Region:Middle East

Author(s):Dev

Product Code:KRAD5220

Pages:81

Published On:December 2025

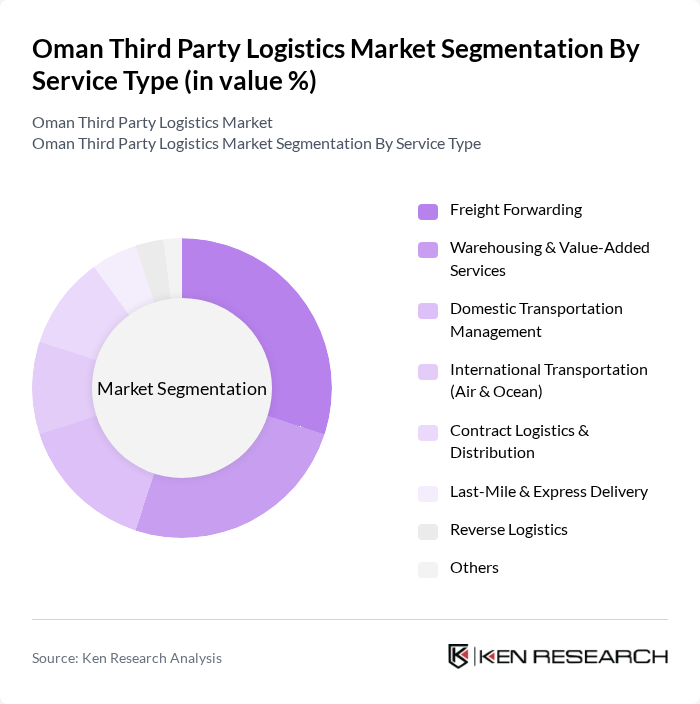

By Service Type:The service type segmentation includes various logistics services that cater to different needs within the market. The subsegments are Freight Forwarding, Warehousing & Value-Added Services, Domestic Transportation Management, International Transportation (Air & Ocean), Contract Logistics & Distribution, Last-Mile & Express Delivery, Reverse Logistics, and Others. Among these, Freight Forwarding is currently the leading subsegment due to the increasing volume of international trade and the need for efficient transportation solutions, with Transportation services dominating overall. The demand for integrated logistics services is also on the rise, driven by the growth of e-commerce and the need for timely deliveries.

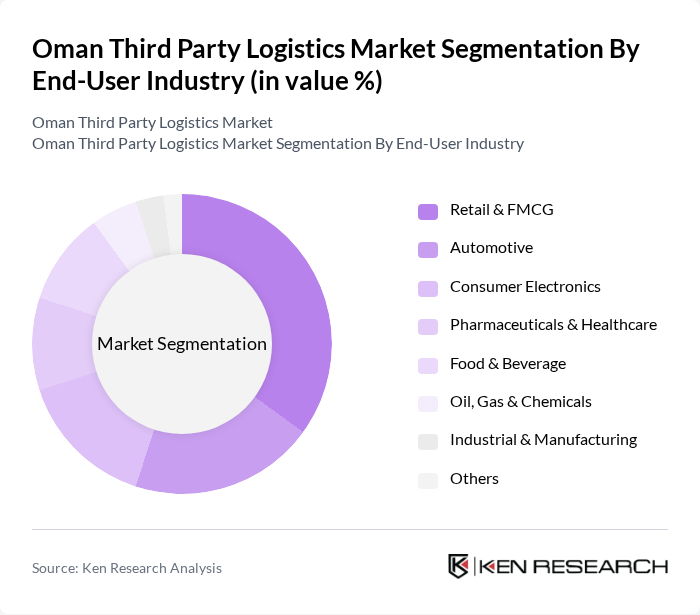

By End-User Industry:The end-user industry segmentation encompasses various sectors that utilize third-party logistics services. The subsegments include Retail & FMCG, Automotive, Consumer Electronics, Pharmaceuticals & Healthcare, Food & Beverage, Oil, Gas & Chemicals, Industrial & Manufacturing, and Others. The Retail & FMCG sector is the dominant segment, driven by the rapid growth of e-commerce and changing consumer preferences for online shopping, alongside significant demand from manufacturing, oil & gas, and distribution sectors. This sector's demand for efficient logistics solutions is further fueled by the need for timely deliveries and inventory management.

The Oman Third Party Logistics Market is characterized by a dynamic mix of regional and international players. Leading participants such as DHL Global Forwarding & DHL Supply Chain Oman, Kuehne + Nagel Oman, CEVA Logistics Oman, DB Schenker Oman, GAC Oman, Aramex Oman, Al Madina Logistics Services Company SAOG, Kunooz Logistics, Premier Logistics Muscat, Sultan Bin Soud Ahmed Al Logistics (Sultan Logistics), Oman Logistics Company (ASYAD Group), Oman Shipping Company (ASYAD Shipping), Bahwan Logistics, Khimji Ramdas Logistics, Al Fairuz Logistics contribute to innovation, geographic expansion, and service delivery in this space.

The Oman third-party logistics market is poised for significant transformation, driven by digital advancements and sustainability initiatives. As companies increasingly adopt automation and data analytics, operational efficiencies are expected to improve. Furthermore, the government's focus on environmental regulations will likely encourage logistics providers to adopt greener practices. This shift towards integrated logistics solutions will enhance service offerings, positioning Oman as a competitive player in the regional logistics landscape.

| Segment | Sub-Segments |

|---|---|

| By Service Type | Freight Forwarding Warehousing & Value-Added Services Domestic Transportation Management International Transportation (Air & Ocean) Contract Logistics & Distribution Last-Mile & Express Delivery Reverse Logistics Others |

| By End-User Industry | Retail & FMCG Automotive Consumer Electronics Pharmaceuticals & Healthcare Food & Beverage Oil, Gas & Chemicals Industrial & Manufacturing Others |

| By Logistics Function | Transportation-only 3PL Warehousing-only 3PL Integrated 3PL (End-to-End Solutions) Specialized Project Logistics Cold Chain Logistics Others |

| By Contract Type | Dedicated / Contract Logistics On-demand / Ad-hoc Logistics Long-term Strategic Partnerships Short-term Project-based Contracts |

| By Geographic Coverage | Muscat Governorate Dhofar (incl. Salalah) Al Batinah North (incl. Sohar) Al Dakhiliyah (incl. Nizwa) Free Zones & Ports (Sohar, Duqm, Salalah) Other Regions |

| By Technology Utilization | Transportation Management Systems (TMS) Warehouse Management Systems (WMS) IoT & Telematics in Fleet and Asset Tracking Automation & Robotics in Warehousing Data Analytics & AI-driven Optimization Others |

| By Customer Segment | Large Enterprises Upper Mid-market Firms SMEs Government & Public Sector Startups & Digital-native Businesses |

| Scope Item/Segment | Sample Size | Target Respondent Profiles |

|---|---|---|

| Retail Logistics Operations | 90 | Logistics Managers, Supply Chain Coordinators |

| Manufacturing Supply Chain | 70 | Operations Managers, Procurement Specialists |

| E-commerce Fulfillment Strategies | 80 | eCommerce Directors, Warehouse Supervisors |

| Healthcare Logistics Management | 60 | Supply Chain Directors, Compliance Officers |

| Transportation and Freight Services | 75 | Fleet Managers, Logistics Analysts |

The Oman Third Party Logistics Market is valued at approximately USD 1.2 billion, reflecting a significant growth driven by the demand for efficient supply chain solutions, e-commerce expansion, and government investments in logistics infrastructure.