Region:Middle East

Author(s):Shubham

Product Code:KRAD3616

Pages:81

Published On:November 2025

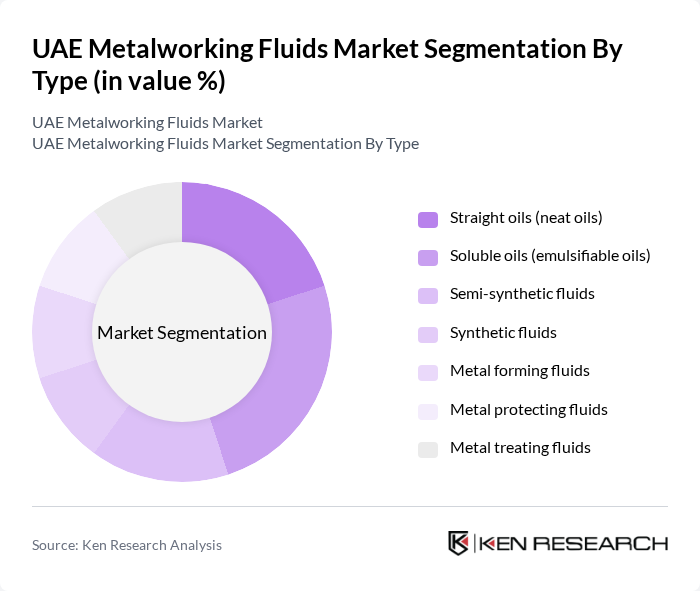

By Type:The market is segmented into various types of metalworking fluids, including straight oils, soluble oils, semi-synthetic fluids, synthetic fluids, metal forming fluids, metal protecting fluids, and metal treating fluids. Each type serves specific applications and industries, catering to the diverse needs of manufacturers. Soluble oils remain the most widely used due to their versatility and cost-effectiveness, while synthetic and semi-synthetic fluids are gaining traction in high-precision and environmentally sensitive applications .

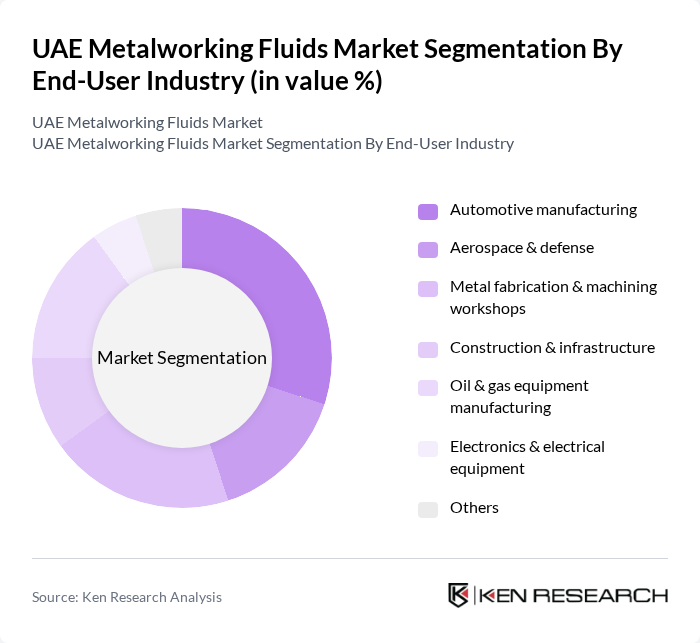

By End-User Industry:The metalworking fluids market is further segmented by end-user industries, including automotive manufacturing, aerospace & defense, metal fabrication & machining workshops, construction & infrastructure, oil & gas equipment manufacturing, electronics & electrical equipment, and others. Each industry has unique requirements for metalworking fluids, influencing the demand dynamics. The automotive sector remains the largest consumer, followed by aerospace & defense and oil & gas equipment manufacturing, reflecting the UAE's strategic focus on industrial diversification and advanced manufacturing .

