Region:Asia

Author(s):Shubham

Product Code:KRAA8548

Pages:82

Published On:November 2025

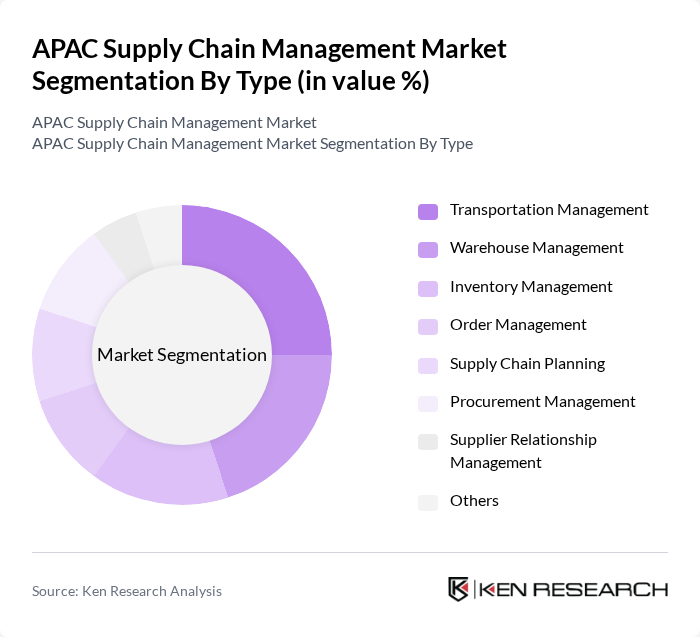

By Type:The segmentation by type includes various components essential for effective supply chain management. The subsegments are Transportation Management, Warehouse Management, Inventory Management, Order Management, Supply Chain Planning, Procurement Management, Supplier Relationship Management, and Others. Each of these plays a crucial role in streamlining operations and enhancing efficiency across the supply chain. Transportation Management remains dominant due to the region’s complex logistics needs, while Warehouse and Inventory Management are increasingly adopting automation and cloud-based solutions to improve accuracy and speed.

The Transportation Management subsegment is currently dominating the market due to the increasing need for efficient logistics and distribution networks. As e-commerce continues to grow, businesses are investing heavily in transportation solutions to ensure timely delivery and cost-effectiveness. This trend is further supported by advancements in technology, such as route optimization, real-time tracking, and AI-driven logistics platforms, which enhance operational efficiency. The demand for integrated transportation solutions is expected to continue driving growth in this subsegment.

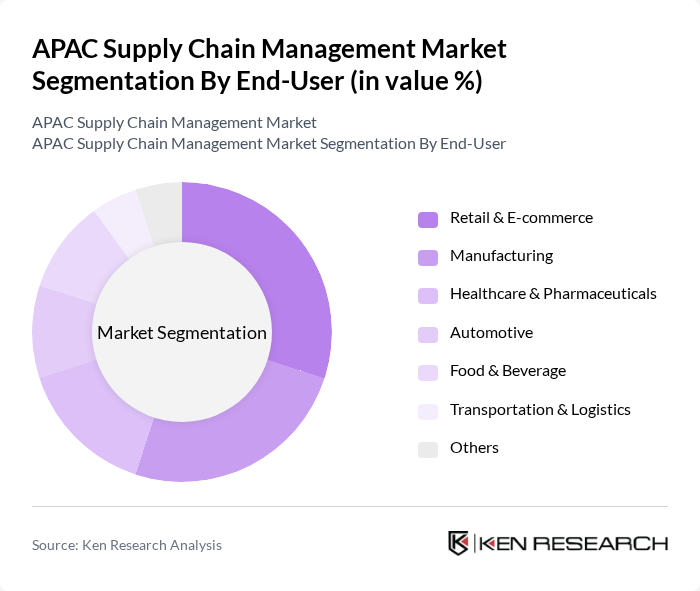

By End-User:The end-user segmentation encompasses various industries that utilize supply chain management solutions. The subsegments include Retail & E-commerce, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Food & Beverage, Transportation & Logistics, and Others. Each sector has unique requirements and challenges that drive the demand for tailored supply chain solutions. Retail & E-commerce lead due to rapid online sales growth, while Manufacturing and Healthcare are expanding adoption of digital supply chain platforms to improve transparency and compliance.

The Retail & E-commerce sector is leading the market due to the exponential growth of online shopping and the need for efficient supply chain solutions to meet consumer demands. The rise of digital platforms has necessitated advanced logistics and inventory management systems to ensure quick delivery and customer satisfaction. As consumer preferences shift towards convenience and speed, retailers are increasingly adopting innovative supply chain technologies such as AI-powered forecasting and omnichannel distribution to enhance their operational capabilities.

The APAC Supply Chain Management Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, DB Schenker, XPO Logistics, C.H. Robinson, Nippon Express, CEVA Logistics, Yusen Logistics, Sinotrans Limited, SF Express, Kerry Logistics Network Limited, JD Logistics, CJ Logistics, Agility Logistics, Geodis contribute to innovation, geographic expansion, and service delivery in this space.

The APAC supply chain management market is poised for significant evolution, driven by technological advancements and changing consumer behaviors. Companies are increasingly adopting automation and data analytics to enhance efficiency and responsiveness. Furthermore, the emphasis on sustainability will shape supply chain strategies, with firms investing in eco-friendly practices. As businesses expand into emerging markets, the focus will shift towards building resilient and agile supply chains capable of adapting to dynamic market conditions and consumer demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Management Warehouse Management Inventory Management Order Management Supply Chain Planning Procurement Management Supplier Relationship Management Others |

| By End-User | Retail & E-commerce Manufacturing Healthcare & Pharmaceuticals Automotive Food & Beverage Transportation & Logistics Others |

| By Country | China Japan India South Korea Australia Singapore Malaysia Rest of Asia Pacific |

| By Technology | Cloud-Based Solutions On-Premise Solutions Blockchain Technology Artificial Intelligence & Analytics IoT & RFID Others |

| By Application | Retail Supply Chain Manufacturing Supply Chain E-commerce Supply Chain Food and Beverage Supply Chain Healthcare Supply Chain Automotive Supply Chain Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Subsidies for Logistics Infrastructure Tax Incentives for Supply Chain Investments Regulatory Support for E-commerce Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Manufacturing Supply Chain Efficiency | 120 | Supply Chain Managers, Operations Directors |

| E-commerce Logistics Optimization | 90 | E-commerce Operations Managers, Logistics Coordinators |

| Retail Inventory Management | 70 | Inventory Managers, Retail Operations Heads |

| Transportation Management Systems | 60 | IT Managers, Transportation Analysts |

| Cold Chain Logistics | 50 | Quality Assurance Managers, Supply Chain Analysts |

The APAC Supply Chain Management Market is valued at approximately USD 38 billion, driven by the rapid expansion of e-commerce, demand for efficient logistics solutions, and the need for businesses to optimize their supply chain operations.