Region:Asia

Author(s):Rebecca

Product Code:KRAA9261

Pages:95

Published On:November 2025

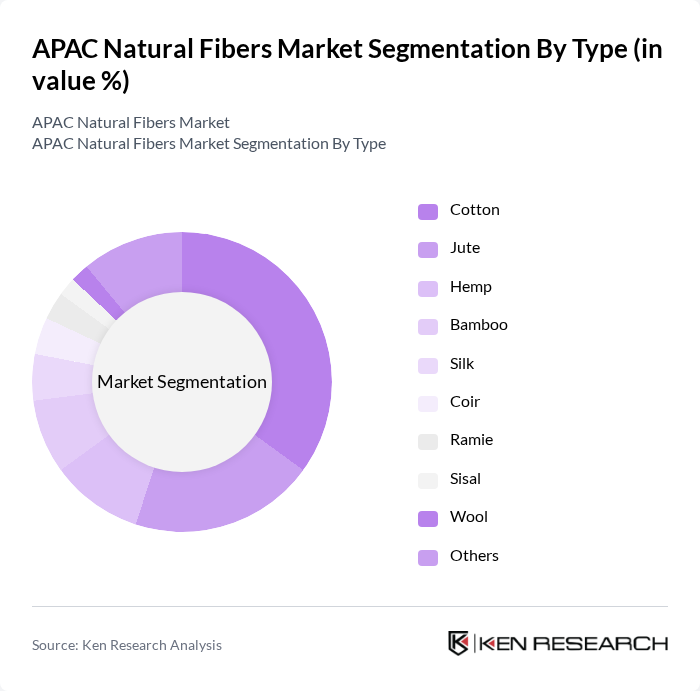

By Type:The market is segmented into various types of natural fibers, including Cotton, Jute, Hemp, Bamboo, Silk, Coir, Ramie, Sisal, Wool, and Others. Each type has unique properties and applications, catering to different consumer needs and preferences. Cotton remains the most widely used fiber due to its versatility and comfort, while jute and hemp are gaining traction for their sustainability attributes. Bamboo and ramie are increasingly used in specialty textiles and eco-friendly packaging, while wool and silk retain importance in premium apparel and home furnishings .

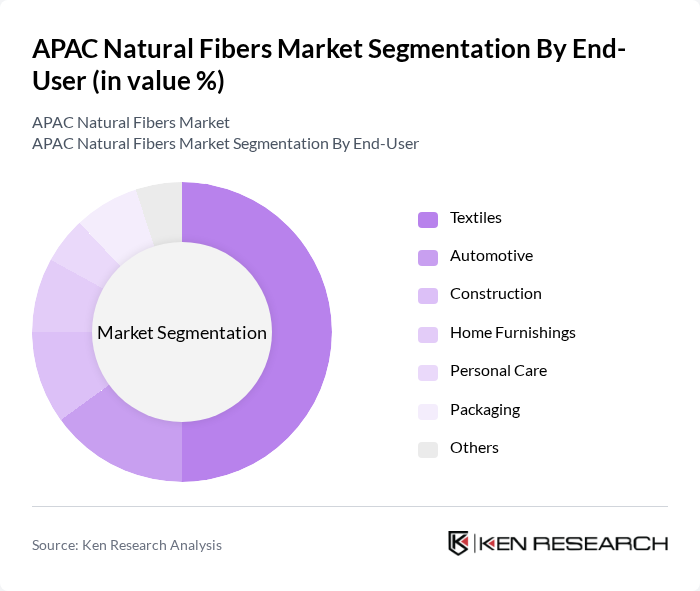

By End-User:The end-user segmentation includes Textiles, Automotive, Construction, Home Furnishings, Personal Care, Packaging, and Others. The textile industry is the largest consumer of natural fibers, driven by the growing demand for sustainable fashion and eco-friendly products. The automotive sector is increasingly utilizing natural fibers for interior components, reflecting a broader trend towards sustainability across industries. Construction and packaging are also adopting natural fibers for insulation and biodegradable materials, while home furnishings and personal care sectors leverage their comfort and hypoallergenic properties .

The APAC Natural Fibers Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aditya Birla Group, Grasim Industries, Jute Corporation of India, Cotton Corporation of India, Indo Count Industries, Vardhman Textiles, Welspun India, RSWM Limited, Bombay Dyeing, Trident Group, Himadri Speciality Chemical, Shree Renuka Sugars, KPR Mill, Suryalata Spinning Mills, Satyam Spinners, China National Cotton Group Corporation, Zhejiang Hengyi Group, Lenzing AG, PT Indo Bharat Rayon (Indonesia), Bangladesh Jute Mills Corporation, Fujian Kaisheng New Materials Co., Ltd., Ramco Industries Limited, Toyobo Co., Ltd. (Japan), Toray Industries, Inc. (Japan), PT Sri Rejeki Isman Tbk (Sritex, Indonesia) contribute to innovation, geographic expansion, and service delivery in this space.

The APAC natural fibers market is poised for significant transformation, driven by a growing eco-conscious consumer base and increasing regulatory support for sustainable practices. As governments implement stricter environmental regulations, the demand for natural fibers is expected to rise. Additionally, technological advancements will likely enhance production efficiency, making natural fibers more competitive against synthetic alternatives. This evolving landscape presents opportunities for innovation and collaboration within the textile industry, fostering a more sustainable future for natural fibers in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Cotton Jute Hemp Bamboo Silk Coir Ramie Sisal Wool Others |

| By End-User | Textiles Automotive Construction Home Furnishings Personal Care Packaging Others |

| By Region | China India Bangladesh Indonesia Vietnam Rest of APAC |

| By Application | Apparel Industrial Textiles Home Textiles Technical Textiles Medical Textiles Others |

| By Processing Method | Mechanical Processing Chemical Processing Bioprocessing Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Institutional Sales Others |

| By Product Form | Raw Fibers Processed Fibers Blended Fibers Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cotton Production Insights | 100 | Farmers, Agricultural Extension Officers |

| Jute Processing Techniques | 60 | Manufacturers, Quality Control Managers |

| Hemp Market Trends | 50 | Textile Designers, Sustainability Experts |

| Natural Fiber Export Dynamics | 70 | Export Managers, Trade Analysts |

| Consumer Preferences for Sustainable Fibers | 120 | Retail Buyers, Market Researchers |

The APAC Natural Fibers Market is valued at approximately USD 35 billion, driven by increasing consumer demand for sustainable and eco-friendly products, as well as a shift in the textile and apparel industries towards natural fibers.