Region:Europe

Author(s):Geetanshi

Product Code:KRAB6321

Pages:87

Published On:October 2025

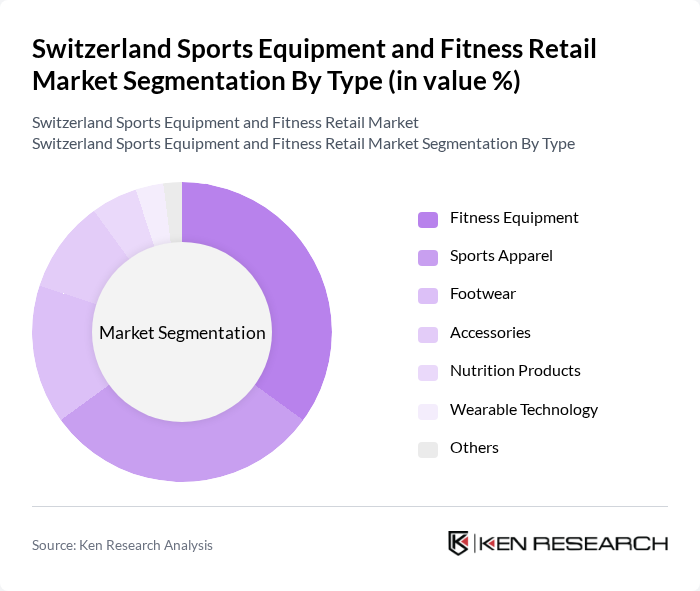

By Type:The market is segmented into various types of products, including fitness equipment, sports apparel, footwear, accessories, nutrition products, wearable technology, and others. Among these, fitness equipment and sports apparel are the leading segments, driven by the increasing number of fitness enthusiasts and the growing trend of athleisure wear. The demand for wearable technology is also on the rise, as consumers seek to track their fitness progress and health metrics.

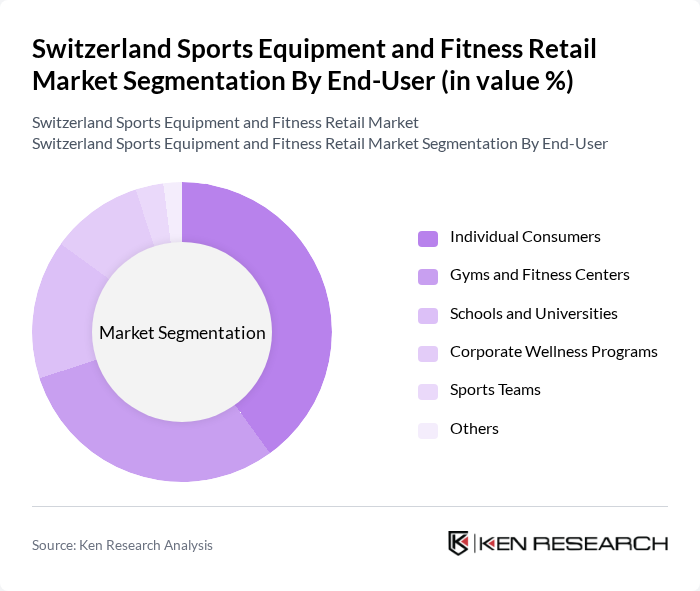

By End-User:The end-user segmentation includes individual consumers, gyms and fitness centers, schools and universities, corporate wellness programs, sports teams, and others. Individual consumers and gyms and fitness centers are the dominant segments, as the growing trend of personal fitness and group workouts drives demand for sports equipment and fitness products. Corporate wellness programs are also gaining traction as companies invest in employee health.

The Switzerland Sports Equipment and Fitness Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Decathlon, Intersport, SportXX, Ochsner Sport, Adidas, Nike, Under Armour, Puma, Asics, Salomon, The North Face, Reebok, Wilson Sporting Goods, Head Sports, and Yonex contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Switzerland sports equipment and fitness retail market appears promising, driven by ongoing trends in health and wellness. The integration of technology in fitness solutions, such as wearable devices and virtual training platforms, is expected to enhance consumer engagement. Additionally, the expansion of fitness centers and the increasing popularity of home fitness solutions will likely create new avenues for growth, allowing retailers to adapt to evolving consumer preferences and capitalize on emerging market trends.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Sports Apparel Footwear Accessories Nutrition Products Wearable Technology Others |

| By End-User | Individual Consumers Gyms and Fitness Centers Schools and Universities Corporate Wellness Programs Sports Teams Others |

| By Sales Channel | Online Retail Brick-and-Mortar Stores Direct Sales Distributors Others |

| By Price Range | Budget Mid-Range Premium Luxury Others |

| By Brand Loyalty | Brand Loyal Customers Price-Sensitive Customers Quality-Conscious Customers Others |

| By Product Lifecycle Stage | Introduction Stage Growth Stage Maturity Stage Decline Stage Others |

| By Consumer Demographics | Age Group Gender Income Level Lifestyle Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Sports Equipment Sales | 150 | Store Managers, Sales Representatives |

| Fitness Center Equipment Usage | 100 | Gym Owners, Personal Trainers |

| Consumer Fitness Equipment Purchases | 200 | Fitness Enthusiasts, Casual Buyers |

| Trends in Sports Apparel | 80 | Fashion Buyers, Brand Managers |

| Market Insights on Accessories | 70 | Product Developers, Marketing Executives |

The Switzerland Sports Equipment and Fitness Retail Market is valued at approximately USD 3.5 billion, reflecting a significant growth trend driven by increasing health consciousness and the popularity of fitness and outdoor activities among consumers.