Region:Asia

Author(s):Shubham

Product Code:KRAD5346

Pages:91

Published On:December 2025

Market.png)

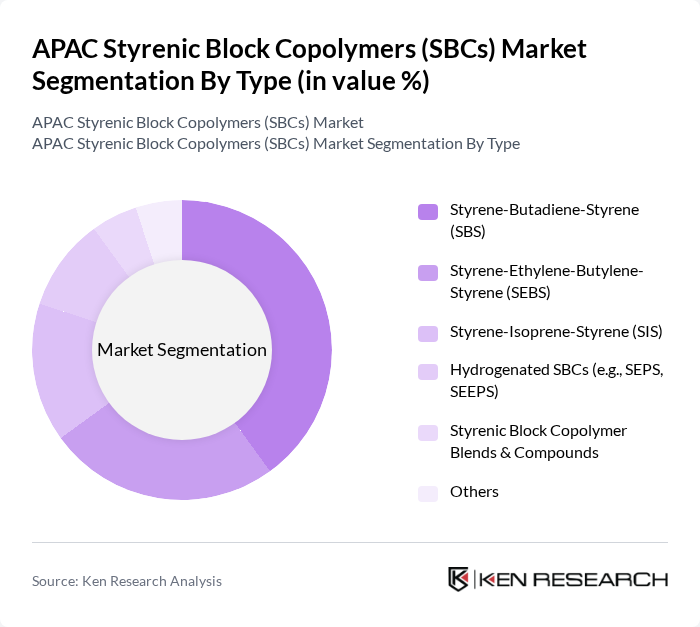

By Type:The market is segmented into various types of SBCs, including Styrene-Butadiene-Styrene (SBS), Styrene-Ethylene-Butylene-Styrene (SEBS), Styrene-Isoprene-Styrene (SIS), Hydrogenated SBCs (e.g., SEPS, SEEPS), Styrenic Block Copolymer Blends & Compounds, and Others. Among these, Styrene-Butadiene-Styrene (SBS) is the leading subsegment due to its widespread use in asphalt modification, roofing membranes, and adhesives, driven by its excellent mechanical properties, compatibility with bitumen, and cost-effectiveness. The demand for SBS is particularly high in the construction and automotive sectors, where improved road durability, noise reduction, and vibration damping are critical, and it is also increasingly adopted in footwear and polymer modification across APAC’s manufacturing bases.

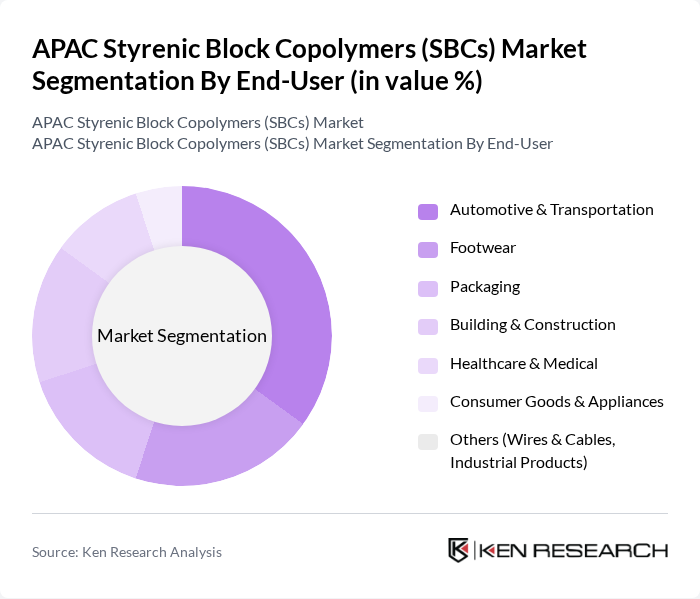

By End-User:The end-user segmentation includes Automotive & Transportation, Footwear, Packaging, Building & Construction, Healthcare & Medical, Consumer Goods & Appliances, and Others. The Automotive & Transportation sector is a major end-user, supported by the increasing demand for lightweight and durable materials that enhance fuel efficiency, ride comfort, and acoustic damping, as well as their role in interior soft-touch components and under-the-hood applications. Rapid growth in footwear manufacturing across China, India, Vietnam, and Indonesia, together with expanding infrastructure and waterproofing needs in building and construction, also drives significant SBC consumption in the region.

The APAC Styrenic Block Copolymers (SBCs) Market is characterized by a dynamic mix of regional and international players. Leading participants such as Sinopec Corp., LCY Chemical Corp., TSRC Corporation, LG Chem Ltd., Asahi Kasei Corporation, Kuraray Co., Ltd., Kraton Corporation, Dynasol Elastomers S.A., Versalis S.p.A., INEOS Styrolution Group GmbH, JSR Corporation, Zeon Corporation, LyondellBasell Industries N.V., BASF SE, Eastman Chemical Company contribute to innovation, geographic expansion, and service delivery in this space.

The APAC SBC market is poised for significant growth, driven by increasing demand for lightweight materials and expanding applications across various sectors. As industries prioritize sustainability, the shift towards bio-based SBCs and smart materials is expected to gain momentum. Furthermore, the ongoing technological advancements in polymer processing will enhance production efficiency, allowing manufacturers to meet the evolving needs of consumers. Overall, the market is likely to witness robust developments, fostering innovation and collaboration among key players in the industry.

| Segment | Sub-Segments |

|---|---|

| By Type | Styrene-Butadiene-Styrene (SBS) Styrene-Ethylene-Butylene-Styrene (SEBS) Styrene-Isoprene-Styrene (SIS) Hydrogenated SBCs (e.g., SEPS, SEEPS) Styrenic Block Copolymer Blends & Compounds Others |

| By End-User | Automotive & Transportation Footwear Packaging Building & Construction Healthcare & Medical Consumer Goods & Appliances Others (Wires & Cables, Industrial Products) |

| By Region | China Japan South Korea India ASEAN (Indonesia, Malaysia, Thailand, Vietnam, Others) Rest of Asia-Pacific |

| By Application | Asphalt & Polymer Modification Adhesives & Sealants Footwear Components Medical Devices & Tubing Wires & Cables Others |

| By Product Form | Pellets / Granules Powder Bales / Blocks Compounded & Ready-to-Use Grades Others |

| By Distribution Channel | Direct Sales to OEMs & Converters Regional Distributors / Traders Global Chemical Distributors Online / E-commerce Platforms Others |

| By Policy Support | Subsidies & Incentives for Infrastructure and Construction Tax Exemptions for Specialty & High-Performance Materials Regulatory Support for Green & Low-VOC Materials Standards & Norms for Road, Roofing, and Medical Applications Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Automotive Applications of SBCs | 120 | Product Engineers, R&D Managers |

| Adhesives and Sealants Market | 90 | Procurement Managers, Application Engineers |

| Consumer Goods Packaging | 85 | Brand Managers, Packaging Engineers |

| Construction Materials Sector | 100 | Construction Project Managers, Material Suppliers |

| Medical Device Applications | 70 | Regulatory Affairs Specialists, Product Development Managers |

The APAC Styrenic Block Copolymers (SBCs) Market is valued at approximately USD 3.0 billion, driven by the increasing demand for high-performance materials across various sectors such as automotive, packaging, construction, and healthcare.