Region:Central and South America

Author(s):Geetanshi

Product Code:KRAA2046

Pages:96

Published On:August 2025

Market.png)

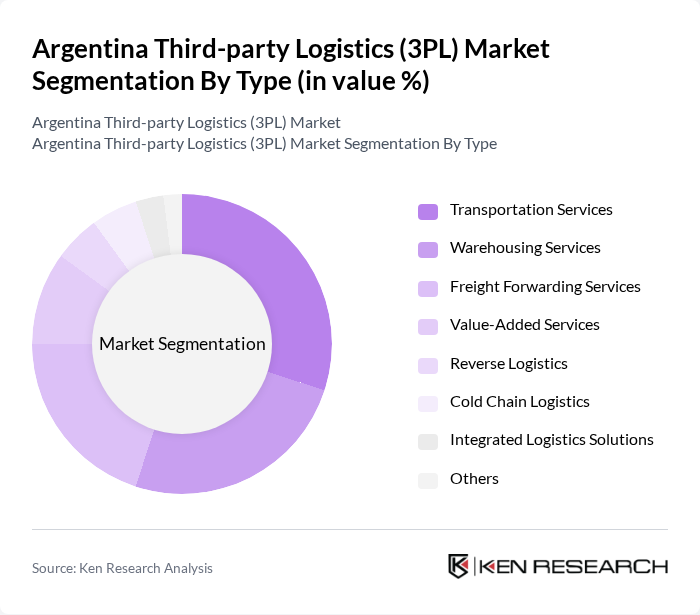

By Type:The market is segmented into a range of services tailored to diverse logistics requirements. The primary subsegments include Transportation Services, Warehousing Services, Freight Forwarding Services, Value-Added Services, Reverse Logistics, Cold Chain Logistics, Integrated Logistics Solutions, and Others. Transportation Services encompass road, rail, air, and maritime logistics, while Warehousing Services cover storage, inventory management, and distribution. Freight Forwarding Services facilitate international and domestic cargo movement. Value-Added Services include packaging, labeling, and assembly. Reverse Logistics handles returns and recycling, and Cold Chain Logistics supports temperature-sensitive goods. Integrated Logistics Solutions offer end-to-end supply chain management .

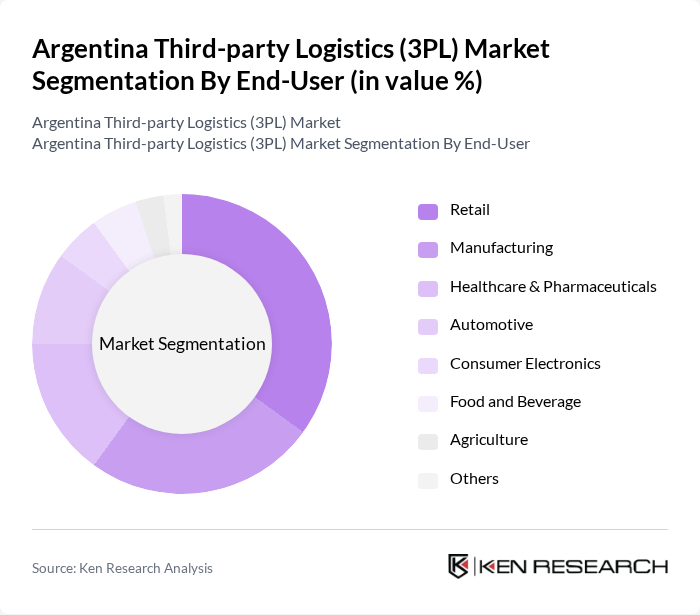

By End-User:The end-user segmentation reflects the broad spectrum of industries utilizing 3PL services. Key segments include Retail, Manufacturing, Healthcare & Pharmaceuticals, Automotive, Consumer Electronics, Food and Beverage, Agriculture, and Others. Retail and e-commerce drive demand for fast, flexible logistics. Manufacturing relies on 3PL for inbound and outbound supply chain management. Healthcare & Pharmaceuticals require specialized handling and cold chain solutions. Automotive, Consumer Electronics, and Food and Beverage sectors depend on timely, secure, and compliant logistics, while Agriculture benefits from integrated and temperature-controlled logistics .

The Argentina Third-party Logistics (3PL) Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Supply Chain Argentina, Kuehne + Nagel Argentina, Grupo Logístico Andreani, Logística y Transporte S.A., Andreani Logística, Cencosud Logistics, Transcom S.A., OCA S.A., TGL Argentina, CTC Logística, Cargotrans S.A., Yusen Logistics Argentina, Panalpina Argentina S.A., Gefco Argentina S.A., Logística Integral S.A. contribute to innovation, geographic expansion, and service delivery in this space.

The future of the Argentine 3PL market appears promising, driven by the ongoing digital transformation and the increasing integration of technology in logistics operations. As companies adopt advanced data analytics and automation, efficiency and service quality are expected to improve significantly. Furthermore, the focus on sustainable practices will likely shape logistics strategies, encouraging providers to innovate and adapt to changing consumer preferences. This evolution will create a more resilient and competitive logistics landscape in Argentina.

| Segment | Sub-Segments |

|---|---|

| By Type | Transportation Services Warehousing Services Freight Forwarding Services Value-Added Services Reverse Logistics Cold Chain Logistics Integrated Logistics Solutions Others |

| By End-User | Retail Manufacturing Healthcare & Pharmaceuticals Automotive Consumer Electronics Food and Beverage Agriculture Others |

| By Service Model | Asset-Based 3PL Non-Asset-Based 3PL Hybrid 3PL |

| By Distribution Mode | Road Transportation Rail Transportation Air Transportation Sea Transportation Intermodal Transportation |

| By Customer Type | B2B B2C C2C |

| By Contract Type | Long-term Contracts Short-term Contracts Spot Contracts |

| By Pricing Model | Fixed Pricing Variable Pricing Performance-based Pricing |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Management | 100 | Logistics Directors, Supply Chain Managers |

| Pharmaceutical Distribution | 80 | Operations Managers, Compliance Officers |

| E-commerce Fulfillment Strategies | 110 | E-commerce Operations Managers, Warehouse Supervisors |

| Automotive Supply Chain Solutions | 70 | Procurement Managers, Logistics Coordinators |

| Cold Chain Logistics | 50 | Quality Assurance Managers, Distribution Managers |

The Argentina Third-party Logistics (3PL) Market is valued at approximately USD 8 billion, reflecting a significant growth trend driven by the increasing demand for efficient supply chain solutions and the rapid expansion of e-commerce in the region.