Region:Middle East

Author(s):Rebecca

Product Code:KRAC9852

Pages:89

Published On:November 2025

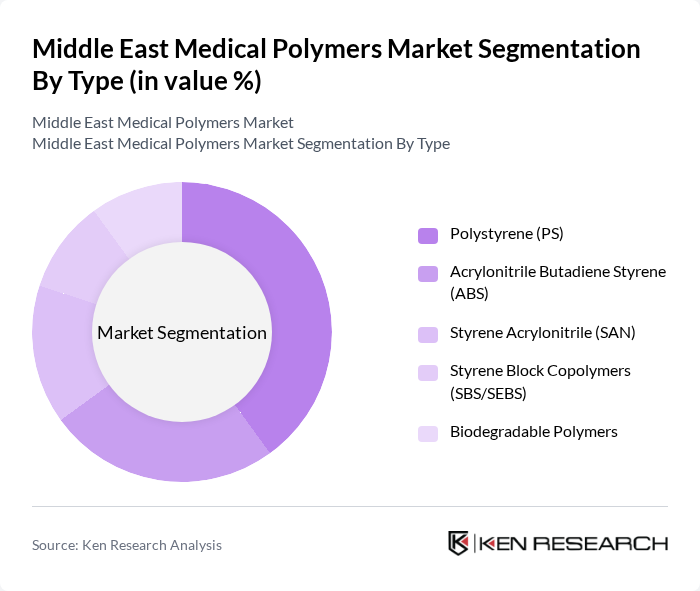

By Type:The market is segmented into various types of polymers used in medical applications. The key subsegments include Polystyrene (PS), Acrylonitrile Butadiene Styrene (ABS), Styrene Acrylonitrile (SAN), Styrene Block Copolymers (SBS/SEBS), and Biodegradable Polymers. Among these, Polystyrene (PS) is the most widely used due to its excellent clarity, ease of processing, and cost-effectiveness, making it a preferred choice for medical packaging and disposable devices.

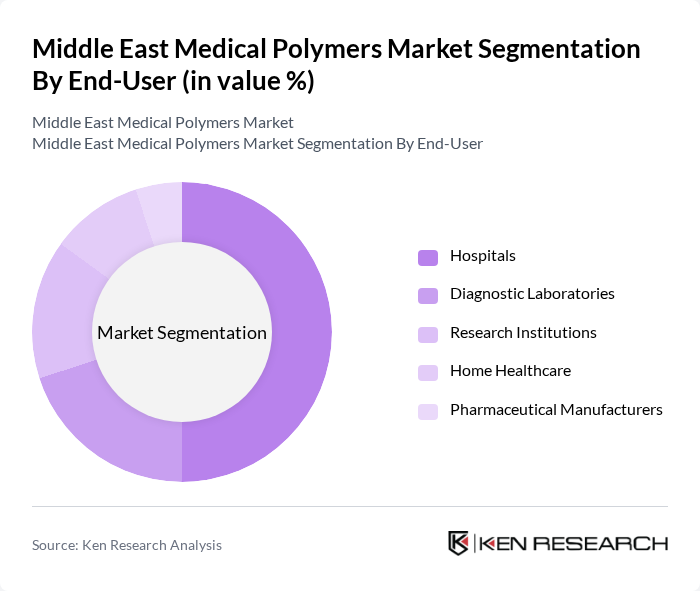

By End-User:The end-user segmentation includes Hospitals, Diagnostic Laboratories, Research Institutions, Home Healthcare, and Pharmaceutical Manufacturers. Hospitals are the leading end-user segment, driven by the increasing number of surgical procedures and the demand for advanced medical devices. The growing trend towards home healthcare solutions is also contributing to the rising demand for medical polymers in this segment.

The Middle East Medical Polymers Market is characterized by a dynamic mix of regional and international players. Leading participants such as BASF SE, Covestro AG, DuPont de Nemours, Inc., Eastman Chemical Company, Evonik Industries AG, SABIC (Saudi Basic Industries Corporation), Solvay S.A., LyondellBasell Industries Holdings B.V., Kuraray Co. Ltd., ELIX Polymers, Arkema Group, Sumitomo Chemical Co. Ltd., KRAIBURG TPE GmbH & Co. KG, Medtronic plc, B. Braun Melsungen AG contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Middle East medical polymers market appears promising, driven by technological advancements and increasing healthcare investments. The integration of smart technologies in medical devices is expected to enhance patient outcomes and operational efficiency. Additionally, the shift towards sustainable materials will likely gain momentum, as manufacturers seek eco-friendly alternatives. These trends indicate a dynamic market landscape, with opportunities for innovation and growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Polystyrene (PS) Acrylonitrile Butadiene Styrene (ABS) Styrene Acrylonitrile (SAN) Styrene Block Copolymers (SBS/SEBS) Biodegradable Polymers |

| By End-User | Hospitals Diagnostic Laboratories Research Institutions Home Healthcare Pharmaceutical Manufacturers |

| By Application | Medical Packaging Medical Devices and Components Drug Delivery Systems Medical Tubing Applications Diagnostic Equipment |

| By Material Grade | Standard Grade Polymers Premium Medical-Grade Polymers Biocompatible Polymers Sterilizable Polymers Others |

| By Region | GCC Countries (Saudi Arabia, UAE, Qatar, Kuwait, Bahrain, Oman) Levant Region (Turkey, Israel, Jordan) North Africa (Egypt, Morocco, Tunisia) Other Middle East & Africa |

| By Distribution Channel | Direct Sales to Healthcare Providers Authorized Distributors and Agents Online and E-commerce Platforms Regional Trading Companies |

| By Regulatory Compliance | ISO 13485 (Medical Device Quality Management) CE Marking (European Conformity) FDA Approval (U.S. Food and Drug Administration) GCC Standards and Local Certifications |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Medical Device Manufacturers | 45 | Product Managers, R&D Directors |

| Healthcare Facilities | 50 | Procurement Officers, Facility Managers |

| Regulatory Bodies | 40 | Policy Makers, Compliance Officers |

| Research Institutions | 48 | Research Scientists, Academic Leaders |

| Distributors of Medical Supplies | 42 | Sales Managers, Supply Chain Coordinators |

The Middle East Medical Polymers Market is valued at approximately USD 1.8 billion, driven by increasing demand for medical devices, advancements in healthcare infrastructure, and a rise in chronic diseases across the region.