Region:Asia

Author(s):Shubham

Product Code:KRAD6684

Pages:94

Published On:December 2025

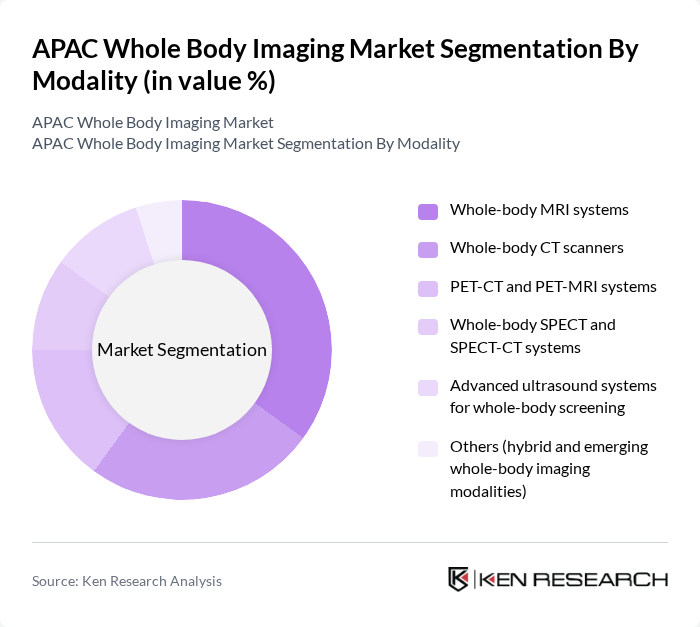

By Modality:The modalities in the whole body imaging market include various advanced imaging technologies that cater to different diagnostic needs. The subsegments include Whole-body MRI systems, Whole-body CT scanners, PET-CT and PET-MRI systems, Whole-body SPECT and SPECT-CT systems, Advanced ultrasound systems for whole-body screening, and Others (hybrid and emerging whole-body imaging modalities). Among these, Whole-body MRI systems are gaining traction due to their non-invasive nature and superior imaging capabilities, making them a preferred choice for comprehensive diagnostics.

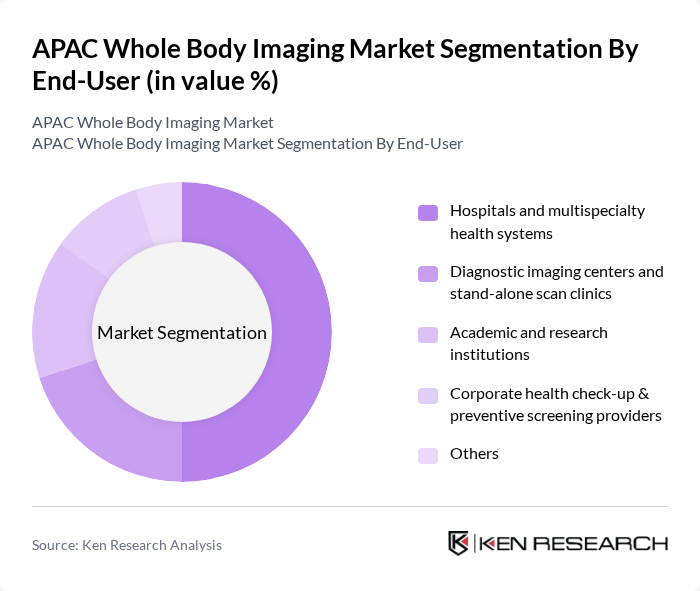

By End-User:The end-users of whole body imaging technologies include Hospitals and multispecialty health systems, Diagnostic imaging centers and stand-alone scan clinics, Academic and research institutions, Corporate health check-up & preventive screening providers, and Others. Hospitals and multispecialty health systems dominate this segment due to their comprehensive healthcare services and the increasing demand for advanced diagnostic imaging in patient care.

The APAC Whole Body Imaging Market is characterized by a dynamic mix of regional and international players. Leading participants such as Siemens Healthineers AG, GE HealthCare Technologies Inc., Koninklijke Philips N.V. (Philips Healthcare), Canon Medical Systems Corporation, Fujifilm Holdings Corporation, Hitachi, Ltd. (Hitachi Healthcare / Fujifilm Healthcare after integration), Carestream Health, Inc., Samsung Medison Co., Ltd., Shenzhen Mindray Bio?Medical Electronics Co., Ltd., Hologic, Inc., Neusoft Medical Systems Co., Ltd., Agfa?Gevaert Group, United Imaging Healthcare Co., Ltd., Shimadzu Corporation, Esaote S.p.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the APAC whole body imaging market appears promising, driven by ongoing technological innovations and increasing healthcare investments. The integration of artificial intelligence in imaging analysis is expected to enhance diagnostic accuracy and efficiency, while the shift towards personalized medicine will cater to individual patient needs. Furthermore, the growing emphasis on preventive healthcare will likely lead to increased adoption of imaging technologies, ensuring that healthcare providers can meet the rising demand for early diagnosis and treatment.

| Segment | Sub-Segments |

|---|---|

| By Modality | Whole-body MRI systems Whole-body CT scanners PET-CT and PET-MRI systems Whole-body SPECT and SPECT-CT systems Advanced ultrasound systems for whole-body screening Others (hybrid and emerging whole-body imaging modalities) |

| By End-User | Hospitals and multispecialty health systems Diagnostic imaging centers and stand?alone scan clinics Academic and research institutions Corporate health check?up & preventive screening providers Others |

| By Country | China Japan India South Korea Australia & New Zealand Southeast Asia (Indonesia, Thailand, Malaysia, Vietnam and others) Rest of Asia-Pacific |

| By Technology | Digital and AI?enabled imaging Conventional (analog and legacy) imaging Hybrid and multimodal imaging platforms Others |

| By Clinical Application | Oncology (cancer detection, staging and surveillance) Cardiology and vascular imaging Neurology and neurodegenerative disorders Musculoskeletal and orthopedic assessment Whole?body health check?ups and preventive screening Others |

| By Payer Type | Public reimbursement and government?funded programs Private insurance Out?of?pocket and self?pay Others |

| By Deployment Setting | Tertiary care and academic hospitals Secondary care hospitals Outpatient diagnostic and imaging centers Mobile imaging units Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Hospital Imaging Departments | 120 | Radiologists, Imaging Technologists |

| Diagnostic Imaging Centers | 100 | Center Managers, Medical Directors |

| Healthcare Policy Makers | 80 | Health Administrators, Policy Analysts |

| Medical Equipment Distributors | 70 | Sales Managers, Product Specialists |

| Insurance Providers | 60 | Claims Analysts, Underwriters |

The APAC Whole Body Imaging Market is valued at approximately USD 6.2 billion, driven by advancements in imaging technologies, increasing chronic disease prevalence, and rising awareness of preventive healthcare.