Region:Asia

Author(s):Shubham

Product Code:KRAC8913

Pages:91

Published On:November 2025

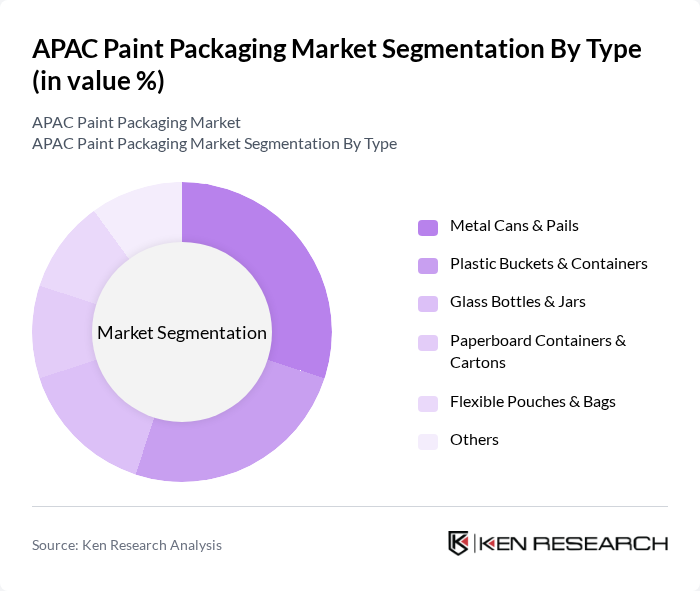

By Type:The market is segmented into various types of packaging, includingMetal Cans & Pails, Plastic Buckets & Containers, Glass Bottles & Jars, Paperboard Containers & Cartons, Flexible Pouches & Bags, and Others. Each of these subsegments caters to different consumer needs and preferences, with specific applications in decorative and industrial paints. Metal cans and pails remain the preferred choice for commercial and industrial applications due to their durability and recyclability, while plastic buckets and containers are favored for their lightweight and cost-effectiveness. Flexible pouches and paperboard containers are gaining popularity for small-volume and retail packaging, reflecting the shift toward sustainable and convenient solutions.

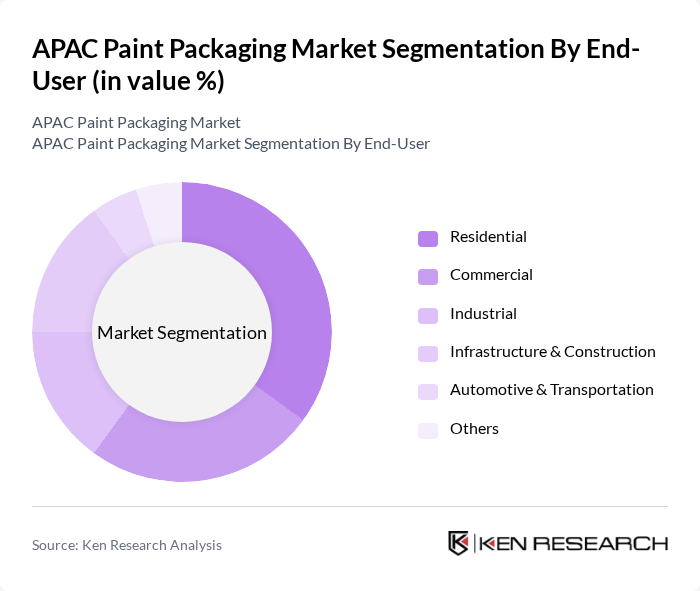

By End-User:The end-user segmentation includesResidential, Commercial, Industrial, Infrastructure & Construction, Automotive & Transportation, and Others. Each segment reflects the diverse applications of paint packaging across various sectors, with specific demands influencing the choice of packaging materials. Residential and commercial segments drive demand for smaller, consumer-oriented packaging, while industrial and infrastructure sectors require bulk and specialized solutions. Automotive and transportation applications focus on high-performance and protective packaging, supporting the region’s expanding vehicle production and maintenance industries.

The APAC Paint Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Asian Paints Ltd., Berger Paints India Ltd., Nippon Paint Holdings Co., Ltd., Kansai Nerolac Paints Ltd., AkzoNobel N.V., PPG Industries, Inc., Sherwin-Williams Company, Jotun A/S, DuluxGroup Ltd., RPM International Inc., Hempel A/S, Uflex Limited, Ester Industries Ltd., Sirca Paints India Ltd., Yung Chi Paint & Varnish Mfg. Co., Ltd. contribute to innovation, geographic expansion, and service delivery in this space.

The APAC paint packaging market is poised for transformative growth, driven by the increasing emphasis on sustainability and innovation. As consumer preferences shift towards eco-friendly products, manufacturers are likely to invest in advanced materials and technologies. Additionally, the rise of e-commerce is expected to reshape packaging requirements, necessitating more durable and efficient solutions. Companies that embrace these trends will be better positioned to capture market share and meet evolving consumer demands in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Metal Cans & Pails Plastic Buckets & Containers Glass Bottles & Jars Paperboard Containers & Cartons Flexible Pouches & Bags Others |

| By End-User | Residential Commercial Industrial Infrastructure & Construction Automotive & Transportation Others |

| By Region | China India Japan South Korea Southeast Asia Rest of APAC |

| By Application | Decorative Paints Industrial Coatings Automotive Paints Protective Coatings Marine & Specialty Coatings Others |

| By Material | Plastic (HDPE, PP, PET, etc.) Metal (Steel, Tinplate, Aluminum) Glass Paper & Paperboard Others |

| By Distribution Channel | Online Retail Offline Retail Direct Sales Distributors/Dealers Others |

| By Packaging Type | Rigid Packaging Flexible Packaging Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Paint Manufacturers | 120 | Production Managers, R&D Heads |

| Packaging Suppliers | 100 | Sales Directors, Product Development Managers |

| Retail Paint Distributors | 90 | Supply Chain Managers, Store Owners |

| End-User Surveys (Contractors & Painters) | 110 | Contractors, Professional Painters |

| Regulatory Bodies | 40 | Policy Makers, Environmental Compliance Officers |

The APAC Paint Packaging Market is valued at approximately USD 14 billion, driven by increasing demand for decorative and industrial paints and a rise in construction activities across the region.