Region:Middle East

Author(s):Geetanshi

Product Code:KRAA1966

Pages:82

Published On:August 2025

By Type:The market is segmented into various types, including Freight Forwarding, Warehousing & Distribution, Road Transportation, Air Freight, Sea Freight, Customs Brokerage, Supply Chain Management & Consulting, Cold Chain Logistics, and Others. Each of these segments plays a crucial role in the overall supply chain ecosystem, catering to different logistical needs and operational requirements .

By End-User:The end-user segmentation includes Retail & E-commerce, Manufacturing, Oil & Gas, Healthcare & Pharmaceuticals, Automotive, Construction, Agriculture & Primary Industry, BFSI (Banking, Financial Services & Insurance), Food and Beverage, and Others. Each sector has unique supply chain requirements, influencing the demand for specific services and solutions .

The Qatar Supply Chain Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as Gulf Warehousing Company (GWC), Milaha (Qatar Navigation Q.P.S.C.), Agility Logistics, DB Schenker, Kuehne + Nagel, DHL Supply Chain, Aramex, CEVA Logistics, FedEx Logistics, UPS Supply Chain Solutions, Al-Futtaim Logistics, Qatar Airways Cargo, Maersk Qatar, Qatar National Import and Export Co., Bin Yousef Cargo contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Qatar supply chain services market appears promising, driven by ongoing government initiatives and technological advancements. As Qatar continues to invest in infrastructure and digital transformation, the logistics sector is expected to evolve significantly. The integration of AI and automation will enhance operational efficiency, while sustainability initiatives will shape logistics practices. Additionally, the growth of e-commerce will necessitate innovative solutions, positioning Qatar as a competitive player in the regional supply chain landscape.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Warehousing & Distribution Road Transportation Air Freight Sea Freight Customs Brokerage Supply Chain Management & Consulting Cold Chain Logistics Others |

| By End-User | Retail & E-commerce Manufacturing Oil & Gas Healthcare & Pharmaceuticals Automotive Construction Agriculture & Primary Industry BFSI (Banking, Financial Services & Insurance) Food and Beverage Others |

| By Service Model | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Integrated Logistics Services Dedicated Contract Carriage Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Retail Outlets Others |

| By Industry Vertical | Consumer Goods Electronics Pharmaceuticals Chemicals Energy & Utilities Others |

| By Geographic Coverage | Doha & Surrounding Areas Industrial Zones (e.g., Ras Laffan, Mesaieed) Free Trade Zones Regional (GCC) International Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Oil & Gas Supply Chain Management | 60 | Supply Chain Managers, Operations Directors |

| Retail Logistics and Distribution | 50 | Logistics Coordinators, Inventory Managers |

| Construction Material Supply Chains | 40 | Procurement Managers, Project Managers |

| Healthcare Supply Chain Operations | 40 | Pharmacy Managers, Supply Chain Analysts |

| Food and Beverage Distribution | 50 | Warehouse Managers, Distribution Supervisors |

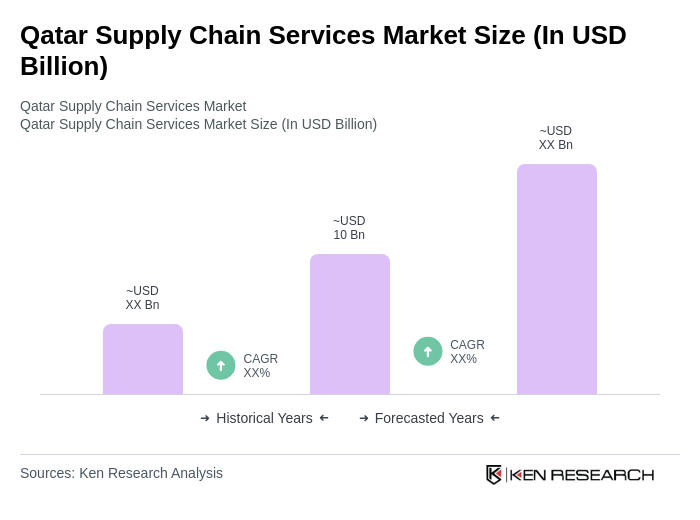

The Qatar Supply Chain Services Market is valued at approximately USD 10 billion, driven by the rapid expansion of the logistics sector and increased demand for efficient supply chain solutions, supported by significant investments in infrastructure and technology.