Region:Asia

Author(s):Geetanshi

Product Code:KRAA9089

Pages:85

Published On:November 2025

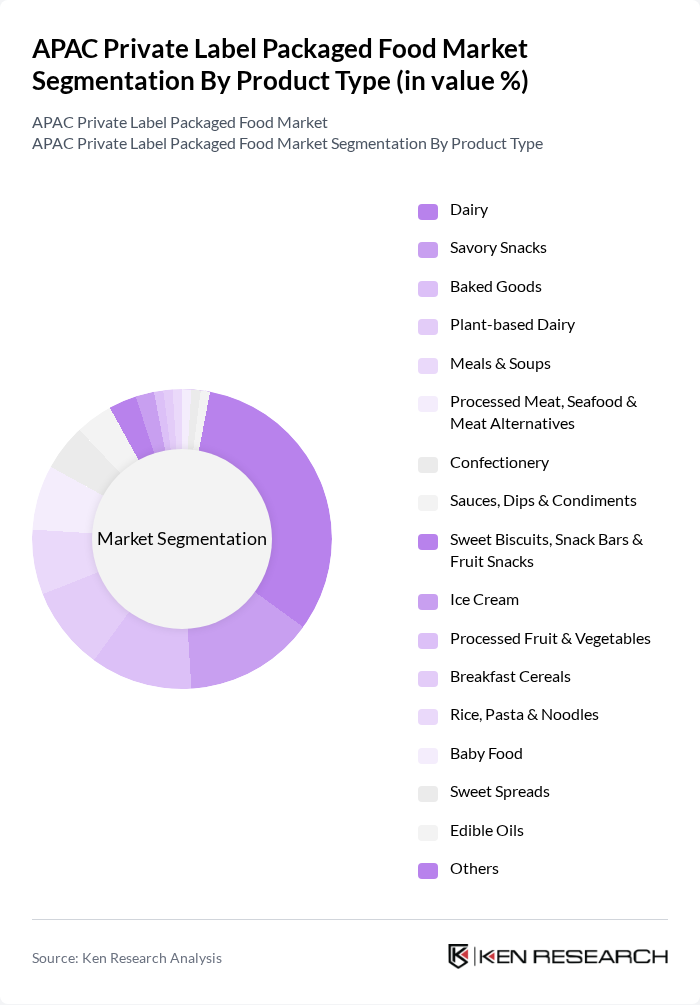

By Product Type:The product type segmentation of the APAC Private Label Packaged Food Market includes various categories such as Dairy, Plant-based Dairy, Baked Goods, Savory Snacks, Meals & Soups, Confectionery, Processed Meat, Seafood & Meat Alternatives, Sauces, Dips & Condiments, Sweet Biscuits, Snack Bars & Fruit Snacks, Ice Cream, Processed Fruit & Vegetables, Breakfast Cereals, Rice, Pasta & Noodles, Baby Food, Sweet Spreads, Edible Oils, and Others. Dairy products remain the leading category due to their essential role in daily nutrition and the increasing demand for healthy options, commanding a revenue share of approximately 35% in the market.

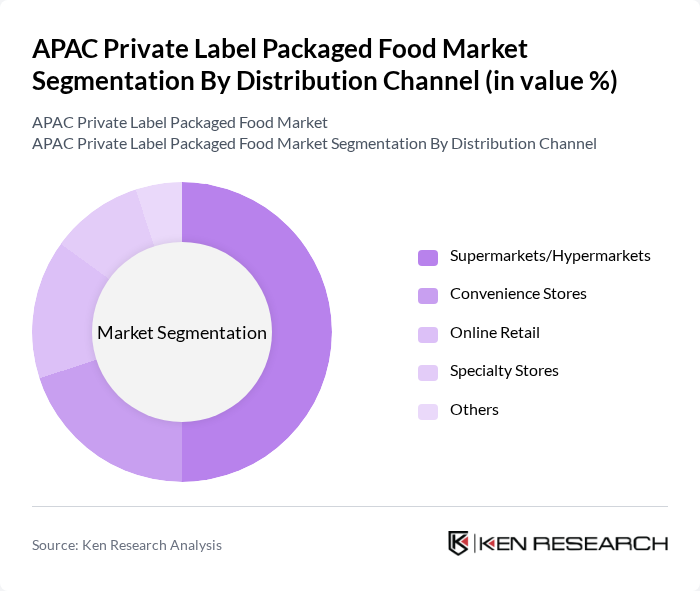

By Distribution Channel:The distribution channel segmentation includes Supermarkets/Hypermarkets, Convenience Stores, Online Retail, Specialty Stores, and Others. Supermarkets and hypermarkets dominate the market, accounting for approximately 50% of the regional distribution landscape, due to their extensive reach and ability to offer a wide range of private label products. The rise of e-commerce has also significantly contributed to the growth of online retail, providing consumers with convenient access to private label options.

The APAC Private Label Packaged Food Market is characterized by a dynamic mix of regional and international players. Leading participants such as Aeon Co., Ltd., Alibaba Group (Freshippo), Reliance Retail, Woolworths Group, Seven & i Holdings Co., Ltd., BigBasket (Innovative Retail Concepts Pvt. Ltd.), Sun Art Retail Group Ltd., Coles Group Limited, JD.com, Inc., Dairy Farm International Holdings Limited, Lotte Mart, Metro AG, SPAR International, Tesco PLC, Amazon (Amazon Fresh, Amazon Basics) contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC private label packaged food market appears promising, driven by evolving consumer preferences and technological advancements. As e-commerce continues to expand, retailers are likely to enhance their online presence, offering a wider array of private label products. Additionally, the trend towards sustainability will likely influence product development, with an increasing focus on eco-friendly packaging and organic ingredients. These factors will contribute to a dynamic market landscape, fostering innovation and competition among private label brands.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Dairy Plant-based Dairy Baked Goods Savory Snacks Meals & Soups Confectionery Processed Meat, Seafood & Meat Alternatives Sauces, Dips & Condiments Sweet Biscuits, Snack Bars & Fruit Snacks Ice Cream Processed Fruit & Vegetables Breakfast Cereals Rice, Pasta & Noodles Baby Food Sweet Spreads Edible Oils Others |

| By Distribution Channel | Supermarkets/Hypermarkets Convenience Stores Online Retail Specialty Stores Others |

| By Consumer Demographics | Age Group (Children, Adults, Seniors) Income Level (Low, Middle, High) Lifestyle (Health-Conscious, Convenience Seekers) Others |

| By Packaging Type | Flexible Packaging Rigid Packaging Glass Packaging Others |

| By Region | China Japan India Southeast Asia Australia & New Zealand Others |

| By Price Range | Budget Mid-Range Premium Others |

| By Health Claims | Organic Gluten-Free Low-Calorie Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retailer Insights on Private Label Products | 150 | Category Managers, Purchasing Agents |

| Consumer Preferences in Packaged Foods | 120 | Household Decision Makers, Grocery Shoppers |

| Distribution Channel Analysis | 100 | Logistics Coordinators, Supply Chain Managers |

| Market Trends in Health-Conscious Foods | 80 | Nutritionists, Health Food Retailers |

| Brand Perception Studies | 110 | Marketing Executives, Brand Strategists |

The APAC Private Label Packaged Food Market is valued at approximately USD 131 billion, reflecting a significant growth trend driven by consumer demand for affordable and quality food products.