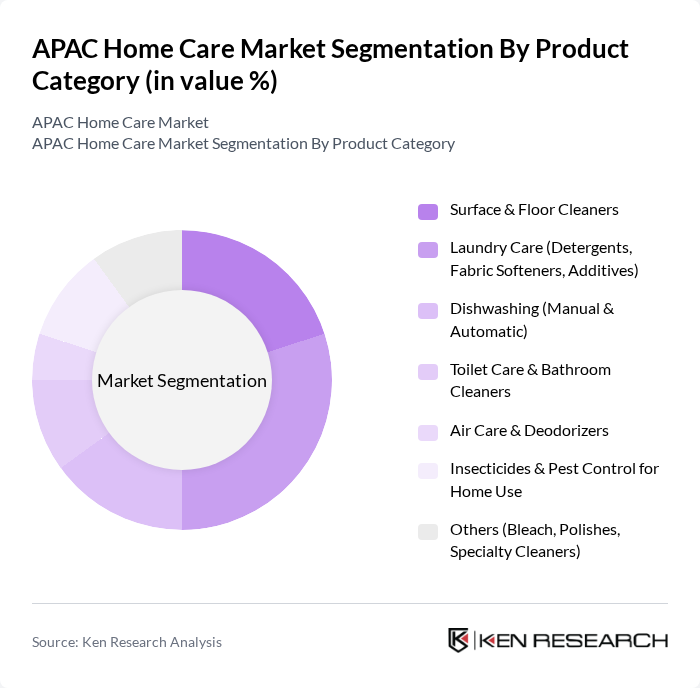

By Product Category:The product category segmentation includes various essential home care products that cater to different cleaning and hygiene needs in households. The subsegments are Surface & Floor Cleaners, Laundry Care (Detergents, Fabric Softeners, Additives), Dishwashing (Manual & Automatic), Toilet Care & Bathroom Cleaners, Air Care & Deodorizers, Insecticides & Pest Control for Home Use, and Others (Bleach, Polishes, Specialty Cleaners). Among these, Laundry Care is the leading subsegment in Asia-Pacific in terms of value, driven by the high penetration of detergent products, rising use of fabric conditioners and specialized additives, and increasing frequency of laundry in urban households.

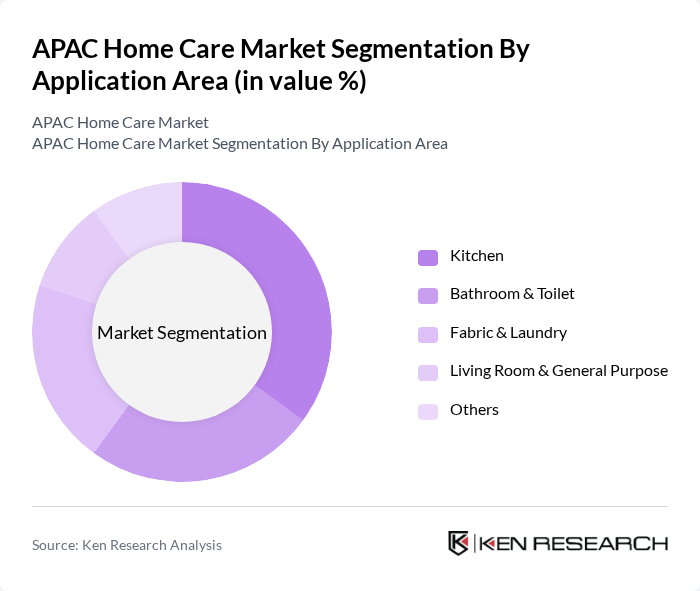

By Application Area:The application area segmentation focuses on the specific locations within the home where cleaning products are utilized, reflecting differentiated usage intensity and product mix. The subsegments include Kitchen, Bathroom & Toilet, Fabric & Laundry, Living Room & General Purpose, and Others. The Kitchen segment is particularly dominant, as it requires frequent cleaning and maintenance due to food preparation activities, grease and oil build-up, and the need for hygiene on food-contact surfaces, leading to a higher consumption of dishwashing liquids, surface sprays, and multipurpose cleaners.

The APAC Home Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co., Unilever PLC, Reckitt Benckiser Group plc, Henkel AG & Co. KGaA, S. C. Johnson & Son, Inc., Kao Corporation, Lion Corporation, Colgate-Palmolive Company, Godrej Consumer Products Limited, Marico Limited, LG Household & Health Care Ltd., Amway Corp., The Clorox Company, Pigeon Corporation, Seventh Generation, Inc. (Unilever) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC home care market is poised for transformative growth driven by technological advancements and evolving consumer preferences. As urbanization continues, the demand for innovative home care solutions will rise, particularly those that integrate smart technology. Additionally, sustainability will play a crucial role, with consumers increasingly favoring eco-friendly products. Companies that adapt to these trends and invest in research and development will likely capture significant market share, positioning themselves favorably in this dynamic landscape.

| Segment | Sub-Segments |

|---|---|

| By Product Category | Surface & Floor Cleaners Laundry Care (Detergents, Fabric Softeners, Additives) Dishwashing (Manual & Automatic) Toilet Care & Bathroom Cleaners Air Care & Deodorizers Insecticides & Pest Control for Home Use Others (Bleach, Polishes, Specialty Cleaners) |

| By Application Area | Kitchen Bathroom & Toilet Fabric & Laundry Living Room & General Purpose Others |

| By Country | China Japan India South Korea Australia & New Zealand Southeast Asia (Indonesia, Thailand, Malaysia, Vietnam, Philippines, Others) Rest of APAC |

| By Product Formulation | Liquid Powder/Granules Sprays & Aerosols Tablets, Pods & Concentrates Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Traditional Grocery/Kirana & Mom-and-pop Stores Online Retail & E-commerce Marketplaces Direct Selling & Subscription Models Others |

| By Consumer Demographics | Age Group Income Level Family Size Urban vs Rural Households Others |

| By Sustainability & Claims | Eco-friendly/Bio-based Products Hypoallergenic & Sensitive-skin Friendly Fragrance-free/Low-fragrance Value/Budget Products Premium & Specialty Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Household Cleaning Products | 140 | Household Decision Makers, Product Users |

| Personal Care Products | 110 | Consumers aged 18-45, Beauty Enthusiasts |

| Laundry Care Products | 130 | Families with Children, Laundry Product Users |

| Eco-friendly Home Care Products | 80 | Sustainability Advocates, Environmentally Conscious Consumers |

| Emerging Market Trends | 90 | Retail Managers, Market Analysts |

The APAC Home Care Market is valued at approximately USD 55 billion, driven by factors such as urbanization, rising disposable incomes, and increased consumer awareness of hygiene, particularly in emerging economies like China, India, and Indonesia.