Region:North America

Author(s):Dev

Product Code:KRAC0480

Pages:90

Published On:August 2025

By Type:The hydropower market can be segmented into various types, including Run-of-River, Reservoir (Storage), Pumped Storage Hydropower (PSH), Small Hydropower (?10 MW), and Micro and Pico Hydro (<1 MW). Each type serves different energy needs and operational efficiencies, with specific applications in both urban and rural settings.

The Reservoir (Storage) segment is currently the dominant type in the hydropower market due to its ability to provide a stable and reliable energy supply. These facilities can store water and release it as needed, making them ideal for meeting peak demand and ensuring grid stability. Additionally, advancements in technology and refurbishment programs have improved the efficiency and environmental performance of storage systems, and the growing emphasis on flexible capacity to balance variable wind and solar further supports this segment.

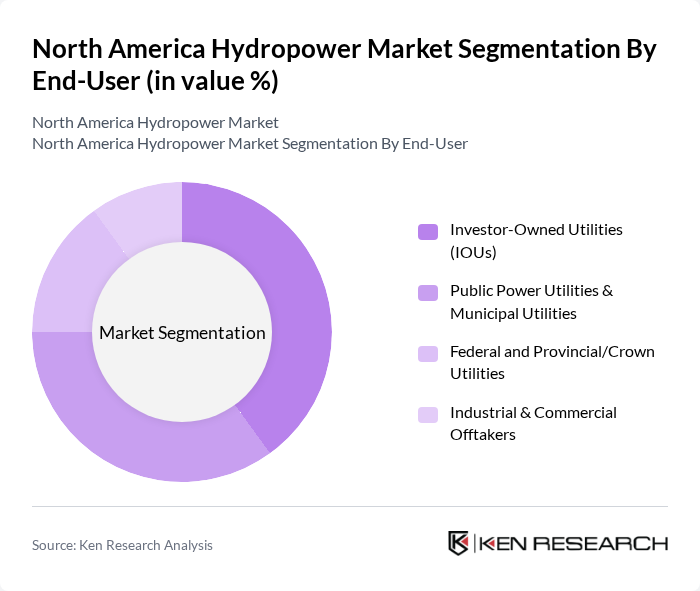

By End-User:The end-user segmentation includes Investor-Owned Utilities (IOUs), Public Power Utilities & Municipal Utilities, Federal and Provincial/Crown Utilities, and Industrial & Commercial Offtakers. Each of these segments plays a crucial role in the distribution and consumption of hydropower across North America.

The Investor-Owned Utilities (IOUs) segment leads the market due to their extensive infrastructure and investment capabilities. These utilities are often responsible for large-scale hydropower projects and have the financial resources to invest in new technologies and upgrades. Their established customer base and regulatory frameworks further enhance their position, while public power entities and Crown corporations also play significant roles in hydropower ownership and dispatch in the region.

The North America Hydropower Market is characterized by a dynamic mix of regional and international players. Leading participants such as Hydro?Québec, BC Hydro & Power Authority, Ontario Power Generation Inc. (OPG), Brookfield Renewable Partners L.P., NextEra Energy Resources, LLC, Duke Energy Corporation, Tennessee Valley Authority (TVA), U.S. Army Corps of Engineers – Hydropower, Southern Company (Alabama Power/Georgia Power), Idaho Power Company, Manitoba Hydro, Avangrid, Inc., PacifiCorp (Berkshire Hathaway Energy), Puget Sound Energy, Portland General Electric (PGE) contribute to innovation, geographic expansion, and service delivery in this space.

The North American hydropower market is poised for significant evolution, driven by increasing investments in renewable energy infrastructure and technological advancements. In future, the integration of smart grid technologies is expected to enhance operational efficiency and reliability. Additionally, the focus on energy storage solutions will facilitate better management of hydropower resources, allowing for greater flexibility in energy distribution. As public-private partnerships grow, collaboration will likely lead to innovative financing models, further propelling the sector's growth and sustainability.

| Segment | Sub-Segments |

|---|---|

| By Type | Run-of-River Reservoir (Storage) Pumped Storage Hydropower (PSH) Small Hydropower (?10 MW) Micro and Pico Hydro (<1 MW) |

| By End-User | Investor-Owned Utilities (IOUs) Public Power Utilities & Municipal Utilities Federal and Provincial/Crown Utilities Industrial & Commercial Offtakers |

| By Application | Grid-Connected Baseline/Peaking Off-Grid & Remote/Isolated Grids Repowering & Uprating of Existing Plants New Build (Greenfield) Projects |

| By Investment Source | Public Capital (Federal/State/Provincial) Private Equity & Infrastructure Funds Public-Private Partnerships (PPP) Multilateral & Export Credit Support |

| By Policy Support | Production/Investment Tax Credits Clean Energy Standards / RPS Renewable Energy Certificates (RECs) Carbon Pricing & Clean Energy Credits |

| By Technology | Turbines (Francis, Kaplan, Pelton) Balance of Plant & Digital Control Systems Pumped Storage & Hybrid Storage (BESS + Hydro) Fish Passage & Environmental Mitigation |

| By Distribution Mode | Power Purchase Agreements (PPAs) Merchant & Wholesale Markets (ISO/RTO) Utility-Owned Generation Community & Cooperative Programs |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Utility-Scale Hydropower Projects | 120 | Project Managers, Operations Directors |

| Small-Scale Hydropower Installations | 80 | Site Engineers, Business Development Managers |

| Regulatory Compliance in Hydropower | 60 | Compliance Officers, Environmental Managers |

| Hydropower Technology Innovations | 60 | R&D Managers, Technology Analysts |

| Market Trends and Investment Opportunities | 90 | Investment Analysts, Energy Policy Advisors |

The North America Hydropower Market is valued at approximately USD 12 billion, reflecting a five-year historical analysis. This growth is driven by the increasing demand for renewable energy, grid reliability, and modernization of aging hydro fleets.