Region:Global

Author(s):Geetanshi

Product Code:KRAA2345

Pages:95

Published On:August 2025

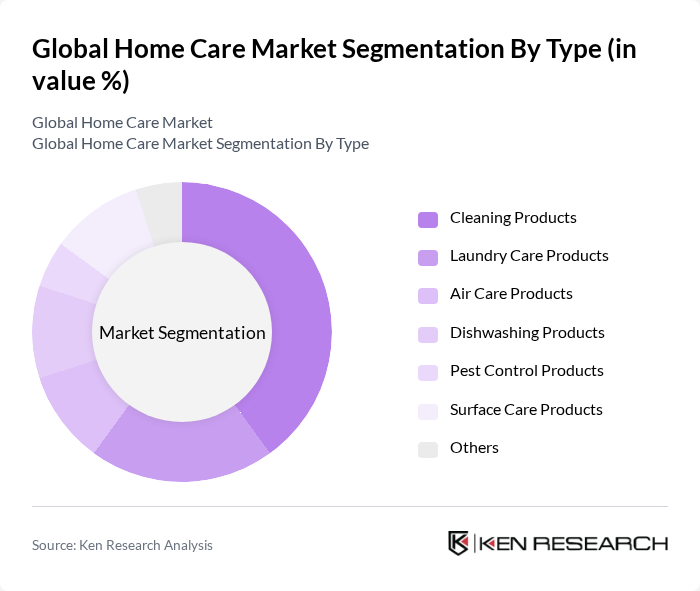

By Type:The market is segmented into various types of products, including cleaning products, laundry care products, air care products, dishwashing products, pest control products, surface care products, and others. Among these, cleaning products dominate the market due to their essential role in maintaining hygiene and cleanliness in households and commercial establishments. The segment continues to benefit from innovations in sustainable packaging and the introduction of plant-based and biodegradable formulations .

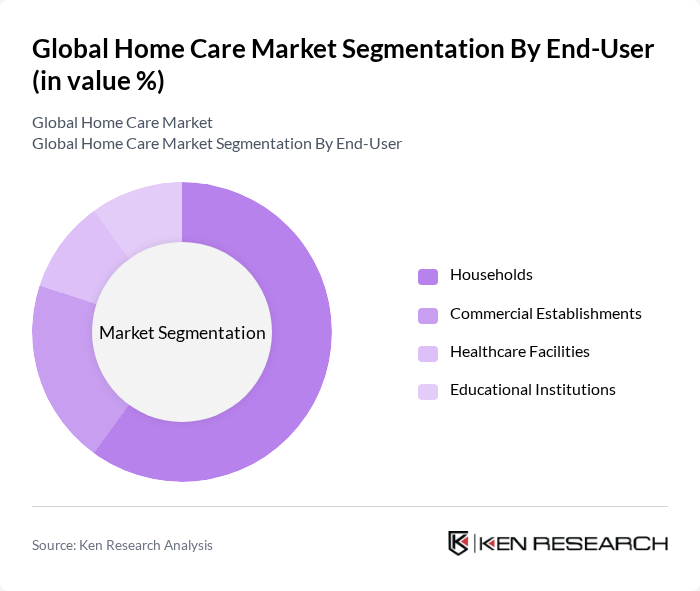

By End-User:The end-user segmentation includes households, commercial establishments, healthcare facilities, and educational institutions. Households represent the largest segment, driven by the increasing focus on cleanliness and hygiene among consumers, particularly in urban areas. The trend is further supported by rising dual-income households and greater adoption of convenience-oriented home care solutions .

The Global Home Care Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble Co., Unilever PLC, Reckitt Benckiser Group PLC, Colgate-Palmolive Company, SC Johnson & Son, Inc., Henkel AG & Co. KGaA, Kimberly-Clark Corporation, The Clorox Company, Church & Dwight Co., Inc., Ecolab Inc., Amway Corporation, 3M Company, PZ Cussons PLC, Kao Corporation, Lion Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The future of the home care market appears promising, driven by technological advancements and evolving consumer preferences. The integration of smart home technologies is expected to enhance product functionality, while the shift towards natural and organic products will cater to health-conscious consumers. Additionally, the rise of subscription-based services will provide convenience and foster customer loyalty. Companies that adapt to these trends will likely capture significant market share and drive sustainable growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Cleaning Products Laundry Care Products Air Care Products Dishwashing Products Pest Control Products Surface Care Products Others |

| By End-User | Households Commercial Establishments Healthcare Facilities Educational Institutions |

| By Distribution Channel | Supermarkets/Hypermarkets Online Retail Convenience Stores Specialty Stores Direct Sales |

| By Product Formulation | Liquid Powder Spray Gel Tablets |

| By Packaging Type | Bottles Pouches Cans Boxes Others |

| By Price Range | Economy Mid-Range Premium |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Driven Consumers |

| By Region | North America Europe Asia-Pacific Latin America Middle East & Africa |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Household Cleaning Products | 120 | Homeowners, Cleaning Product Buyers |

| Personal Care Items | 100 | Consumers aged 18-65, Personal Care Enthusiasts |

| Eco-friendly Home Care Solutions | 80 | Sustainability Advocates, Green Product Users |

| Commercial Cleaning Services | 70 | Facility Managers, Business Owners |

| Innovative Home Care Technologies | 50 | Tech-savvy Consumers, Early Adopters |

The Global Home Care Market is valued at approximately USD 200 billion, driven by factors such as urbanization, rising disposable incomes, and increased consumer awareness regarding hygiene and cleanliness, particularly following global health crises.