Region:Middle East

Author(s):Dev

Product Code:KRAE0237

Pages:93

Published On:December 2025

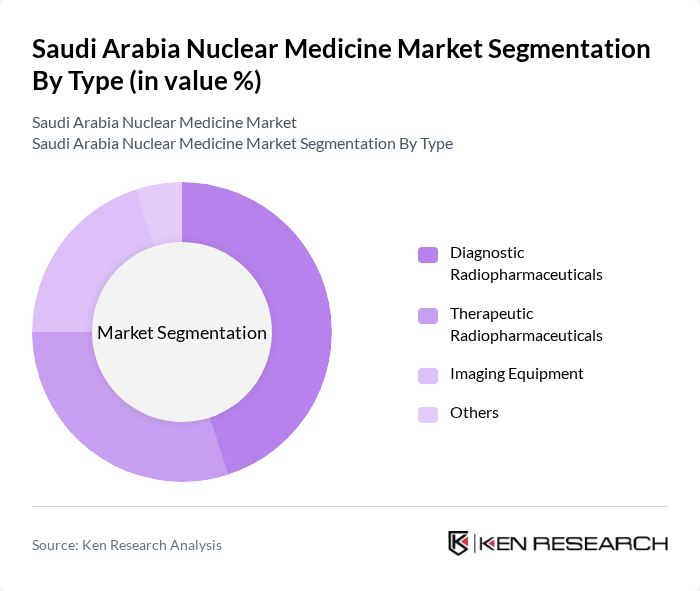

By Type:The market is segmented into Diagnostic Radiopharmaceuticals, Therapeutic Radiopharmaceuticals, Imaging Equipment, and Others. Diagnostic Radiopharmaceuticals are leading the market due to their critical role in early disease detection and monitoring, particularly in oncology and cardiology. The increasing demand for precise imaging techniques is driving the growth of this segment, as healthcare providers seek to enhance diagnostic accuracy and patient care.

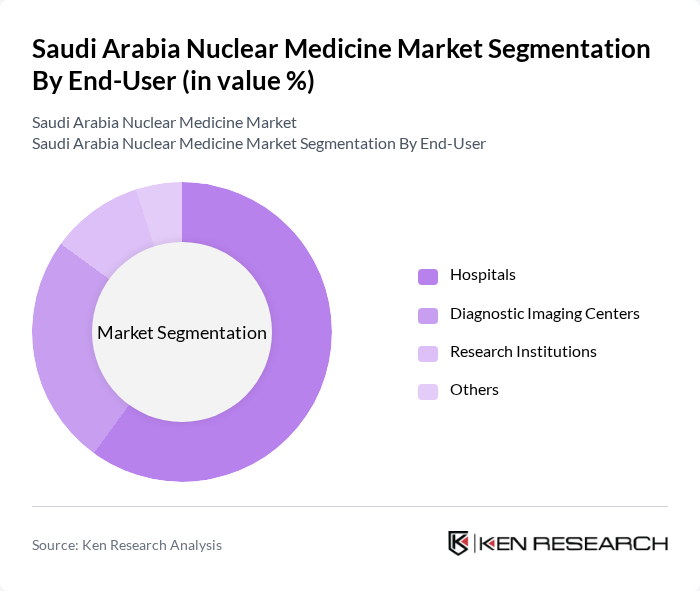

By End-User:The end-user segmentation includes Hospitals, Diagnostic Imaging Centers, Research Institutions, and Others. Hospitals are the dominant end-user segment, driven by the increasing number of patients requiring nuclear medicine services for diagnosis and treatment. The integration of nuclear medicine into hospital settings enhances patient management and treatment outcomes, making hospitals the primary consumers of nuclear medicine technologies.

The Saudi Arabia Nuclear Medicine Market is characterized by a dynamic mix of regional and international players. Leading participants such as King Faisal Specialist Hospital & Research Centre, Saudi German Hospital, Al-Moosa Specialist Hospital, Dallah Hospital, Prince Sultan Military Medical City, King Abdulaziz Medical City, Al Noor Hospital, Dr. Sulaiman Al Habib Medical Group, Al-Hayat Medical Center, Al-Muhaidib Group, Al-Faisal University, Saudi Pharmaceutical Industries and Medical Appliances Corporation, Saudi Biopharmaceuticals Manufacturing Company, Advanced Medical Solutions, Gulf Medical Company contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Saudi Arabia nuclear medicine market appears promising, driven by technological advancements and increased healthcare investments. The integration of artificial intelligence in diagnostics is expected to enhance the precision of nuclear imaging, while the shift towards outpatient services will improve patient access. As the government continues to prioritize healthcare infrastructure, the market is likely to experience significant growth, fostering innovation and collaboration within the sector, ultimately benefiting patient care and outcomes.

| Segment | Sub-Segments |

|---|---|

| By Type | Diagnostic Radiopharmaceuticals Therapeutic Radiopharmaceuticals Imaging Equipment Others |

| By End-User | Hospitals Diagnostic Imaging Centers Research Institutions Others |

| By Application | Oncology Cardiology Neurology Others |

| By Distribution Channel | Direct Sales Distributors Online Sales Others |

| By Geography | Central Region Eastern Region Western Region Southern Region |

| By Technology | SPECT PET Hybrid Imaging Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Nuclear Medicine Departments in Hospitals | 100 | Chief Radiologists, Nuclear Medicine Technologists |

| Radiopharmaceutical Suppliers | 75 | Sales Managers, Product Development Specialists |

| Healthcare Administrators | 80 | Hospital Administrators, Procurement Officers |

| Medical Imaging Centers | 60 | Operations Managers, Imaging Technologists |

| Regulatory Bodies and Associations | 50 | Policy Makers, Regulatory Affairs Managers |

The Saudi Arabia Nuclear Medicine Market is valued at approximately USD 10 billion, reflecting significant growth driven by the increasing prevalence of chronic diseases and advancements in healthcare infrastructure and imaging technologies.