Region:Asia

Author(s):Geetanshi

Product Code:KRAD6031

Pages:100

Published On:December 2025

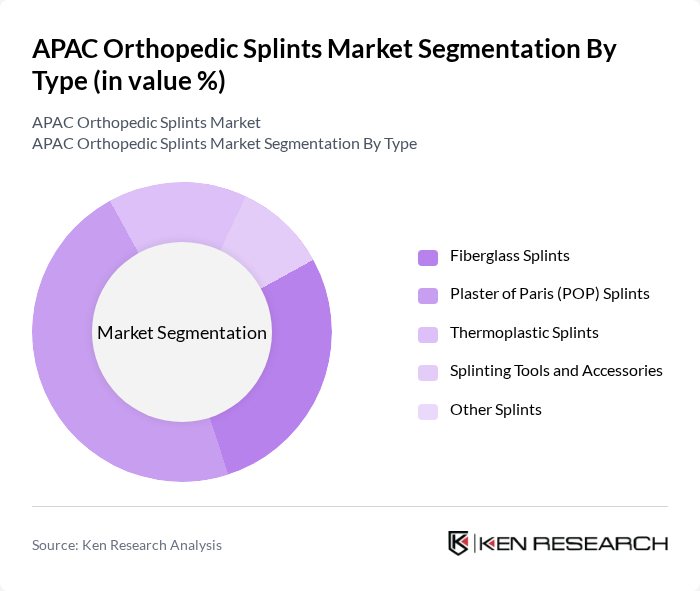

By Type:The market is segmented into various types of orthopedic splints, including fiberglass splints, plaster of Paris (POP) splints, thermoplastic splints, splinting tools and accessories, and other splints. Among these, fiberglass splints are gaining popularity due to their lightweight and water-resistant properties, making them a preferred choice in emergency care settings. Plaster of Paris splints remain widely used due to their affordability and ease of application. The demand for thermoplastic splints is also increasing, driven by their moldability and comfort for patients.

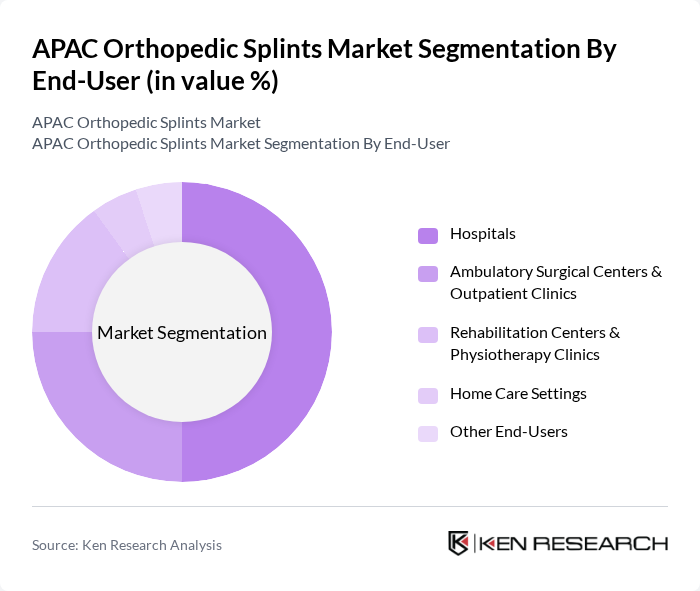

By End-User:The end-user segmentation includes hospitals, ambulatory surgical centers & outpatient clinics, rehabilitation centers & physiotherapy clinics, home care settings, and other end-users. Hospitals are the leading end-users due to their comprehensive orthopedic services and the need for immediate care in trauma cases. Ambulatory surgical centers are also witnessing growth as they provide cost-effective and efficient care for minor orthopedic procedures. Rehabilitation centers are increasingly adopting advanced splinting solutions to enhance patient recovery.

The APAC Orthopedic Splints Market is characterized by a dynamic mix of regional and international players. Leading participants such as Össur hf., Enovis Corporation (DJO Global), Breg, Inc., medi GmbH & Co. KG, DeRoyal Industries, Inc., Smith & Nephew plc, Stryker Corporation, Zimmer Biomet Holdings, Inc., 3M Company, Tynor Orthotics Pvt. Ltd., OPPO Medical Inc., BSN medical GmbH (Essity AB), Ottobock SE & Co. KGaA, Bauerfeind AG, Nippon Sigmax Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC orthopedic splints market is poised for significant growth, driven by technological advancements and demographic shifts. As the geriatric population expands and the incidence of orthopedic injuries rises, healthcare providers will increasingly seek innovative splint solutions. Additionally, the integration of smart technology and biodegradable materials will likely shape future product offerings, enhancing patient care and sustainability. The expansion of e-commerce platforms will also facilitate greater access to orthopedic splints, particularly in underserved regions, further driving market growth.

| Segment | Sub-Segments |

|---|---|

| By Type | Fiberglass Splints Plaster of Paris (POP) Splints Thermoplastic Splints Splinting Tools and Accessories Other Splints |

| By End-User | Hospitals Ambulatory Surgical Centers & Outpatient Clinics Rehabilitation Centers & Physiotherapy Clinics Home Care Settings Other End-Users |

| By Region | China Japan India South Korea Australia & New Zealand Southeast Asia (Indonesia, Thailand, Malaysia, Vietnam, Others) Rest of Asia-Pacific |

| By Material | Fiberglass Plaster Thermoplastics Metal & Metal Alloys Foam & Padding Materials Other Materials |

| By Application | Upper Extremity (Hand, Wrist, Elbow) Lower Extremity (Ankle, Foot, Knee) Spinal & Cervical Trauma & Emergency Care Post-operative & Post-cast Support Other Applications |

| By Distribution Channel | Hospital Pharmacies Retail Pharmacies & Medical Stores E-commerce & Online Platforms Direct Tenders & Institutional Sales Other Channels |

| By Policy Support | Public Health Insurance Coverage Private Health Insurance Reimbursement Medical Device Import/Manufacturing Incentives Local Content & Make-in-APAC Initiatives Other Policy Support Mechanisms |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Procurement for Orthopedic Supplies | 120 | Procurement Managers, Supply Chain Coordinators |

| Orthopedic Clinics and Rehabilitation Centers | 90 | Clinic Directors, Physical Therapists |

| Medical Device Distributors | 75 | Sales Managers, Product Specialists |

| Healthcare Policy Makers | 60 | Health Economists, Policy Analysts |

| Patient Feedback on Splint Usage | 100 | Patients, Caregivers |

The APAC Orthopedic Splints Market is valued at approximately USD 1.3 billion, driven by factors such as the increasing prevalence of orthopedic injuries, advancements in splinting technologies, and a rising geriatric population.