Region:Asia

Author(s):Shubham

Product Code:KRAE0374

Pages:80

Published On:December 2025

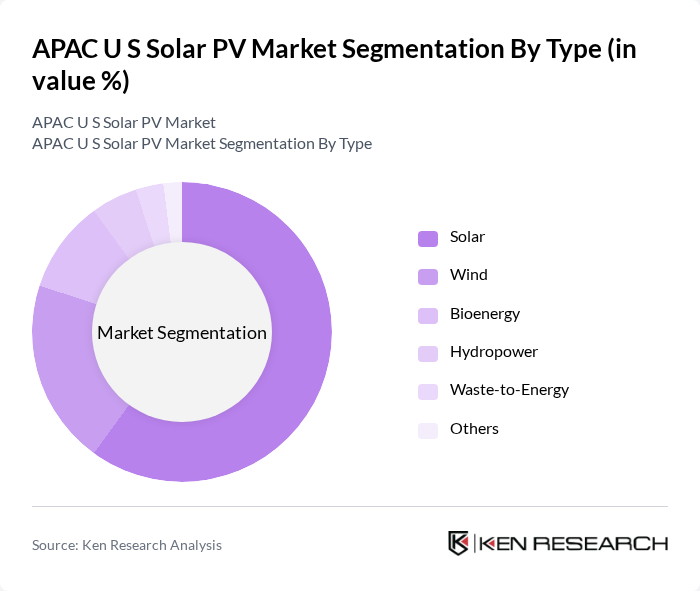

By Type:The market is segmented into various types, including Solar, Wind, Bioenergy, Hydropower, Waste-to-Energy, and Others. Among these, the Solar segment is the most dominant, driven by technological advancements and decreasing costs, making solar energy more accessible and appealing to consumers and businesses alike. The Wind segment is also significant, particularly in regions with favorable wind conditions, while Bioenergy and Hydropower are gaining traction due to their sustainability benefits.

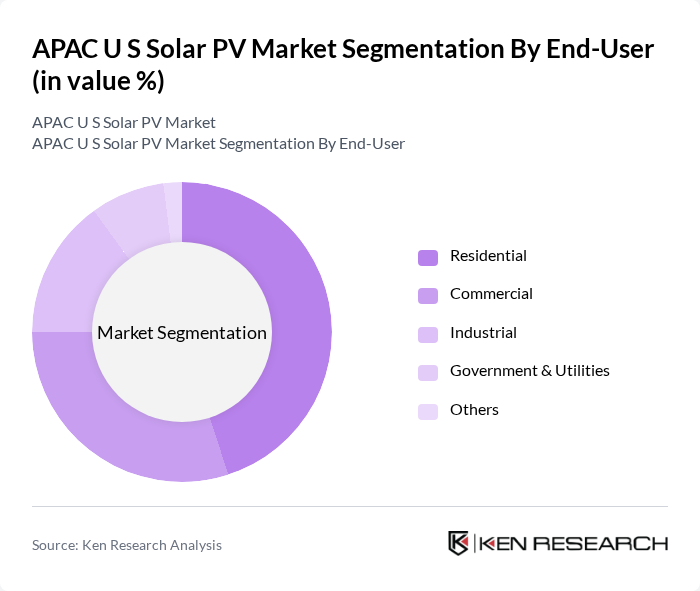

By End-User:The end-user segmentation includes Residential, Commercial, Industrial, Government & Utilities, and Others. The Residential segment leads the market, driven by increasing consumer awareness of renewable energy benefits and government incentives for solar installations. The Commercial segment is also growing, as businesses seek to reduce energy costs and enhance sustainability. Industrial applications are expanding, particularly in energy-intensive sectors, while Government & Utilities are investing in large-scale solar projects to meet renewable energy targets.

The APAC U S Solar PV Market is characterized by a dynamic mix of regional and international players. Leading participants such as First Solar, SunPower Corporation, Canadian Solar, JinkoSolar, Trina Solar, LONGi Solar, Hanwha Q CELLS, REC Group, SMA Solar Technology, Enphase Energy, ABB, Siemens, Schneider Electric, Risen Energy, and Yingli Green Energy contribute to innovation, geographic expansion, and service delivery in this space.

The APAC solar PV market is poised for significant growth, driven by increasing energy demands and supportive government policies. By future, the region is expected to see a rise in solar installations, with a focus on integrating energy storage solutions and smart grid technologies. As environmental concerns escalate, the push for carbon neutrality will further accelerate investments in solar energy. The collaboration between private sectors and governments will be crucial in overcoming challenges and harnessing the full potential of solar energy in the region.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Wind Bioenergy Hydropower Waste-to-Energy Others |

| By End-User | Residential Commercial Industrial Government & Utilities Others |

| By Region | North India South India East India West India |

| By Technology | Photovoltaic CSP Onshore Wind Offshore Wind Biomass Gasification Others |

| By Application | Grid-Connected Off-Grid Rooftop Installations Utility-Scale Projects Others |

| By Investment Source | Domestic FDI PPP Government Schemes Others |

| By Policy Support | Subsidies Tax Exemptions RECs Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar Installations | 150 | Homeowners, Solar Installers |

| Commercial Solar Projects | 100 | Facility Managers, Energy Procurement Officers |

| Utility-Scale Solar Developments | 80 | Project Developers, Utility Executives |

| Solar Equipment Manufacturing | 70 | Manufacturing Managers, Supply Chain Directors |

| Policy and Regulatory Insights | 60 | Government Officials, Regulatory Analysts |

The APAC U S Solar PV Market is valued at approximately USD 135 billion, driven by reduced solar technology costs, strong policy frameworks, and increasing electricity demand due to urbanization and industrial growth.