Region:North America

Author(s):Geetanshi

Product Code:KRAA2052

Pages:96

Published On:August 2025

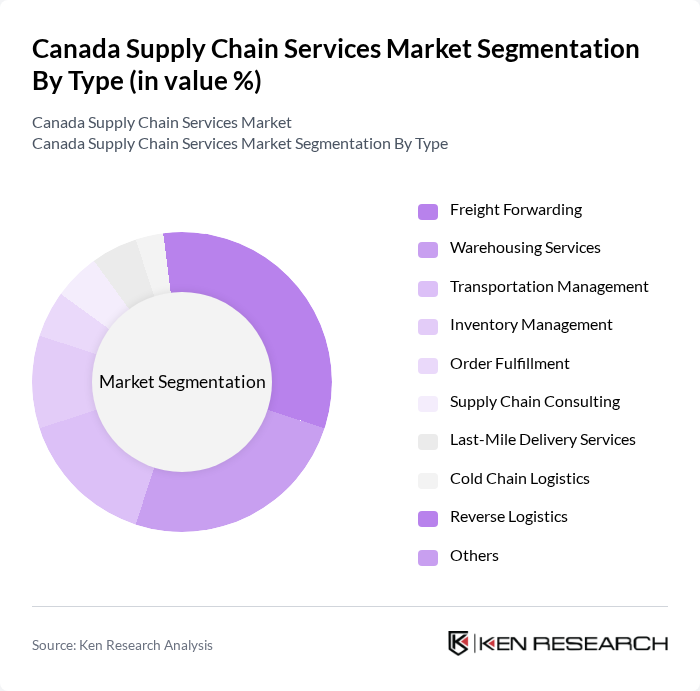

By Type:The supply chain services market is segmented into various types, including freight forwarding, warehousing services, transportation management, inventory management, order fulfillment, supply chain consulting, last-mile delivery services, cold chain logistics, reverse logistics, and others. Among these, freight forwarding and warehousing services are the most prominent, driven by the increasing need for efficient logistics solutions and the growth of e-commerce. The demand for last-mile delivery services has also surged due to the rise in online shopping, making it a critical component of the supply chain .

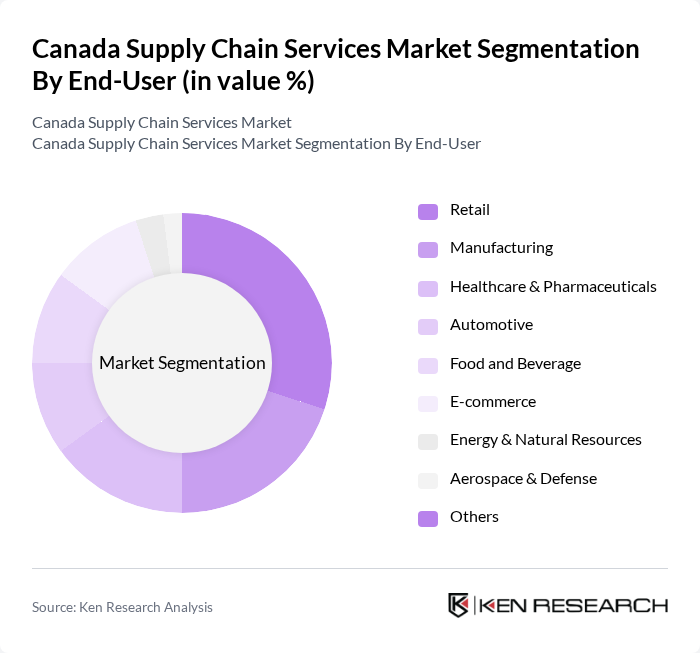

By End-User:The end-user segmentation includes retail, manufacturing, healthcare & pharmaceuticals, automotive, food and beverage, e-commerce, energy & natural resources, aerospace & defense, and others. The retail and e-commerce sectors are the largest consumers of supply chain services, driven by the increasing demand for fast and reliable delivery options. The healthcare sector is also growing, particularly in cold chain logistics, due to the need for temperature-sensitive products .

The Canada Supply Chain Services Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain, Kuehne + Nagel, XPO Logistics, C.H. Robinson, FedEx Logistics, UPS Supply Chain Solutions, DB Schenker, Ryder Supply Chain Solutions, Geodis, Expeditors International, J.B. Hunt Transport Services, Penske Logistics, Coyote Logistics, TFI International, UniUni, Manitoulin Transport, Purolator, DSV Canada, Metro Supply Chain Group, SCI Group contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Canada supply chain services market is poised for transformation, driven by technological innovations and evolving consumer preferences. As companies increasingly prioritize supply chain resilience, investments in digital tools and automation will likely accelerate. Furthermore, the emphasis on sustainability will shape operational strategies, with businesses adopting greener practices to meet regulatory standards and consumer expectations. This dynamic environment presents opportunities for growth and adaptation, ensuring that supply chain services remain integral to the Canadian economy.

| Segment | Sub-Segments |

|---|---|

| By Type | Freight Forwarding Warehousing Services Transportation Management Inventory Management Order Fulfillment Supply Chain Consulting Last-Mile Delivery Services Cold Chain Logistics Reverse Logistics Others |

| By End-User | Retail Manufacturing Healthcare & Pharmaceuticals Automotive Food and Beverage E-commerce Energy & Natural Resources Aerospace & Defense Others |

| By Service Type | Third-Party Logistics (3PL) Fourth-Party Logistics (4PL) Freight Brokerage Dedicated Contract Carriage Customs Brokerage Others |

| By Distribution Channel | Direct Sales Online Platforms Distributors Retail Outlets Others |

| By Geographic Coverage | National Regional Local International Others |

| By Customer Type | B2B B2C Government Non-Profit Others |

| By Pricing Model | Fixed Pricing Variable Pricing Subscription-Based Pricing Performance-Based Pricing Others |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Supply Chain Management | 60 | Supply Chain Managers, Logistics Coordinators |

| Manufacturing Logistics Solutions | 50 | Operations Managers, Production Supervisors |

| E-commerce Fulfillment Strategies | 40 | eCommerce Directors, Warehouse Operations Managers |

| Third-Party Logistics Providers | 45 | Business Development Managers, Account Executives |

| Cold Chain Logistics | 40 | Quality Assurance Managers, Supply Chain Analysts |

The Canada Supply Chain Services Market is valued at approximately USD 4.3 billion, reflecting a five-year historical analysis. This growth is driven by the demand for efficient logistics solutions and the expansion of e-commerce in the region.