Region:Asia

Author(s):Geetanshi

Product Code:KRAD3764

Pages:87

Published On:November 2025

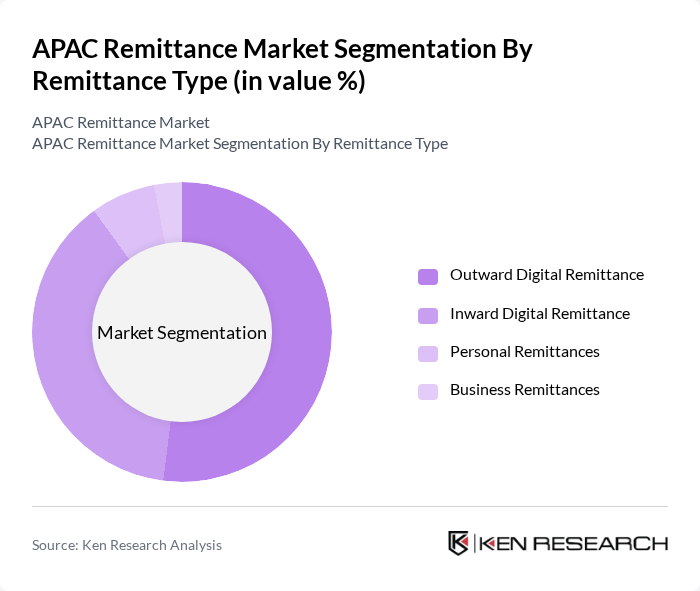

By Remittance Type:The remittance market can be segmented into various types, including Inward Digital Remittance, Outward Digital Remittance, Personal Remittances, and Business Remittances. Each of these subsegments plays a crucial role in the overall market dynamics, driven by different consumer needs and preferences.

The Outward Digital Remittance segment is currently the largest revenue-generating segment, primarily due to the high volume of funds sent by expatriates to their home countries. This segment benefits from the increasing adoption of digital platforms, which facilitate faster and cheaper transactions. The growing trend of online banking and mobile wallets has also contributed to the rise in digital remittances, as senders prefer utilizing digital channels for convenience and security. Inward Digital Remittance represents the most lucrative growth segment, registering the fastest expansion as recipient households increasingly adopt digital disbursement platforms integrated with complementary financial services.

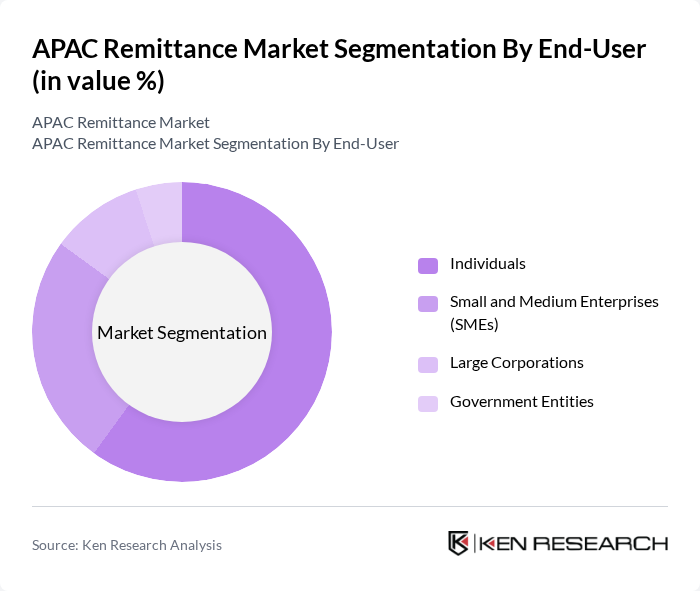

By End-User:The end-user segmentation includes Individuals, Small and Medium Enterprises (SMEs), Large Corporations, and Government Entities. Each of these user categories has distinct requirements and preferences when it comes to remittance services.

Individuals represent the largest segment of end-users in the remittance market, driven by the need for personal financial support and family assistance. The increasing number of migrant workers and the growing trend of digital remittances have made this segment particularly robust. SMEs also play a significant role, as they often rely on remittances for cross-border transactions and business operations, but they are outpaced by the sheer volume of individual transactions.

The APAC Remittance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram International, Wise (formerly TransferWise), Remitly Global, Inc., PayPal/Xoom, WorldRemit, Revolut Ltd., Ria Money Transfer, OFX (Online Financial Exchange), Azimo, Skrill (Paysafe Group), Payoneer, Ant Group (Alipay), Tencent (WeChat Pay), GCash (Globe Telecom), Paytm, PhonePe, Chipper Cash contribute to innovation, geographic expansion, and service delivery in this space.

The APAC remittance market is poised for transformative growth, driven by technological advancements and evolving consumer preferences. As digital payment solutions become more integrated into everyday transactions, the demand for instant and cost-effective remittance services will rise. Additionally, partnerships between fintech companies and traditional financial institutions are expected to enhance service offerings, making remittances more accessible. The focus on compliance and security will also shape the market, ensuring that consumer trust remains a priority in this rapidly changing landscape.

| Segment | Sub-Segments |

|---|---|

| By Remittance Type | Inward Digital Remittance Outward Digital Remittance Personal Remittances Business Remittances |

| By End-User | Individuals Small and Medium Enterprises (SMEs) Large Corporations Government Entities |

| By Geography | South Asia (India, Bangladesh, Pakistan, Sri Lanka) Southeast Asia (Philippines, Indonesia, Vietnam, Thailand) East Asia (China, Japan, South Korea, Taiwan) Other APAC Markets |

| By Remittance Channel | Banks Money Transfer Operators (MTOs) Digital Fintech Platforms Mobile Money Services |

| By Payment Method | Bank Transfers Mobile Wallet Transfers Cash Pickup Blockchain/Cryptocurrency |

| By Transaction Size | Micro Transactions (Under $100) Small Transactions ($100-$500) Medium Transactions ($500-$5,000) Large Transactions (Above $5,000) |

| By Transaction Frequency | Daily Weekly Monthly Quarterly/Annual |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Cross-border Remittance Users | 120 | Migrant Workers, International Students |

| Remittance Service Providers | 60 | Product Managers, Business Development Managers |

| Regulatory Bodies | 40 | Policy Makers, Financial Regulators |

| Financial Technology Innovators | 50 | CTOs, Product Development Managers |

| Consumer Advocacy Groups | 40 | Advocacy Leaders, Community Organizers |

The APAC Remittance Market is valued at approximately USD 14.2 billion, driven by the increasing number of migrant workers and the rise of digital payment platforms that enhance accessibility and cost-effectiveness in remittance services.