Region:Europe

Author(s):Geetanshi

Product Code:KRAA2035

Pages:84

Published On:August 2025

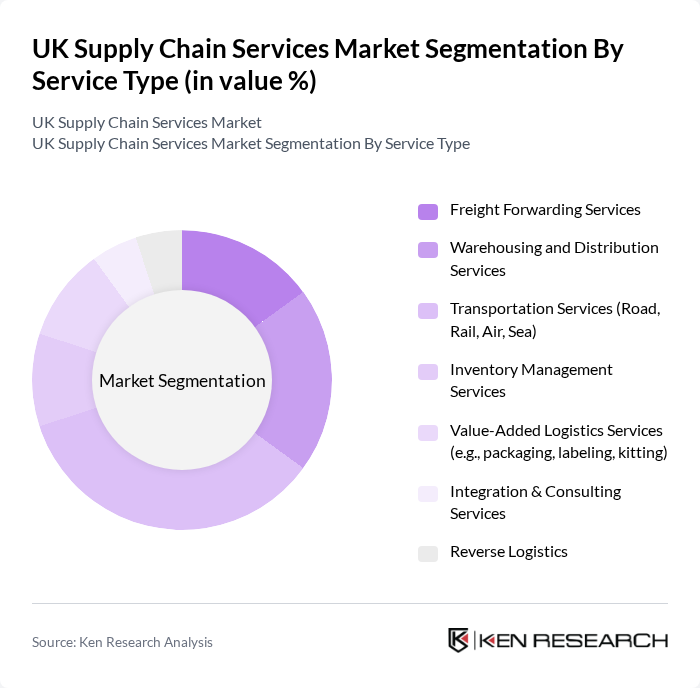

By Service Type:The service type segmentation includes various subsegments such as Freight Forwarding Services, Warehousing and Distribution Services, Transportation Services (Road, Rail, Air, Sea), Inventory Management Services, Value-Added Logistics Services, Integration & Consulting Services, and Reverse Logistics. Among these, Transportation Services are currently dominating the market due to the increasing need for efficient and timely delivery solutions, especially in the context of e-commerce growth and global trade. Roadways remain the most significant mode, offering flexibility and reliability for both inbound and outbound logistics .

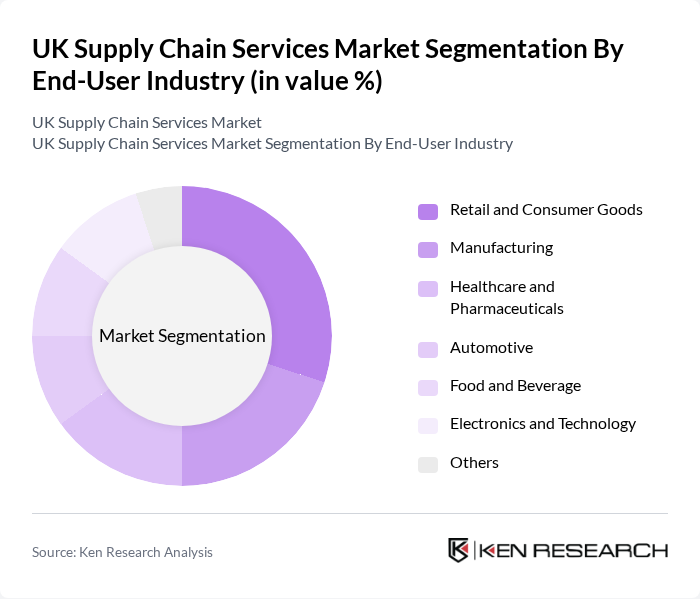

By End-User Industry:The end-user industry segmentation encompasses Retail and Consumer Goods, Manufacturing, Healthcare and Pharmaceuticals, Automotive, Food and Beverage, Electronics and Technology, and Others. The Retail and Consumer Goods sector is leading this market segment, driven by the rapid growth of online shopping and the need for efficient supply chain solutions to meet consumer demands. Manufacturing and healthcare also represent substantial shares due to the complexity and regulatory requirements of their supply chains .

The UK Supply Chain Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, GXO Logistics, Kuehne + Nagel, DB Schenker, CEVA Logistics, UPS Supply Chain Solutions, FedEx Logistics, DSV, Geodis, Wincanton, XPO Logistics, Kuehne + Nagel Ltd, Eddie Stobart Logistics, Clipper Logistics, and Royal Mail Group contribute to innovation, geographic expansion, and service delivery in this space.

The UK supply chain services market is poised for transformation, driven by technological advancements and evolving consumer preferences. As companies increasingly adopt digital solutions, the emphasis on data analytics and supply chain visibility will enhance operational efficiency. Furthermore, the shift towards omnichannel distribution will necessitate innovative logistics strategies. In future, the focus on sustainability will also shape investment decisions, as businesses seek to align with environmental goals while meeting consumer demands for responsible practices.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Freight Forwarding Services Warehousing and Distribution Services Transportation Services (Road, Rail, Air, Sea) Inventory Management Services Value-Added Logistics Services (e.g., packaging, labeling, kitting) Integration & Consulting Services Reverse Logistics |

| By End-User Industry | Retail and Consumer Goods Manufacturing Healthcare and Pharmaceuticals Automotive Food and Beverage Electronics and Technology Others |

| By Service Model | Third-Party Logistics (3PL/Contract Logistics) Fourth-Party Logistics (4PL/Lead Logistics) Integrated Logistics Services Dedicated Contract Carriage Others |

| By Mode of Transportation | Road Rail Air Sea Multimodal |

| By Region | London South East North West East of England South West Scotland West Midlands Yorkshire and The Humber East Midlands Others |

| By Customer Type | B2B B2C Government/Public Sector SMEs Large Enterprises |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Pay-as-you-go Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Management | 100 | Supply Chain Managers, Logistics Coordinators |

| Manufacturing Logistics Optimization | 60 | Operations Directors, Production Managers |

| E-commerce Fulfillment Strategies | 80 | eCommerce Operations Managers, Warehouse Supervisors |

| Third-Party Logistics (3PL) Services | 50 | Business Development Managers, Account Managers |

| Cold Chain Logistics | 40 | Quality Assurance Managers, Supply Chain Analysts |

The UK Supply Chain Services Market is valued at approximately USD 21 billion, reflecting a significant growth driven by the demand for efficient logistics solutions, technological advancements, and the rise of e-commerce.