Region:Asia

Author(s):Shubham

Product Code:KRAC4368

Pages:98

Published On:January 2026

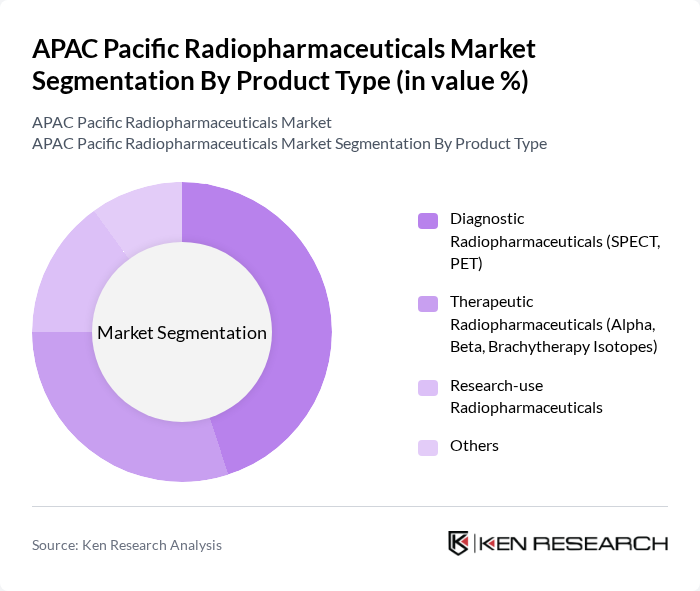

By Product Type:The product type segmentation includes Diagnostic Radiopharmaceuticals (SPECT, PET), Therapeutic Radiopharmaceuticals (Alpha, Beta, Brachytherapy Isotopes), Research-use Radiopharmaceuticals, and Others. Among these, Diagnostic Radiopharmaceuticals are leading the market due to their critical role in early disease detection and monitoring, with diagnostic products consistently accounting for the largest share of radiopharmaceutical use in Asia-Pacific.

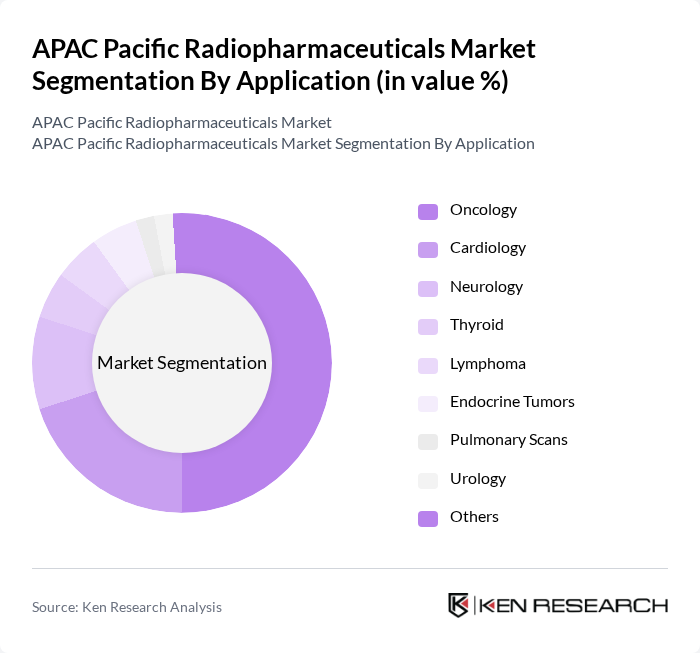

By Application:The application segmentation encompasses Oncology, Cardiology, Neurology, Thyroid, Lymphoma, Endocrine Tumors, Pulmonary Scans, Urology, and Others. Oncology is the dominant application area, driven by the rising incidence of cancer and the increasing use of radiopharmaceuticals for targeted therapy and precision imaging across the region. The growing awareness of early cancer detection, coupled with wider availability of PET-CT and SPECT-CT, and the effectiveness of radiopharmaceuticals in staging, response assessment, and radionuclide therapy are key factors contributing to this trend.

The APAC Pacific Radiopharmaceuticals Market is characterized by a dynamic mix of regional and international players. Leading participants such as GE HealthCare Technologies Inc., Siemens Healthineers AG, Cardinal Health, Inc., Bayer AG, Eli Lilly and Company, Novartis AG (including Advanced Accelerator Applications), Bracco Imaging S.p.A., IBA Radiopharma Solutions, Lantheus Holdings, Inc., Curium Pharma, Nihon Medi-Physics Co., Ltd., Telix Pharmaceuticals Limited, NorthStar Medical Radioisotopes, LLC, Radiopharm Theranostics Ltd, Fusion Pharmaceuticals Inc. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC radiopharmaceuticals market appears promising, driven by increasing investments in nuclear medicine and a growing emphasis on personalized medicine. As healthcare systems evolve, the integration of artificial intelligence and machine learning in diagnostics is expected to enhance treatment precision. Furthermore, the expansion of radiopharmaceutical applications in emerging markets will likely create new avenues for growth, fostering collaborations among key industry players to innovate and improve patient care.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Diagnostic Radiopharmaceuticals (SPECT, PET) Therapeutic Radiopharmaceuticals (Alpha, Beta, Brachytherapy Isotopes) Research-use Radiopharmaceuticals Others |

| By Application | Oncology Cardiology Neurology Thyroid Lymphoma Endocrine Tumors Pulmonary Scans Urology Others |

| By End-User | Hospitals and Clinics Diagnostic / Medical Imaging Centers Research & Academic Institutions Others |

| By Technology | PET Imaging SPECT Imaging Alpha and Beta Emitter Therapies Others |

| By Geography | China Japan India South Korea Australia & New Zealand Southeast Asia Rest of Asia Pacific |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oncology Radiopharmaceuticals | 120 | Nuclear Medicine Physicians, Oncology Pharmacists |

| Cardiology Applications | 90 | Cardiologists, Radiology Technologists |

| Neurology Imaging Agents | 70 | Neurologists, Clinical Researchers |

| Regulatory Compliance Insights | 50 | Regulatory Affairs Managers, Quality Assurance Officers |

| Market Trends and Innovations | 60 | Healthcare Analysts, Industry Consultants |

The APAC Pacific Radiopharmaceuticals Market is valued at approximately USD 2.0 billion, driven by the increasing prevalence of cancer and cardiovascular diseases, along with advancements in nuclear medicine technology.