Region:Global

Author(s):Rebecca

Product Code:KRAA4307

Pages:95

Published On:January 2026

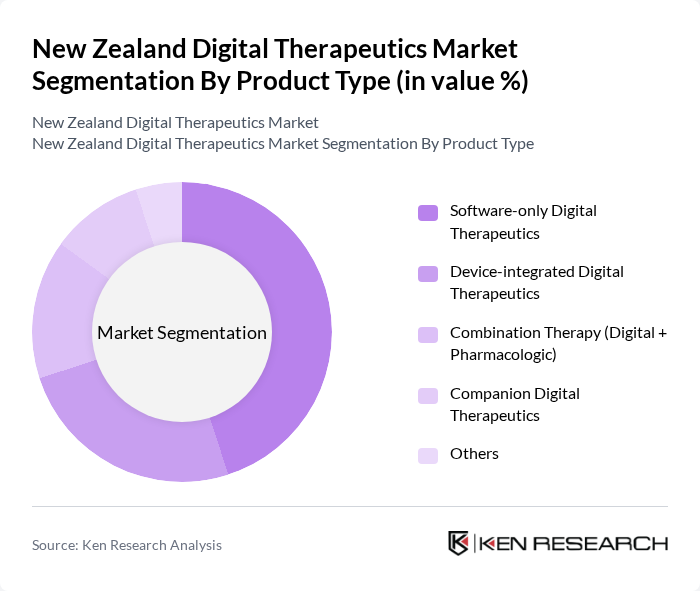

By Product Type:The market is segmented into various product types, including Software-only Digital Therapeutics, Device-integrated Digital Therapeutics, Combination Therapy (Digital + Pharmacologic), Companion Digital Therapeutics, and Others. Among these, Software-only Digital Therapeutics is currently leading the market due to its ease of deployment via smartphones and tablets, scalability, and lower upfront costs, mirroring global digital therapeutics patterns where software-based monotherapy and behavioural / cognitive interventions dominate. The increasing demand for mental health solutions, diabetes and cardiometabolic disease management apps, and remote monitoring tools has further propelled this segment's growth, supported by high mobile penetration and strong consumer adoption of app-based health services in New Zealand.

By Application:The applications of digital therapeutics include Treatment / Care Management, Preventive & Lifestyle Management, Rehabilitation & Post-acute Care, Medication Adherence & Care Coordination, and Others. Treatment / Care Management is the leading application area, aligned with global usage patterns where chronic disease and mental health management solutions represent the largest share of digital therapeutics deployments. This is driven by the increasing need for effective management of diabetes, cardiovascular diseases, respiratory diseases, and depression/anxiety, alongside New Zealand’s emphasis on virtual care and remote patient monitoring within its e-health and telehealth initiatives. The rise in telehealth services, AI-supported coaching tools, and remote patient monitoring platforms has also contributed to the growth of this segment by enabling continuous, outcomes-focused care outside traditional clinical settings.

The New Zealand Digital Therapeutics Market is characterized by a dynamic mix of regional and international players. Leading participants such as Voluntis, Pear Therapeutics, Omada Health, Akili Interactive, DarioHealth, Happify Health, Welldoc, SilverCloud Health, Big Health, mySugr, Liva Healthcare, Biofourmis, Click Therapeutics, LifeScan, Woebot Health contribute to innovation, geographic expansion, and service delivery in this space, often partnering with local providers, payers, and employers to deliver evidence-based digital interventions.

The future of the New Zealand digital therapeutics market appears promising, driven by technological advancements and increasing healthcare demands. As the healthcare landscape evolves, the integration of artificial intelligence and machine learning into therapeutic solutions is expected to enhance treatment efficacy. Additionally, the focus on remote patient monitoring will likely expand, providing healthcare providers with real-time data to improve patient outcomes and streamline care delivery, fostering a more proactive healthcare environment.

| Segment | Sub-Segments |

|---|---|

| By Product Type | Software-only Digital Therapeutics Device-integrated Digital Therapeutics Combination Therapy (Digital + Pharmacologic) Companion Digital Therapeutics Others |

| By Application | Treatment / Care Management Preventive & Lifestyle Management Rehabilitation & Post-acute Care Medication Adherence & Care Coordination Others |

| By Therapeutic Area | Mental Health & Behavioral Disorders (e.g., anxiety, depression) Diabetes & Metabolic Disorders Cardiovascular & Hypertension Management Respiratory & COPD / Asthma Management Neurology & Cognitive Disorders Others (e.g., musculoskeletal, oncology support) |

| By End-User | Patients & Consumers Healthcare Providers (public & private) Payers (insurers, ACC, government schemes) Employers & Corporate Wellness Programs Others |

| By Delivery Platform | Mobile Applications Web-based Platforms / Portals Integrated with Wearables & Connected Devices Telehealth / Virtual Care Integration Others |

| By Distribution Model | Business-to-Business (B2B) Business-to-Consumer (B2C) Business-to-Business-to-Consumer (B2B2C) Through Healthcare Institutions & Health Systems Others |

| By Region (Within New Zealand) | North Island – Major Urban Centres (e.g., Auckland, Wellington) North Island – Regional & Rural Areas South Island – Major Urban Centres (e.g., Christchurch, Dunedin) South Island – Regional & Rural Areas Remote & Hard-to-Reach Communities |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Healthcare Professionals | 120 | Doctors, Psychologists, General Practitioners |

| Patients Using Digital Therapeutics | 110 | Individuals with chronic conditions, Mental health patients |

| Health Tech Stakeholders | 90 | Product Managers, Business Development Executives |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Insurance Providers | 70 | Underwriters, Claims Adjusters |

The New Zealand Digital Therapeutics Market is valued at approximately USD 160 million, reflecting a significant growth driven by the increasing prevalence of chronic diseases and the rising acceptance of digital health solutions among consumers and healthcare providers.