Region:Asia

Author(s):Geetanshi

Product Code:KRAB6314

Pages:81

Published On:October 2025

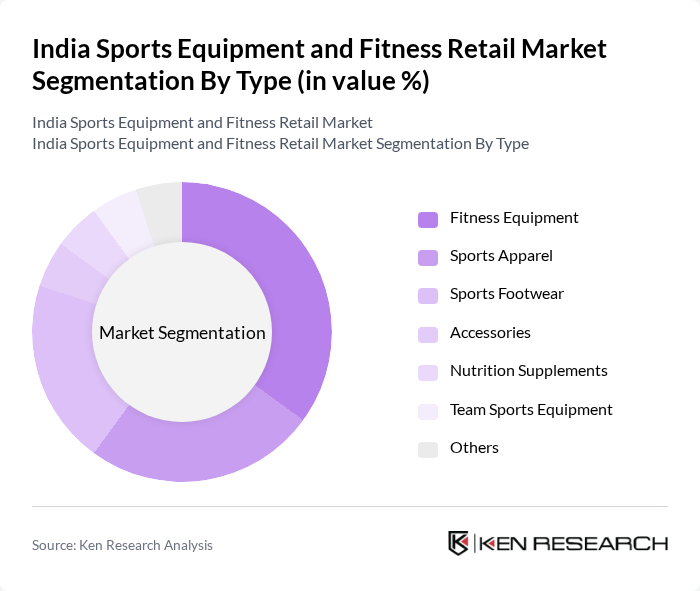

By Type:The market is segmented into various types of products, including fitness equipment, sports apparel, sports footwear, accessories, nutrition supplements, team sports equipment, and others. Among these, fitness equipment has gained significant traction due to the increasing number of home gyms and fitness centers. The demand for sports apparel and footwear is also on the rise, driven by the growing trend of athleisure wear and the popularity of sports among the youth.

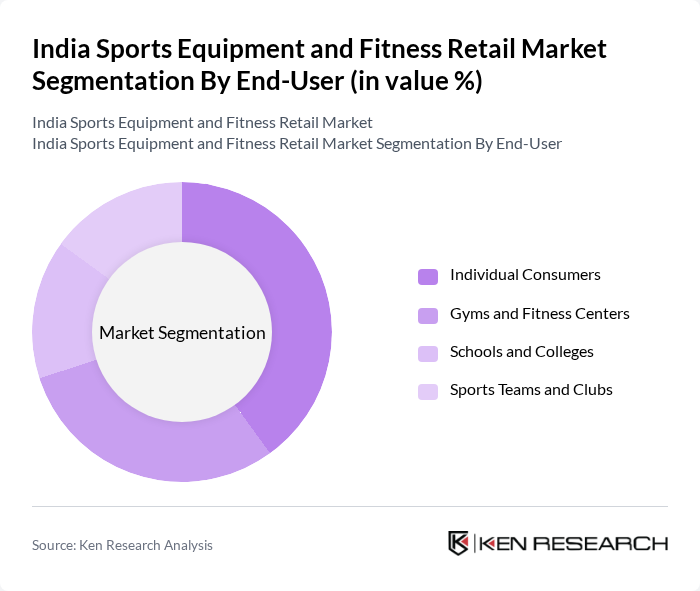

By End-User:The end-user segmentation includes individual consumers, gyms and fitness centers, schools and colleges, and sports teams and clubs. Individual consumers represent a significant portion of the market, driven by the increasing trend of personal fitness and wellness. Gyms and fitness centers are also key players, as they require a wide range of equipment and apparel to cater to their clientele.

The India Sports Equipment and Fitness Retail Market is characterized by a dynamic mix of regional and international players. Leading participants such as Decathlon Sports India Pvt. Ltd., Nike India Pvt. Ltd., Adidas India Pvt. Ltd., Puma Sports India Pvt. Ltd., Reebok India Company, Wildcraft India Pvt. Ltd., Nivia Sports Pvt. Ltd., Cosco (India) Ltd., Khelmart.com, Fitness First India, Sparx Sports, HRX by Hrithik Roshan, Stryd India, Aastha Sports, Sports365 contribute to innovation, geographic expansion, and service delivery in this space.

The future of the India sports equipment and fitness retail market appears promising, driven by technological advancements and changing consumer preferences. The integration of digital platforms for fitness solutions is expected to enhance accessibility, while the growing trend of personalized fitness experiences will likely lead to increased demand for customized sports equipment. Additionally, the focus on sustainability will push brands to innovate eco-friendly products, aligning with consumer values and regulatory expectations.

| Segment | Sub-Segments |

|---|---|

| By Type | Fitness Equipment Sports Apparel Sports Footwear Accessories Nutrition Supplements Team Sports Equipment Others |

| By End-User | Individual Consumers Gyms and Fitness Centers Schools and Colleges Sports Teams and Clubs |

| By Region | North India South India East India West India |

| By Sales Channel | Online Retail Offline Retail Direct Sales |

| By Price Range | Budget Mid-Range Premium |

| By Brand Popularity | Established Brands Emerging Brands Private Labels |

| By Product Lifecycle Stage | New Products Growth Stage Products Mature Products Declining Products |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Market Insights | 150 | Store Managers, Retail Buyers |

| Consumer Fitness Equipment Preferences | 200 | Fitness Enthusiasts, Gym Members |

| Trends in Sports Apparel | 100 | Fashion Retailers, Brand Managers |

| Market Dynamics in Fitness Services | 80 | Gym Owners, Personal Trainers |

| Impact of E-commerce on Sports Retail | 120 | E-commerce Managers, Digital Marketing Specialists |

The India Sports Equipment and Fitness Retail Market is valued at approximately USD 8.5 billion, reflecting significant growth driven by increasing health consciousness, fitness trends, and the expansion of e-commerce platforms facilitating access to sports and fitness products.