Region:Middle East

Author(s):Shubham

Product Code:KRAC3628

Pages:86

Published On:January 2026

By Product Type:The product type segmentation includes various forms of industrial packaging, each catering to specific needs within the market. Drums represent a major sub?segment and are widely used for transporting liquids, chemicals, lubricants, and bulk materials due to their durability, stackability, and ability to meet UN performance standards for dangerous goods. Intermediate Bulk Containers (IBCs) are also gaining traction for their efficiency in handling large volumes, reusability, and suitability for petrochemicals, food ingredients, and pharmaceuticals. Sacks and Bags, including industrial sacks and FIBCs, are favored in the food, agriculture, and chemical industries for their lightweight, cost?effective nature, and ease of handling in bulk logistics. Crates, Pallets & Pails are essential for safe storage and transportation, supporting palletized loads in warehouses and containerized shipping. Corrugated Boxes & Industrial Cartons are preferred for their versatility, printability, and compatibility with e?commerce and export shipments. Protective & Cushioning Packaging, including foams, liners, wrap films, and edge protectors, is crucial for safeguarding products during transit, particularly in high?value electronics, machinery, and automotive parts. The Others category includes various specialized packaging solutions such as wrap films, straps, and liners that support load stabilization and containerization.

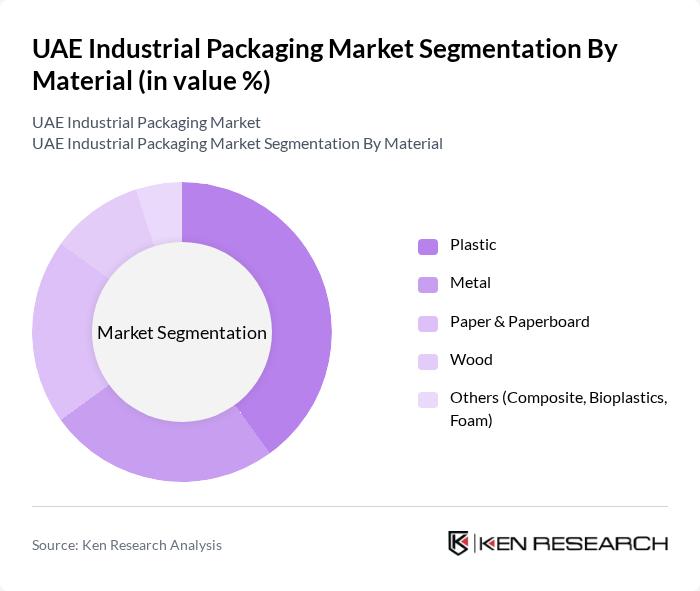

By Material:The material segmentation encompasses various types of materials used in industrial packaging. Plastic is the leading material due to its lightweight, durability, chemical resistance, and versatility, making it suitable for drums, IBCs, industrial sacks, stretch films, and bulk containers across chemicals, oil and gas, and food sectors. Metal is preferred for its strength, barrier properties, and recyclability, particularly in the food, lubricants, and specialty chemicals sectors where steel and aluminium drums and pails are widely used. Paper & Paperboard are gaining popularity for their eco?friendliness and are widely used in corrugated boxes, industrial cartons, and paper sacks as companies in the UAE shift part of their portfolio towards fiber?based solutions to meet sustainability targets. Wood is utilized for crates and pallets, offering strength, reparability, and suitability for heavy machinery and export shipments. The Others category includes composite materials, bioplastics, and foam, which are increasingly being adopted for specialized applications such as high?performance dunnage, insulation, and returnable transit packaging in automotive and electronics supply chains.

The UAE Industrial Packaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Al Bayader International, Gulf East Paper and Plastic Industries LLC, National Plastic & Building Material Industries LLC, Abu Dhabi National Paper Mill (ADNPM), NAPCO Group, Mahmood Saeed Packaging (MS Packaging), Gulf Pack (Hotpack Packaging Industries LLC), Interplast Co. Ltd., Falcon Pack, Emirates Printing Press LLC – Packaging Division, Arabian Packaging Co. LLC, ENPI Group, Al Tawrid Packaging Solutions, Al Ghurair Packaging Solutions, Amcor plc (Regional Operations) contribute to innovation, geographic expansion, and service delivery in this space.

The UAE industrial packaging market is poised for significant transformation, driven by sustainability initiatives and technological advancements. As companies increasingly adopt biodegradable materials and smart packaging technologies, the market will likely see a shift towards more innovative solutions. Additionally, the growth of the manufacturing and e-commerce sectors will further enhance demand for efficient packaging. With government support for sustainable practices, the industry is expected to evolve, creating new opportunities for growth and innovation in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Drums Intermediate Bulk Containers (IBCs) Sacks and Bags Crates, Pallets & Pails Corrugated Boxes & Industrial Cartons Protective & Cushioning Packaging Others (Wrap Films, Straps, Liners) |

| By Material | Plastic Metal Paper & Paperboard Wood Others (Composite, Bioplastics, Foam) |

| By End-Use Industry | Chemicals & Petrochemicals Food & Beverages Pharmaceuticals & Healthcare Oil & Gas Automotive & Industrial Manufacturing Construction & Building Materials Others (Agriculture, Electronics, FMCG) |

| By Packaging Format | Rigid Industrial Packaging Flexible Industrial Packaging Hybrid / Composite Packaging |

| By Region | Abu Dhabi Dubai Sharjah Ajman, Umm Al Quwain & Ras Al Khaimah Fujairah & Others |

| By Function | Bulk Transportation & Export Storage & Warehousing On-site Handling & Safety Hazardous & Dangerous Goods Specialized Temperature-Controlled Applications |

| By Sustainability Profile | Reusable & Returnable Packaging Systems Recyclable Packaging Single-use / Limited Recyclability Bio-based & Low-Carbon Solutions |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Food and Beverage Packaging | 90 | Packaging Managers, Quality Assurance Officers |

| Pharmaceutical Packaging Solutions | 70 | Regulatory Affairs Managers, Production Supervisors |

| Chemical Industry Packaging | 60 | Supply Chain Managers, Safety Compliance Officers |

| Consumer Goods Packaging | 80 | Marketing Managers, Product Development Leads |

| Logistics and Distribution Packaging | 60 | Logistics Coordinators, Warehouse Managers |

The UAE Industrial Packaging Market is valued at approximately USD 4.1 billion, reflecting significant growth driven by the expansion of the manufacturing sector and increased demand from various industries, including chemicals, food, and pharmaceuticals.