Region:Middle East

Author(s):Dev

Product Code:KRAE0257

Pages:95

Published On:December 2025

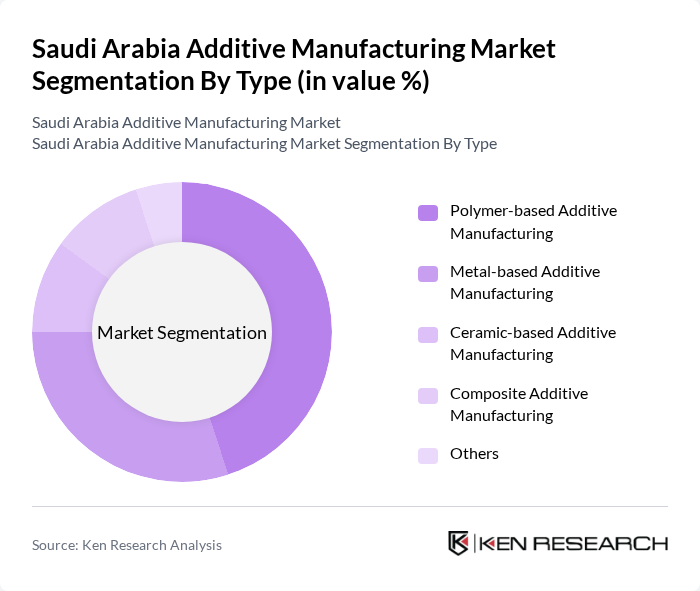

By Type:The additive manufacturing market in Saudi Arabia is segmented into various types, including polymer-based, metal-based, ceramic-based, composite, and others. Among these, polymer-based additive manufacturing is currently the leading segment due to its versatility and cost-effectiveness, making it suitable for a wide range of applications across industries. The demand for lightweight and durable materials in sectors such as automotive and healthcare further drives the growth of this segment.

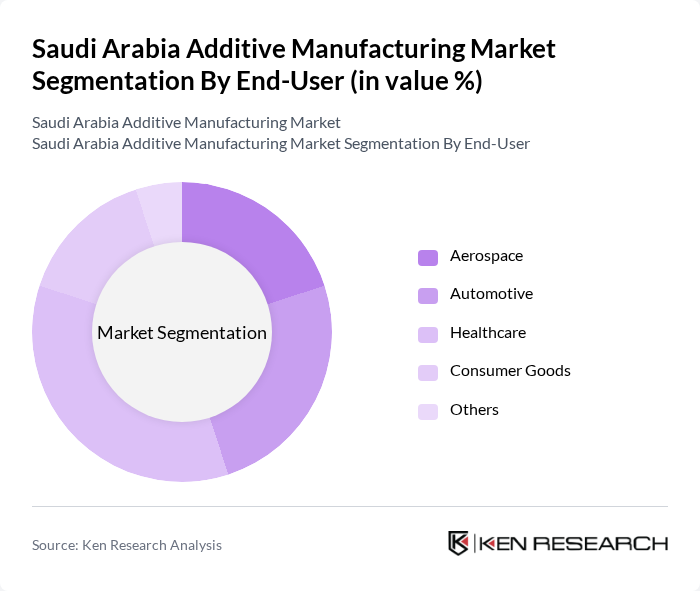

By End-User:The end-user segmentation of the additive manufacturing market includes aerospace, automotive, healthcare, consumer goods, and others. The healthcare sector is the dominant end-user, driven by the increasing demand for customized medical devices and implants. The ability to produce complex geometries and personalized solutions enhances the appeal of additive manufacturing in this field, leading to significant growth in market share.

The Saudi Arabia Additive Manufacturing Market is characterized by a dynamic mix of regional and international players. Leading participants such as Stratasys Ltd., 3D Systems Corporation, EOS GmbH, Materialise NV, HP Inc., Siemens AG, GE Additive, Renishaw plc, SLM Solutions Group AG, Xometry Inc., Formlabs Inc., Ultimaker B.V., Desktop Metal, Inc., Carbon, Inc., and Markforged, Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the additive manufacturing market in Saudi Arabia appears promising, driven by technological advancements and increased government support. As industries continue to embrace Industry 4.0, the integration of AI and machine learning into manufacturing processes is expected to enhance efficiency and reduce costs. Furthermore, the growing emphasis on sustainability will likely lead to innovations in eco-friendly materials and practices, positioning Saudi Arabia as a leader in sustainable additive manufacturing solutions in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Polymer-based Additive Manufacturing Metal-based Additive Manufacturing Ceramic-based Additive Manufacturing Composite Additive Manufacturing Others |

| By End-User | Aerospace Automotive Healthcare Consumer Goods Others |

| By Industry Application | Prototyping Tooling Production Parts Customization Others |

| By Material Type | Thermoplastics Thermosetting Plastics Metals Ceramics Others |

| By Technology | Fused Deposition Modeling (FDM) Stereolithography (SLA) Selective Laser Sintering (SLS) Binder Jetting Others |

| By Geographic Region | Central Region Eastern Region Western Region Southern Region Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Aerospace Additive Manufacturing | 100 | Manufacturing Engineers, Production Managers |

| Healthcare 3D Printing Applications | 80 | Medical Device Developers, Hospital Procurement Officers |

| Automotive Parts Production | 90 | Design Engineers, Supply Chain Managers |

| Consumer Goods Prototyping | 70 | Product Development Managers, Marketing Directors |

| Construction and Infrastructure 3D Printing | 60 | Project Managers, Civil Engineers |

The Saudi Arabia Additive Manufacturing Market is valued at approximately USD 55 million, driven by increasing adoption across various industries, particularly manufacturing and healthcare, which benefit from rapid prototyping and customization capabilities.