Region:Africa

Author(s):Shubham

Product Code:KRAB6297

Pages:97

Published On:October 2025

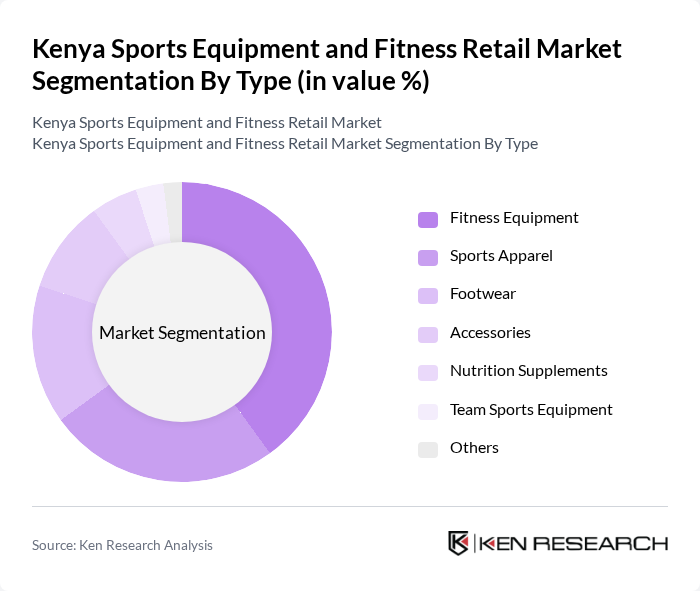

By Type:The market is segmented into various types, including Fitness Equipment, Sports Apparel, Footwear, Accessories, Nutrition Supplements, Team Sports Equipment, and Others. Among these, Fitness Equipment is currently the leading sub-segment, driven by the increasing number of gyms and fitness centers, as well as a growing trend of home workouts. Consumers are investing in high-quality fitness equipment to enhance their workout experiences, leading to a significant market share for this category.

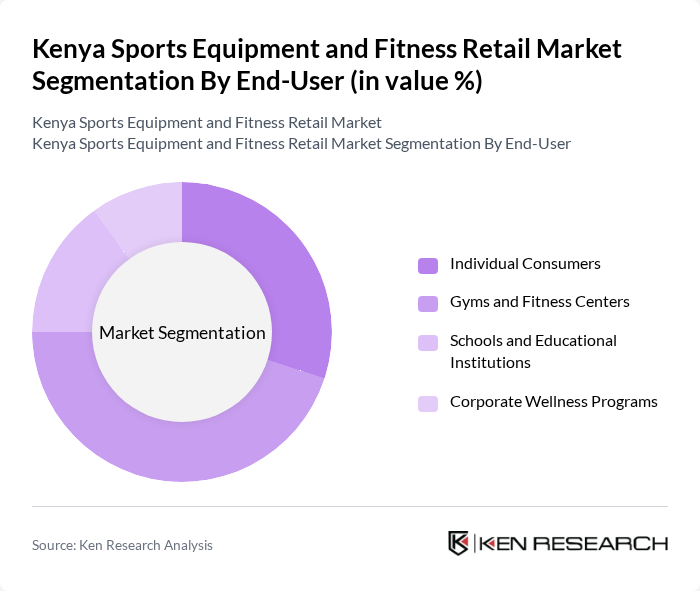

By End-User:The end-user segmentation includes Individual Consumers, Gyms and Fitness Centers, Schools and Educational Institutions, and Corporate Wellness Programs. Gyms and Fitness Centers dominate this segment, as they require a wide range of equipment and apparel to cater to their members. The increasing number of fitness facilities and the growing trend of corporate wellness programs are also contributing to the demand for sports equipment among individual consumers.

The Kenya Sports Equipment and Fitness Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Decathlon Kenya, SportPesa, Jumia Kenya, Nairobi Sports House, Kinetic Sports, Active Sports Kenya, Fitness First Kenya, Simba Sports, Sports Connect, Gikambura Sports, Kenya Sports Equipment, Proline Sports, Fit Kenya, Sports Warehouse, The Sports Shop contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Kenya sports equipment and fitness retail market appears promising, driven by increasing health awareness and a burgeoning fitness culture. With government support and investment in sports infrastructure, the market is poised for growth. Additionally, the rise of e-commerce platforms is expected to enhance accessibility to fitness products. As consumer preferences shift towards sustainable and technologically integrated equipment, retailers must adapt to these trends to capitalize on emerging opportunities in the future.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Sports Apparel Footwear Accessories Nutrition Supplements Team Sports Equipment Others |

| By End-User | Individual Consumers Gyms and Fitness Centers Schools and Educational Institutions Corporate Wellness Programs |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Wholesale Distributors Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Brand Popularity | Local Brands International Brands Emerging Brands |

| By Product Lifecycle Stage | New Products Established Products Declining Products |

| By Distribution Mode | Direct Distribution Indirect Distribution Franchise Models |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Equipment Sales | 150 | Store Managers, Retail Buyers |

| Fitness Equipment Usage | 100 | Personal Trainers, Gym Owners |

| Consumer Fitness Trends | 200 | Fitness Enthusiasts, Casual Gym Goers |

| Online Sports Equipment Purchases | 120 | E-commerce Managers, Digital Marketing Specialists |

| Market Entry Strategies | 80 | Business Development Managers, Market Analysts |

The Kenya Sports Equipment and Fitness Retail Market is valued at approximately USD 1.2 billion, reflecting a significant growth trend driven by increasing health consciousness and a rise in fitness activities among the population.