Region:Middle East

Author(s):Geetanshi

Product Code:KRAC8210

Pages:97

Published On:November 2025

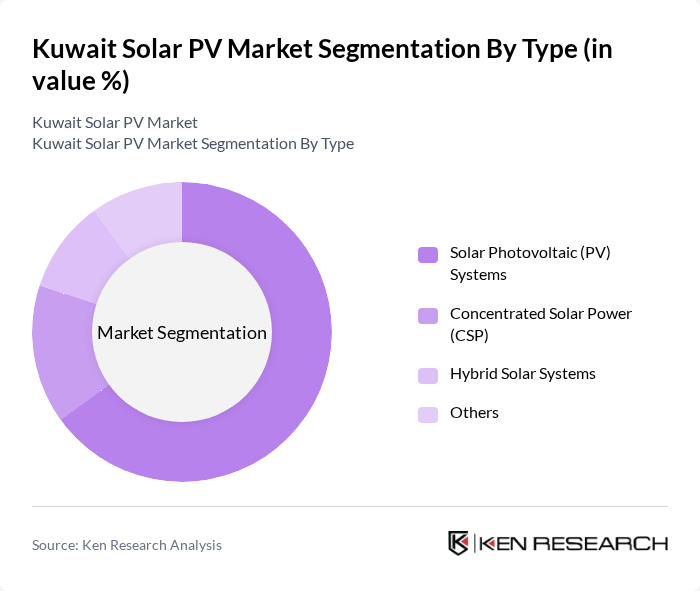

By Type:The market is segmented into various types, including Solar Photovoltaic (PV) Systems, Concentrated Solar Power (CSP), Hybrid Solar Systems, and Others. Among these, Solar Photovoltaic (PV) Systems dominate the market due to their widespread adoption and efficiency in converting sunlight into electricity. The increasing affordability of PV technology and the growing awareness of environmental sustainability have led to a surge in installations across residential, commercial, and industrial sectors .

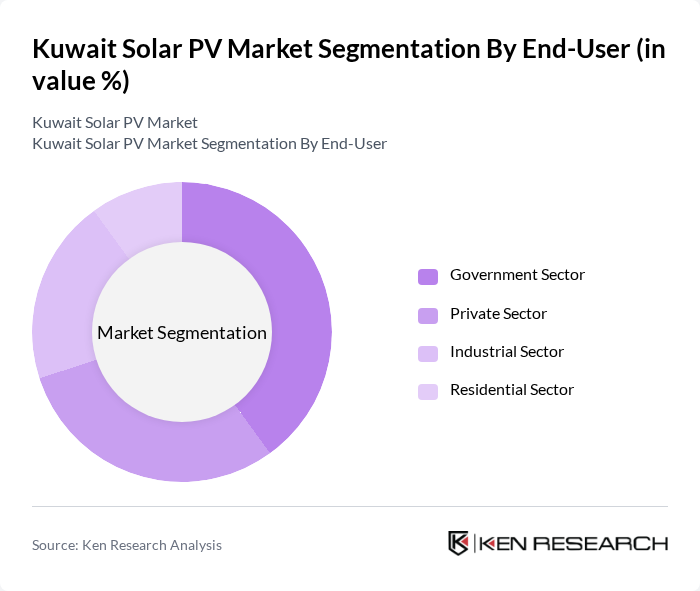

By End-User:The end-user segmentation includes Government Sector, Private Sector, Industrial Sector, and Residential Sector. The Government Sector leads the market, driven by substantial investments in renewable energy projects and initiatives aimed at achieving energy diversification. The private sector is also witnessing growth as businesses increasingly adopt solar solutions to reduce operational costs and enhance sustainability practices .

The Kuwait Solar PV Market is characterized by a dynamic mix of regional and international players. Leading participants such as Kuwait National Petroleum Company (KNPC), Alternative Energy Projects Co. (AEPC), TSK Electronica y Electricidad SA, JinkoSolar Holding Co., Ltd., Solarity Solar Energy, CANAR Trading & Contracting Company, Alghanim International, Kharafi National, First Solar, Inc., Trina Solar Co., Ltd., Hanwha Q CELLS, SMA Solar Technology AG, ABB Ltd., Enphase Energy, Inc., Risen Energy Co., Ltd., REC Group, Yingli Green Energy Holding Co., Ltd., Solaria Energía y Medio Ambiente, S.A., Ecoligo GmbH contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kuwait solar PV market appears promising, driven by increasing energy demands and supportive government policies. As technological advancements continue to lower costs and improve efficiency, more businesses and households are likely to adopt solar solutions. Additionally, the integration of smart grid technologies and energy storage systems will enhance the reliability and efficiency of solar energy, paving the way for a more sustainable energy landscape in Kuwait in future.

| Segment | Sub-Segments |

|---|---|

| By Type | Solar Photovoltaic (PV) Systems Concentrated Solar Power (CSP) Hybrid Solar Systems Others |

| By End-User | Government Sector Private Sector Industrial Sector Residential Sector |

| By Region | Capital Governorate Hawalli Governorate Ahmadi Governorate Others |

| By Technology | Monocrystalline Silicon Polycrystalline Silicon Thin-Film Others |

| By Application | Utility-Scale Projects Commercial & Industrial (C&I) Residential Rooftop Installations Off-Grid Systems |

| By Investment Source | Domestic Investment Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Government Schemes |

| By Policy Support | Subsidies Tax Exemptions Renewable Energy Certificates (RECs) Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Residential Solar PV Installations | 120 | Homeowners, Property Managers |

| Commercial Solar Projects | 90 | Facility Managers, Business Owners |

| Utility-Scale Solar Developments | 60 | Project Developers, Energy Analysts |

| Government Policy Impact | 50 | Regulatory Officials, Policy Makers |

| Solar Technology Providers | 45 | Product Managers, Technical Directors |

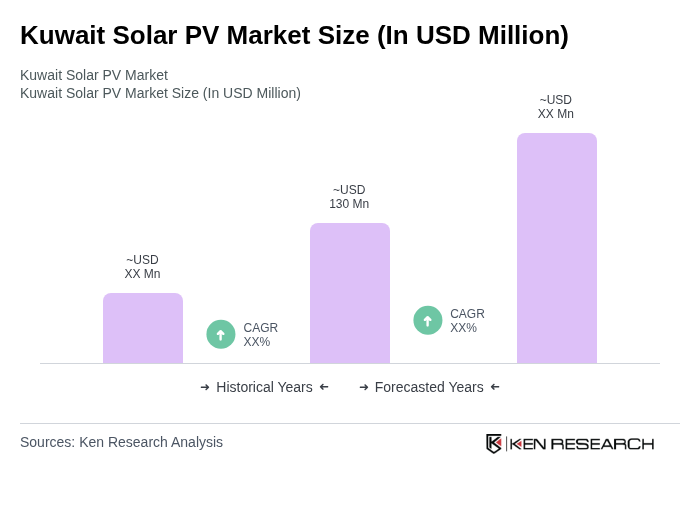

The Kuwait Solar PV Market is valued at approximately USD 130 million, reflecting significant growth driven by the country's commitment to renewable energy and government support for solar infrastructure development.