Region:Asia

Author(s):Dev

Product Code:KRAA9629

Pages:84

Published On:November 2025

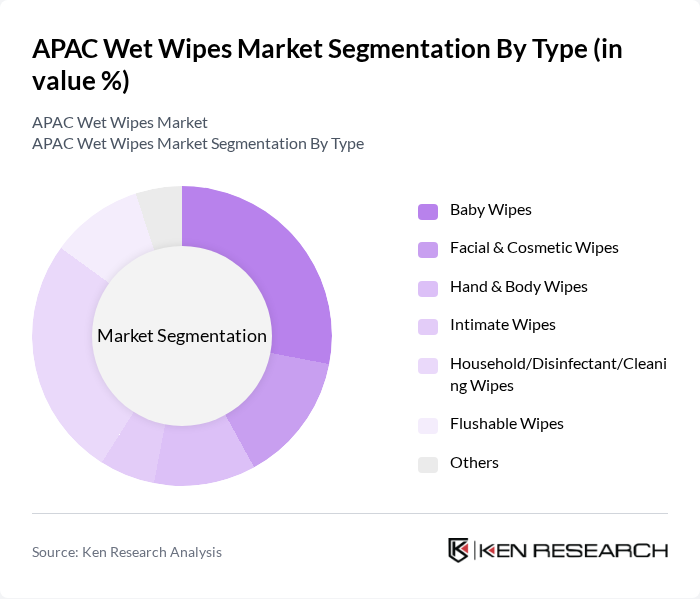

By Type:The wet wipes market can be segmented into various types, including Baby Wipes, Facial & Cosmetic Wipes, Hand & Body Wipes, Intimate Wipes, Household/Disinfectant/Cleaning Wipes, Flushable Wipes, and Others. Among these, Household/Disinfectant/Cleaning Wipes and Baby Wipes are particularly prominent due to their widespread use in households and healthcare settings. The demand for Baby Wipes is driven by the increasing number of working parents and the growing awareness of hygiene among caregivers. Household wipes have gained traction due to the rising focus on cleanliness and sanitation, especially in the wake of the pandemic.

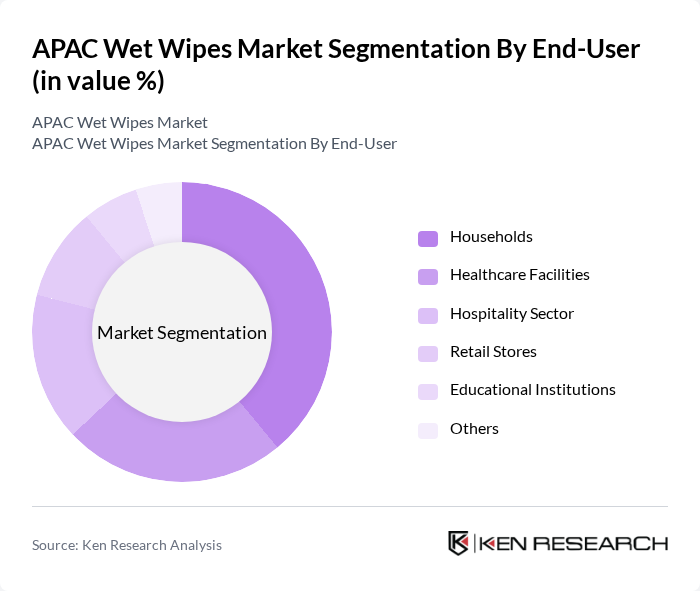

By End-User:The wet wipes market is segmented by end-user into Households, Healthcare Facilities, Hospitality Sector, Retail Stores, Educational Institutions, and Others. Households represent the largest segment, driven by the increasing adoption of wet wipes for daily hygiene and convenience. Healthcare facilities also constitute a significant portion of the market, as the need for sanitization and infection control has become paramount. The hospitality sector is witnessing growth due to the rising demand for cleanliness and hygiene in hotels and restaurants.

The APAC Wet Wipes Market is characterized by a dynamic mix of regional and international players. Leading participants such as Procter & Gamble, Kimberly-Clark Corporation, Unicharm Corporation, Johnson & Johnson, Reckitt Benckiser Group, Edgewell Personal Care, Nice-Pak Products, Inc., Huggies (Kimberly-Clark), Clorox Company, P&G Professional, Seventh Generation, SCA Hygiene Products (Essity), Hartmann Group, Bounty (Procter & Gamble), Babyganics, Dettol (Reckitt Benckiser), Lotion (Unicharm), Pigeon Corporation, Kao Corporation, Lion Corporation contribute to innovation, geographic expansion, and service delivery in this space.

The APAC wet wipes market is poised for continued growth, driven by evolving consumer preferences and increasing health awareness. Innovations in product formulations, particularly those focusing on eco-friendly materials, are expected to gain traction. Additionally, the rise of subscription-based purchasing models will likely enhance customer loyalty and convenience. As brands adapt to these trends, the market will witness a shift towards sustainable practices, aligning with global efforts to reduce plastic waste and promote hygiene.

| Segment | Sub-Segments |

|---|---|

| By Type | Baby Wipes Facial & Cosmetic Wipes Hand & Body Wipes Intimate Wipes Household/Disinfectant/Cleaning Wipes Flushable Wipes Others |

| By End-User | Households Healthcare Facilities Hospitality Sector Retail Stores Educational Institutions Others |

| By Region | China India Japan South Korea ASEAN Countries Australia & New Zealand Others |

| By Application | Daily Hygiene Baby Care Personal Care Medical Use Household Cleaning Others |

| By Packaging Type | Soft Packs Canisters Tubes Others |

| By Distribution Channel | Online Retail Supermarkets/Hypermarkets Convenience Stores Pharmacies Others |

| By Price Range | Economy Mid-Range Premium Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Consumer Preferences for Baby Wipes | 150 | Parents, Caregivers |

| Market Insights from Retail Chains | 100 | Category Managers, Purchasing Agents |

| Usage Patterns of Disinfectant Wipes | 120 | Household Consumers, Office Managers |

| Trends in Eco-friendly Wet Wipes | 80 | Sustainability Advocates, Product Developers |

| Distribution Channel Effectiveness | 90 | Wholesalers, Distributors |

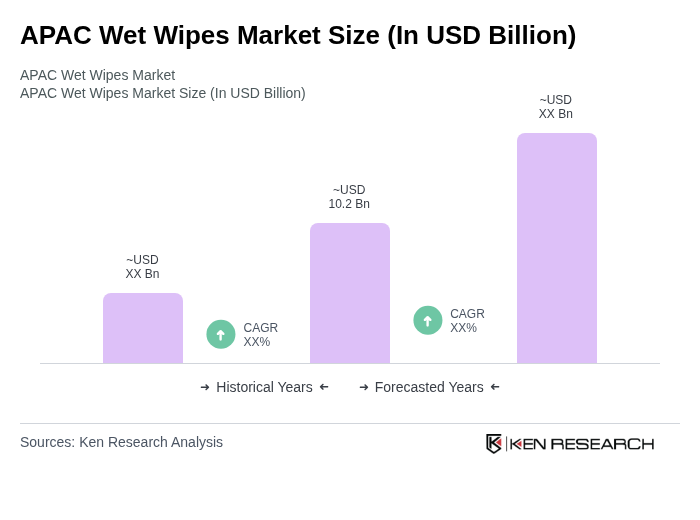

The APAC Wet Wipes Market is valued at approximately USD 10.2 billion, reflecting significant growth driven by consumer demand for convenience, hygiene awareness, and health-related issues, particularly heightened during the COVID-19 pandemic.