The UAE Metalworking Fluids Market is characterized by a dynamic mix of regional and international players. Leading participants such as Castrol Limited (BP Group), Fuchs Petrolub SE, Houghton International (Quaker Houghton), Master Fluid Solutions, Quaker Chemical Corporation (Quaker Houghton), TotalEnergies Marketing Middle East, ExxonMobil Lubricants & Specialties, Chevron Corporation, BP plc, Idemitsu Kosan Co., Ltd., Milacron LLC, Blaser Swisslube AG, Chemtool Incorporated, Lube-Tech, Gulf Oil Middle East Limited, Petromin Corporation, ENOC Lubricants (Emirates National Oil Company), ADNOC Distribution (Abu Dhabi National Oil Company), Al Ghaith Oilfield Supplies & Services, Al Masaood Oil & Gas contribute to innovation, geographic expansion, and service delivery in this space.

The future of the UAE metalworking fluids market appears promising, driven by ongoing technological innovations and a shift towards sustainable practices. As industries increasingly prioritize eco-friendly solutions, the demand for biodegradable and bio-based fluids is expected to rise. Additionally, the integration of smart technologies in fluid management systems will enhance operational efficiency. These trends, coupled with the UAE's strategic investments in manufacturing and aerospace sectors, will likely create a robust environment for market growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Straight oils (neat oils) Soluble oils (emulsifiable oils) Semi-synthetic fluids Synthetic fluids Metal forming fluids Metal protecting fluids Metal treating fluids |

| By End-User Industry | Automotive manufacturing Aerospace & defense Metal fabrication & machining workshops Construction & infrastructure Oil & gas equipment manufacturing Electronics & electrical equipment Others |

| By Application | Metal cutting (machining, turning, milling, drilling) Metal forming (forging, rolling, drawing, stamping) Metal treating (heat treatment, quenching) Metal protecting (rust prevention, corrosion protection) Cleaning Multi-functional Others |

| By Distribution Channel | Direct sales (to manufacturers/end-users) Industrial distributors Online B2B platforms Oil & lubricant retail outlets Others |

| By Region | Abu Dhabi Dubai Sharjah Ras Al Khaimah Ajman Fujairah Umm Al Quwain Others |

| By Fluid Properties | Cooling efficiency Lubrication performance Corrosion resistance Biodegradability & eco-friendliness Others |

| By Packaging Type | Bulk drums & containers Intermediate bulk containers (IBC) Small packs (cans, bottles) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Manufacturing Sector | 100 | Production Managers, Quality Control Engineers |

| Aerospace Component Manufacturing | 60 | Technical Directors, Process Engineers |

| General Manufacturing Applications | 80 | Operations Managers, Maintenance Supervisors |

| Metalworking Fluid Distributors | 50 | Sales Managers, Product Development Specialists |

| Research & Development in Fluid Technology | 40 | R&D Managers, Chemical Engineers |

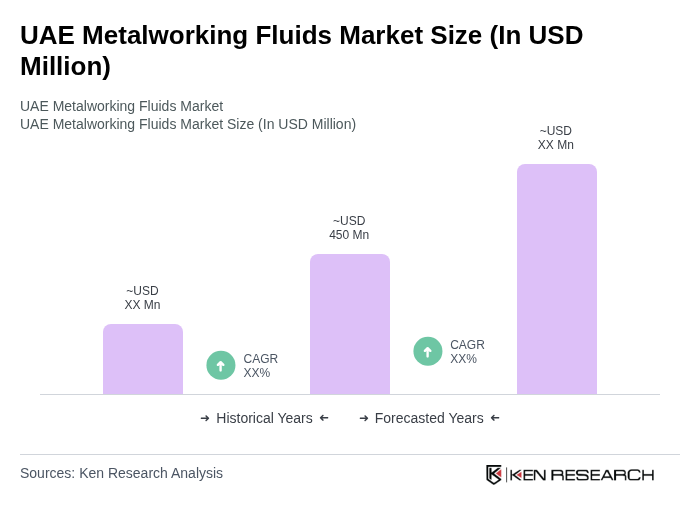

The UAE Metalworking Fluids Market is valued at approximately USD 450 million, reflecting a significant growth driven by advancements in manufacturing processes and the expansion of key sectors such as automotive and aerospace.