Region:Asia

Author(s):Geetanshi

Product Code:KRAD3864

Pages:85

Published On:November 2025

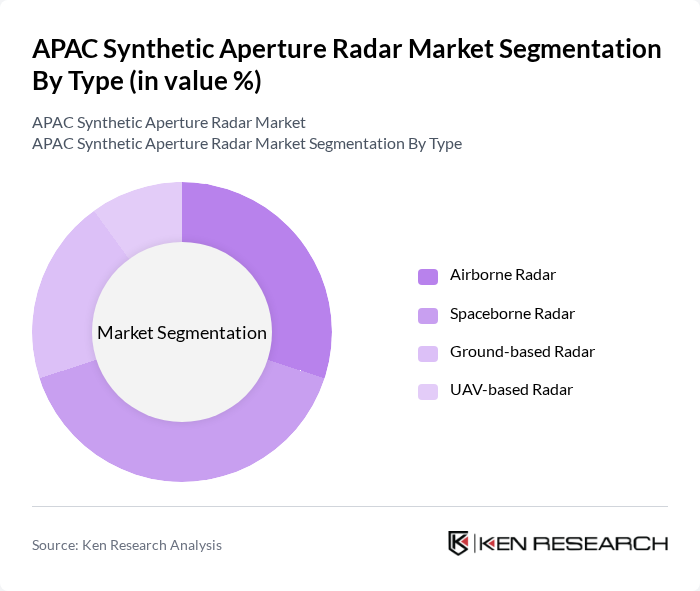

By Type:The market is segmented into four main types: Airborne Radar, Spaceborne Radar, Ground-based Radar, and UAV-based Radar. Each type serves distinct applications and industries, contributing to the overall market dynamics.

The Spaceborne Radar segment is currently dominating the market due to its extensive applications in earth observation, environmental monitoring, and disaster management. The increasing number of satellite launches and advancements in satellite technology have significantly enhanced the capabilities of spaceborne radar systems. Additionally, the growing demand for high-resolution imagery and data analytics in various sectors, including agriculture and urban planning, has further propelled the adoption of spaceborne radar solutions.

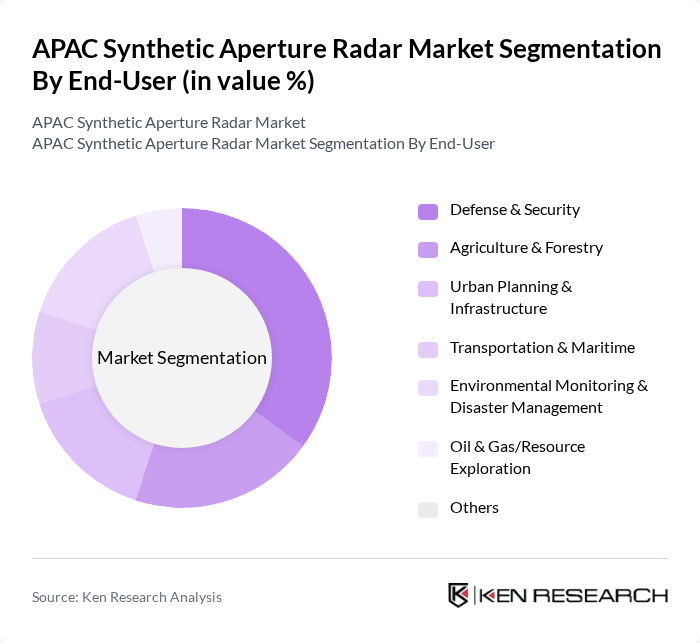

By End-User:The market is segmented into Defense & Security, Agriculture & Forestry, Urban Planning & Infrastructure, Transportation & Maritime, Environmental Monitoring & Disaster Management, Oil & Gas/Resource Exploration, and Others. Each end-user segment has unique requirements and applications for synthetic aperture radar technology.

