Region:Middle East

Author(s):Shubham

Product Code:KRAB7293

Pages:89

Published On:October 2025

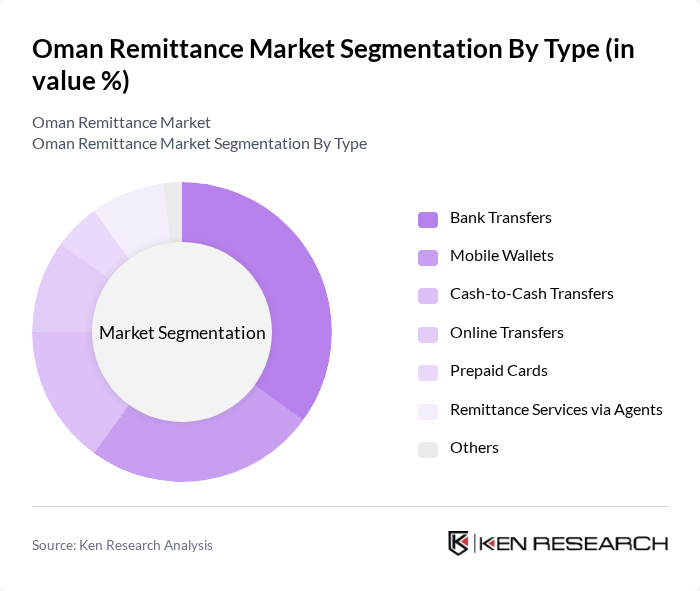

By Type:The remittance market can be segmented into various types, including Bank Transfers, Mobile Wallets, Cash-to-Cash Transfers, Online Transfers, Prepaid Cards, Remittance Services via Agents, and Others. Among these, Bank Transfers and Mobile Wallets are particularly prominent due to their convenience and security features. The increasing adoption of digital payment methods has also led to a rise in Online Transfers and Mobile Wallets, reflecting changing consumer preferences.

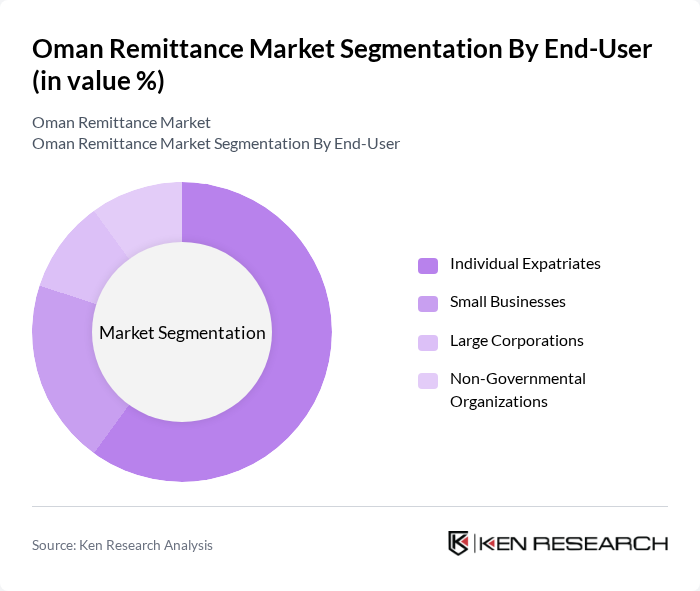

By End-User:The remittance market can also be segmented by end-user categories, including Individual Expatriates, Small Businesses, Large Corporations, and Non-Governmental Organizations. Individual Expatriates dominate this segment, as they represent the largest group sending remittances back home. The need for financial support among families in their home countries drives this trend, making them the primary users of remittance services.

The Oman Remittance Market is characterized by a dynamic mix of regional and international players. Leading participants such as Western Union, MoneyGram, Xoom (a PayPal Service), TransferWise (now Wise), Ria Money Transfer, WorldRemit, Remitly, Al Rajhi Bank, Oman Arab Bank, Bank Muscat, National Bank of Oman, Dhofar Bank, Oman International Bank, Alizz Islamic Bank, Bank Dhofar contribute to innovation, geographic expansion, and service delivery in this space.

The Oman remittance market is poised for significant evolution, driven by technological advancements and changing consumer preferences. As digital platforms gain traction, the market is likely to see increased competition and innovation, enhancing customer experience. Additionally, regulatory frameworks may adapt to facilitate smoother transactions. The focus on financial inclusion will further encourage the development of tailored services, ensuring that remittance solutions meet the diverse needs of the expatriate population while maintaining compliance with evolving regulations.

| Segment | Sub-Segments |

|---|---|

| By Type | Bank Transfers Mobile Wallets Cash-to-Cash Transfers Online Transfers Prepaid Cards Remittance Services via Agents Others |

| By End-User | Individual Expatriates Small Businesses Large Corporations Non-Governmental Organizations |

| By Payment Method | Bank Transfers Credit/Debit Cards Cash Payments Digital Payment Platforms |

| By Destination Country | India Pakistan Bangladesh Philippines Egypt Others |

| By Frequency of Transactions | Daily Weekly Monthly Quarterly |

| By Transaction Size | Small Transactions (up to $500) Medium Transactions ($501 - $2000) Large Transactions (above $2000) |

| By Service Provider Type | Banks Non-Bank Financial Institutions Money Transfer Operators Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Expatriate Remittance Behavior | 150 | Expatriates from South Asia, Middle East, and Africa |

| Financial Service Providers | 100 | Managers and Executives from remittance companies and banks |

| Local Business Impact | 80 | Small and medium business owners reliant on remittance inflows |

| Regulatory Insights | 50 | Policy makers and financial regulators in Oman |

| Consumer Preferences | 120 | Individuals using remittance services for personal and business purposes |

The Oman Remittance Market is valued at approximately USD 5 billion, driven by a large expatriate population that significantly contributes to remittance flows back to their home countries. This market has seen growth due to the increasing ease of digital transactions and competitive pricing among service providers.