Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA0196

Pages:83

Published On:August 2025

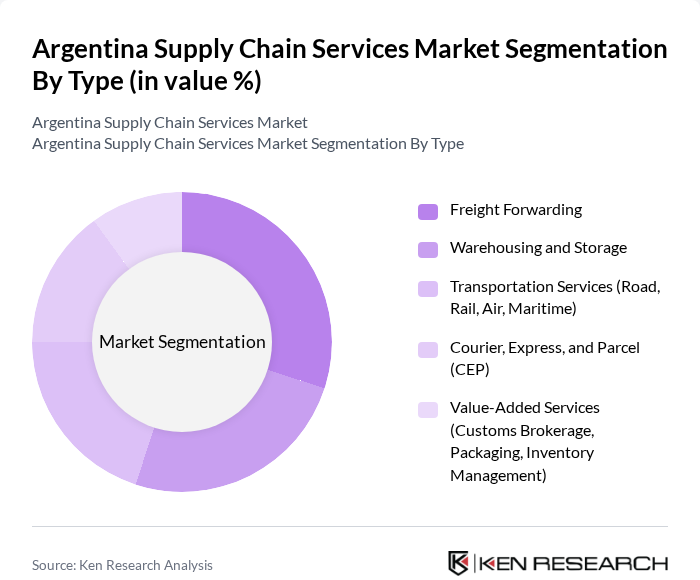

By Type:The market is segmented into core service categories that address diverse logistical requirements. The primary segments include Freight Forwarding, Warehousing and Storage, Transportation Services (encompassing Road, Rail, Air, and Maritime), Courier, Express, and Parcel (CEP), and Value-Added Services such as Customs Brokerage, Packaging, and Inventory Management. Each segment is essential to the overall supply chain ecosystem, with sub-segments gaining prominence based on sector-specific demand and evolving consumer expectations .

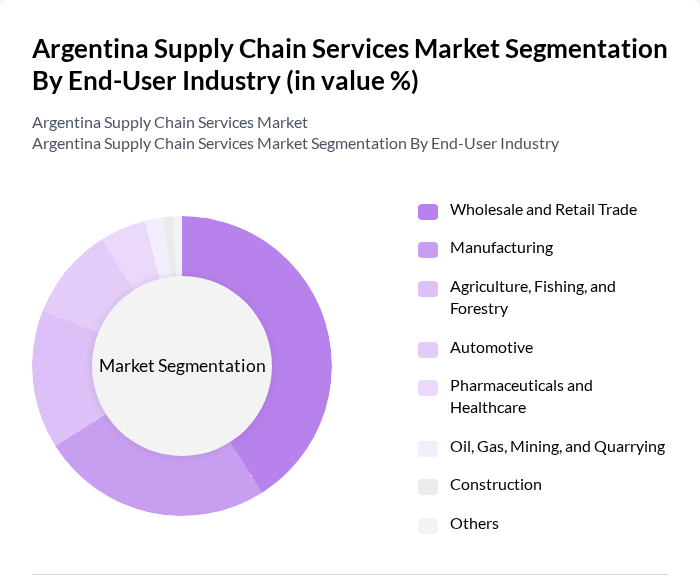

By End-User Industry:The supply chain services market is also segmented by end-user industries, including Wholesale and Retail Trade, Manufacturing, Agriculture, Fishing, and Forestry, Automotive, Pharmaceuticals and Healthcare, Oil, Gas, Mining, and Quarrying, Construction, and Others. Each industry segment has distinct logistical needs, directly influencing the demand for specialized supply chain services. Wholesale and retail trade, in particular, is the dominant end-user segment, largely due to the surge in e-commerce and digital retail channels .

The Argentina Supply Chain Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Grupo Logístico Andreani, DHL Supply Chain Argentina, Kuehne + Nagel Argentina, Cencosud Logistics, Agility Logistics Argentina, OCA S.A., Intercargo S.A.C., Cargotrans S.A., Logística Integral S.A., TASA Logística, Expreso TASA, Loginter S.A., Transporte Cruz del Sur, Andreani Desarrollos Inmobiliarios, Transporte y Logística La Sevillanita contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Argentina supply chain services market appears promising, driven by ongoing investments in technology and infrastructure. As e-commerce continues to expand, logistics providers are likely to enhance their service offerings to meet consumer demands. Additionally, the integration of sustainable practices and digital transformation will play a crucial role in shaping the market landscape. Companies that adapt to these trends will be better positioned to capitalize on emerging opportunities and navigate challenges effectively.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Warehousing and Storage Transportation Services (Road, Rail, Air, Maritime) Courier, Express, and Parcel (CEP) Value-Added Services (Customs Brokerage, Packaging, Inventory Management) |

| By End-User Industry | Wholesale and Retail Trade Manufacturing Agriculture, Fishing, and Forestry Automotive Pharmaceuticals and Healthcare Oil, Gas, Mining, and Quarrying Construction Others |

| By Region | Buenos Aires Córdoba Mendoza Santa Fe Others |

| By Technology | IoT in Supply Chain Cloud-Based Solutions Data Analytics RFID Technology Automation and Robotics Others |

| By Application | Retail Logistics Industrial Logistics E-commerce Logistics Cold Chain Logistics Last-Mile Delivery Others |

| By Investment Source | Private Investments Government Funding Foreign Direct Investment (FDI) Public-Private Partnerships (PPP) Others |

| By Policy Support | Subsidies for Logistics Companies Tax Incentives Regulatory Support for Innovation Grants for Infrastructure Development Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Management | 60 | Supply Chain Managers, Logistics Coordinators |

| Manufacturing Logistics Solutions | 50 | Operations Directors, Plant Managers |

| E-commerce Fulfillment Strategies | 40 | eCommerce Operations Managers, Warehouse Supervisors |

| Third-Party Logistics Providers | 45 | Business Development Managers, Account Executives |

| Cold Chain Logistics | 40 | Quality Assurance Managers, Supply Chain Analysts |

The Argentina Supply Chain Services Market is valued at approximately USD 28 billion, reflecting significant growth driven by the demand for efficient logistics solutions, e-commerce expansion, and advanced supply chain management practices across various industries.