The Defense & Security segment leads the market, driven by the increasing need for advanced surveillance and reconnaissance capabilities among military forces. Rising geopolitical tensions in the region have prompted governments to invest heavily in radar technologies for national security. Additionally, the integration of synthetic aperture radar in defense applications enhances situational awareness and operational efficiency, further solidifying its dominance in the market.

The APAC Synthetic Aperture Radar Market is characterized by a dynamic mix of regional and international players. Leading participants such as Airbus Defence and Space, Northrop Grumman Corporation, Thales Group, Lockheed Martin Corporation, Raytheon Technologies, BAE Systems, Leonardo S.p.A., Saab AB, MDA (MacDonald, Dettwiler and Associates), L3Harris Technologies, Mitsubishi Electric Corporation, Japan Aerospace Exploration Agency (JAXA), Indian Space Research Organisation (ISRO), Synspective Inc., Capella Space, China Academy of Space Technology (CAST), Israel Aerospace Industries (IAI), Elbit Systems contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC synthetic aperture radar market appears promising, driven by technological advancements and increasing applications across various sectors. The integration of artificial intelligence and machine learning into radar systems is expected to enhance data processing capabilities, making them more accessible. Additionally, the growing focus on environmental monitoring and disaster management will likely lead to increased investments in radar technologies, fostering innovation and collaboration among industry players to meet emerging demands.

| Segment | Sub-Segments |

|---|---|

| By Type | Airborne Radar Spaceborne Radar Ground-based Radar UAV-based Radar |

| By End-User | Defense & Security Agriculture & Forestry Urban Planning & Infrastructure Transportation & Maritime Environmental Monitoring & Disaster Management Oil & Gas/Resource Exploration Others |

| By Region | China India Japan South Korea Southeast Asia Australia & New Zealand Rest of APAC |

| By Technology | Synthetic Aperture Radar (SAR) Inverse Synthetic Aperture Radar (ISAR) Multi-band SAR (X, L, C, S, Ku, Ka, UHF/VHF) Others |

| By Application | Surveillance & Reconnaissance Mapping & Topography Disaster Management & Emergency Response Environmental Monitoring Resource Exploration Others |

| By Investment Source | Private Investments Government Funding International Aid Public-Private Partnerships Others |

| By Policy Support | Government Subsidies Tax Incentives Research Grants Technology Transfer Initiatives Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Military Applications of SAR | 100 | Defense Analysts, Military Procurement Officers |

| Agricultural Monitoring | 60 | Agronomists, Precision Farming Specialists |

| Environmental Surveillance | 50 | Environmental Scientists, Policy Makers |

| Maritime Surveillance | 40 | Coast Guard Officials, Maritime Security Experts |

| Disaster Management Applications | 70 | Emergency Response Coordinators, Urban Planners |

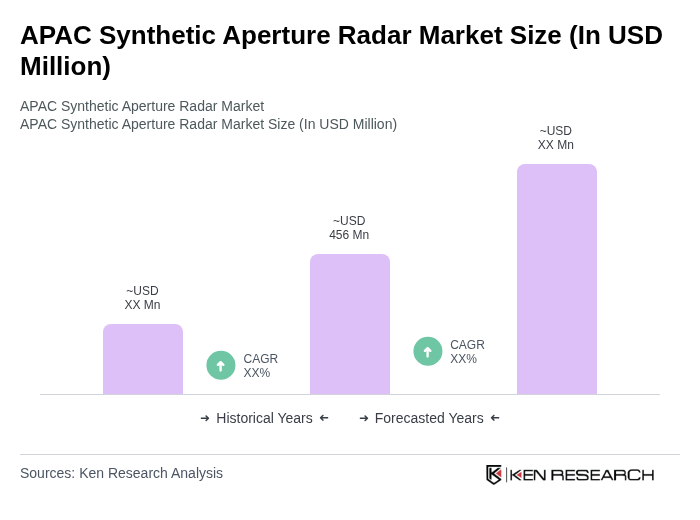

The APAC Synthetic Aperture Radar Market is valued at approximately USD 456 million, reflecting significant growth driven by advancements in radar technology and increasing demand for applications in surveillance, reconnaissance, and environmental monitoring.