Region:Central and South America

Author(s):Geetanshi

Product Code:KRAB6334

Pages:87

Published On:October 2025

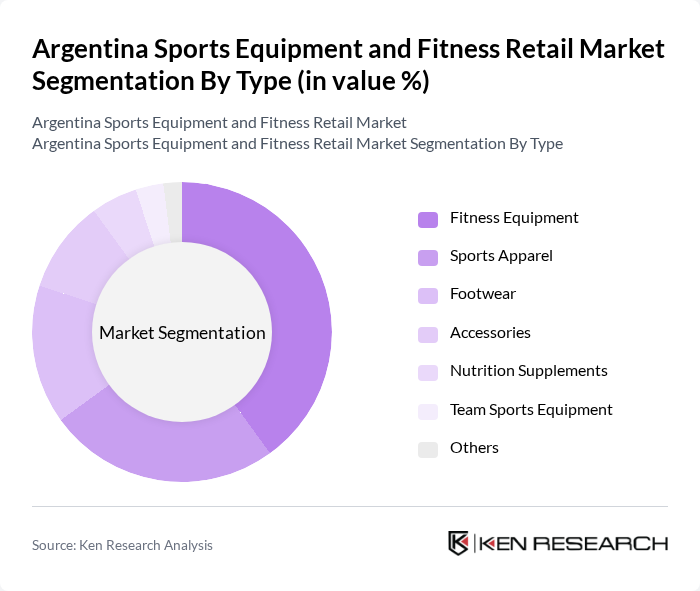

By Type:The market is segmented into various types, including Fitness Equipment, Sports Apparel, Footwear, Accessories, Nutrition Supplements, Team Sports Equipment, and Others. Among these, Fitness Equipment is currently the leading sub-segment, driven by the increasing trend of home workouts and the growing number of fitness enthusiasts. The demand for high-quality and innovative fitness products has surged, as consumers prioritize health and wellness in their daily lives.

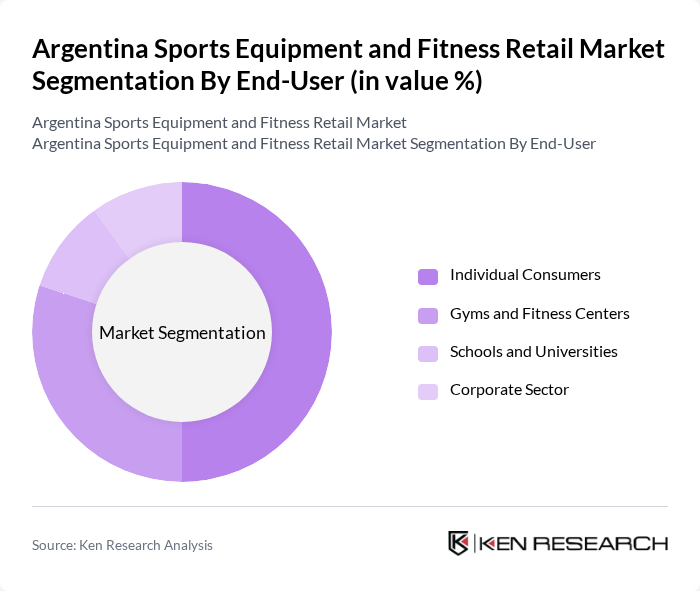

By End-User:The end-user segmentation includes Individual Consumers, Gyms and Fitness Centers, Schools and Universities, and the Corporate Sector. Individual Consumers represent the largest segment, as more people are investing in personal fitness and wellness. The trend of home workouts and personal training has led to increased purchases of fitness equipment and apparel, making this segment a key driver of market growth.

The Argentina Sports Equipment and Fitness Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Adidas Argentina, Nike Argentina, Decathlon Argentina, Sportline, Topper, Umbro Argentina, Reebok Argentina, Puma Argentina, Wilson Sporting Goods, Under Armour Argentina, Kappa Argentina, Asics Argentina, Mizuno Argentina, New Balance Argentina, Salomon Argentina contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Argentine sports equipment and fitness retail market appears promising, driven by increasing health consciousness and a growing fitness culture. As more consumers prioritize physical well-being, the demand for innovative and sustainable fitness solutions is expected to rise. Additionally, the expansion of e-commerce platforms will facilitate access to a broader range of products, enhancing consumer choice and convenience. These trends indicate a robust market evolution, with potential for significant growth in the coming years.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Sports Apparel Footwear Accessories Nutrition Supplements Team Sports Equipment Others |

| By End-User | Individual Consumers Gyms and Fitness Centers Schools and Universities Corporate Sector |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Brand Loyalty | Brand-Conscious Consumers Price-Sensitive Consumers Quality-Driven Consumers |

| By Product Lifecycle Stage | New Products Established Products Declining Products |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Equipment Sales | 150 | Store Managers, Retail Buyers |

| Fitness Center Equipment Purchases | 100 | Gym Owners, Fitness Directors |

| Consumer Preferences in Sports Apparel | 120 | Active Consumers, Fitness Enthusiasts |

| Market Trends in Home Fitness Equipment | 80 | Home Gym Users, Personal Trainers |

| Brand Perception Studies | 90 | Sports Equipment Users, Brand Loyalists |

The Argentina Sports Equipment and Fitness Retail Market is valued at approximately USD 1.5 billion, reflecting a significant growth trend driven by increasing health consciousness and the expansion of retail channels, including online platforms.